- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding And 2 More High Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with the S&P 500 closing at a record high, investors are closely monitoring economic indicators like employment data that could influence Federal Reserve interest rate decisions. In such a vibrant market environment, growth companies with strong insider ownership often attract attention due to their potential for aligned interests and long-term stability.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.6% | 74.3% |

| Hippo Holdings (HIPO) | 14.1% | 41.2% |

| Hesai Group (HSAI) | 21.2% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63% |

| Credo Technology Group Holding (CRDO) | 11.4% | 32.9% |

| Cloudflare (NET) | 10.6% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.5% |

| Astera Labs (ALAB) | 12.3% | 36.8% |

Let's explore several standout options from the results in the screener.

Credo Technology Group Holding (CRDO)

Simply Wall St Growth Rating: ★★★★★★

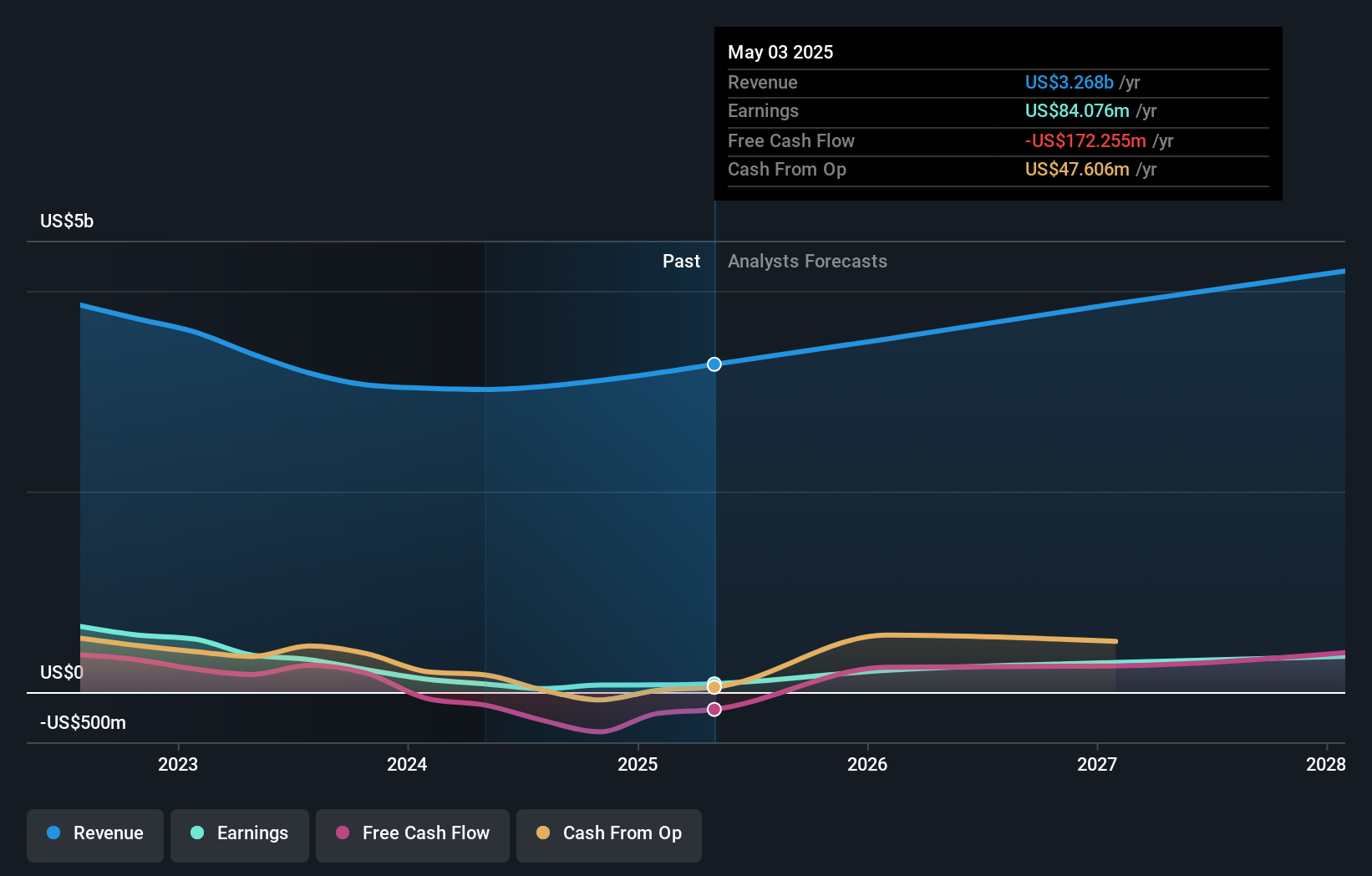

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet and PCIe applications across multiple regions, with a market cap of approximately $21.58 billion.

Operations: Revenue segments for Credo Technology Group Holding Ltd are not specified in the provided text.

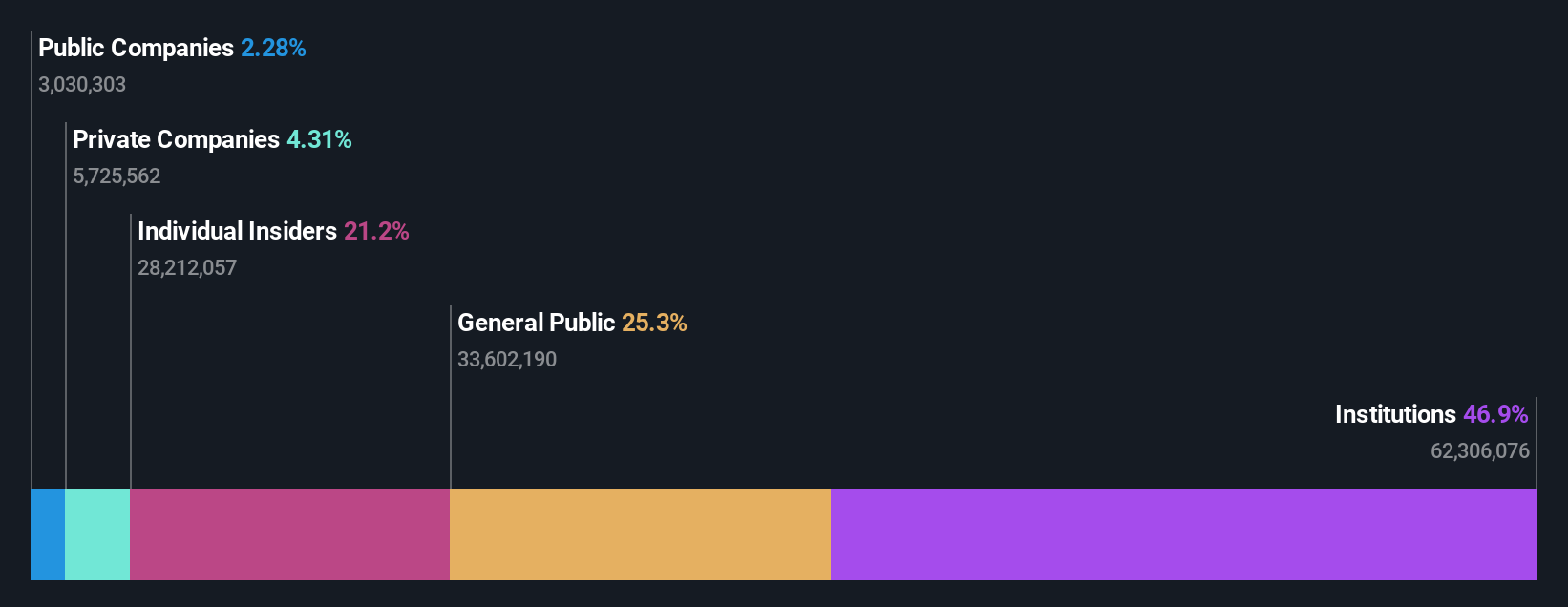

Insider Ownership: 11.4%

Return On Equity Forecast: 33% (2028 estimate)

Credo Technology Group Holding exhibits strong growth prospects with revenue expected to grow 25.6% annually, outpacing the US market. Recent earnings results show a significant turnaround with a net income of US$63.4 million, compared to a loss last year. Despite no substantial insider buying recently, insider selling has been significant over the past three months. Legal settlements have resolved patent disputes, potentially reducing future litigation risks and stabilizing operations.

- Unlock comprehensive insights into our analysis of Credo Technology Group Holding stock in this growth report.

- According our valuation report, there's an indication that Credo Technology Group Holding's share price might be on the expensive side.

Hesai Group (HSAI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally, with a market cap of approximately $3.51 billion.

Operations: The company generates revenue of CN¥2.49 billion from the development, manufacturing, and delivery of LiDAR products.

Insider Ownership: 21.2%

Return On Equity Forecast: 22% (2028 estimate)

Hesai Group's earnings are forecast to grow significantly at 41.5% annually, outpacing the US market. The company recently turned profitable with a net income of CNY 44.09 million for Q2 2025 and plans to raise US$300 million through a Hong Kong listing amid delisting risks in the US. Despite high share price volatility, Hesai’s lidar technology partnerships, such as with Motional and Agtonomy, underscore its industry leadership and growth potential in autonomous mobility solutions.

- Get an in-depth perspective on Hesai Group's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Hesai Group's current price could be inflated.

RH (RH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RH, along with its subsidiaries, operates as a retailer and lifestyle brand in the home furnishings market across the United States, Canada, the United Kingdom, Germany, Belgium, and Spain with a market cap of approximately $4.14 billion.

Operations: The company's revenue segments consist of $191.99 million from Waterworks and $3.08 billion from Restoration Hardware (RH).

Insider Ownership: 16.4%

Return On Equity Forecast: 62% (2028 estimate)

RH is experiencing significant earnings growth, forecasted at 42.1% annually, outpacing the US market. Despite a slower revenue growth rate of 8.6%, RH's expansion strategy includes opening new Design Galleries globally, enhancing its brand presence in key markets like Paris and Milan by 2026. Recent openings in Oklahoma City and Montreal highlight RH's commitment to immersive retail experiences. The company's stock trades below estimated fair value but faces challenges with negative equity and interest coverage issues.

- Take a closer look at RH's potential here in our earnings growth report.

- The analysis detailed in our RH valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Unlock our comprehensive list of 201 Fast Growing US Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? This technology could replace computers: discover the 23 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives