- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

3 US Growth Stocks With High Insider Ownership And Up To 36% Revenue Growth

Reviewed by Simply Wall St

As U.S. stock markets face downward pressure following disappointing jobs and consumer sentiment reports, investors are increasingly focused on companies that demonstrate resilience and potential for growth. In this environment, stocks with high insider ownership can be particularly appealing, as they often indicate strong internal confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 28.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| BBB Foods (NYSE:TBBB) | 16.5% | 40.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.3% | 33.8% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 37.1% |

| Ryan Specialty Holdings (NYSE:RYAN) | 15.8% | 43.9% |

We're going to check out a few of the best picks from our screener tool.

Credo Technology Group Holding (NasdaqGS:CRDO)

Simply Wall St Growth Rating: ★★★★★☆

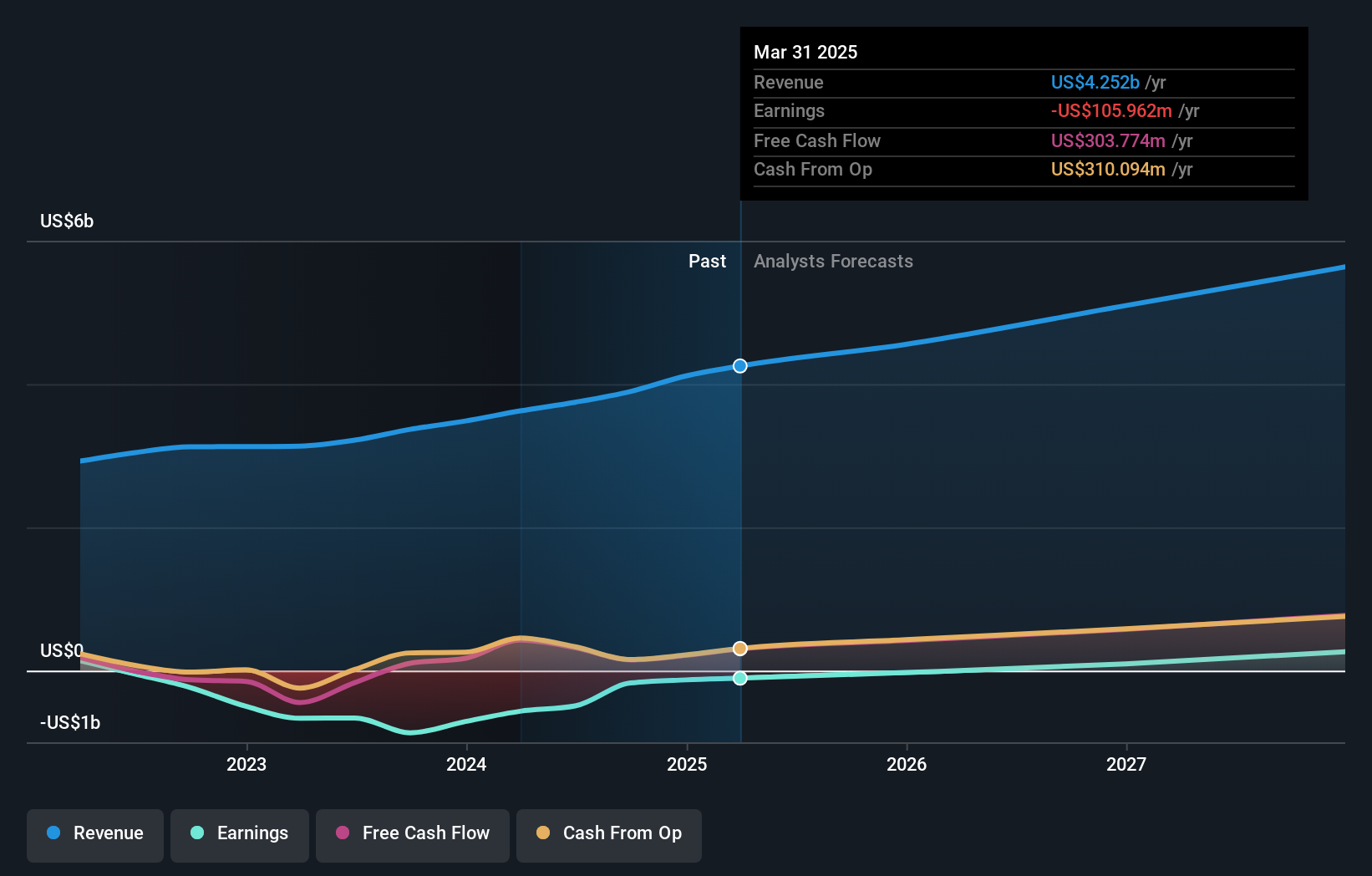

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet applications across the United States, Taiwan, Mainland China, Hong Kong, and globally, with a market cap of approximately $12.92 billion.

Operations: The company's revenue primarily comes from its semiconductor segment, which generated $245.59 million.

Insider Ownership: 12.9%

Revenue Growth Forecast: 36.1% p.a.

Credo Technology Group Holding has seen a significant increase in revenue, reporting US$72.03 million for the recent quarter, up from US$44.04 million a year ago, with forecasts indicating continued strong growth at 36.1% annually. Despite high volatility and insider selling recently, no substantial insider buying occurred in the past three months. The company anticipates becoming profitable within three years and is expanding its market presence through strategic collaborations like its recent partnership with Net One Systems in Japan.

- Click here and access our complete growth analysis report to understand the dynamics of Credo Technology Group Holding.

- Our expertly prepared valuation report Credo Technology Group Holding implies its share price may be too high.

Roku (NasdaqGS:ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market capitalization of approximately $12.34 billion.

Operations: The company's revenue is primarily generated from two segments: Devices, contributing $579.97 million, and Platform, accounting for $3.32 billion.

Insider Ownership: 12.3%

Revenue Growth Forecast: 10.7% p.a.

Roku is expected to become profitable within three years, with earnings forecasted to grow significantly at 53.84% annually. However, its revenue growth of 10.7% per year is slower than the desired high-growth rate but still surpasses the US market average. Recent developments include expanding product offerings like QLED TVs in the UK and a milestone in Canada with over 150 free streaming channels on The Roku Channel, enhancing its content diversity and user engagement.

- Delve into the full analysis future growth report here for a deeper understanding of Roku.

- The valuation report we've compiled suggests that Roku's current price could be quite moderate.

Workday (NasdaqGS:WDAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Workday, Inc. offers enterprise cloud applications both in the United States and internationally, with a market cap of approximately $72.32 billion.

Operations: The company's revenue primarily comes from its Cloud Applications segment, totaling $8.16 billion.

Insider Ownership: 19.7%

Revenue Growth Forecast: 12.2% p.a.

Workday, Inc. has been actively forming strategic partnerships, notably with Nayya and Zuora, enhancing its platform's capabilities in employee benefits and financial management. Recently added to several S&P indices, Workday is recognized for its significant growth potential. Despite a slower revenue growth forecast of 12.2% per year compared to high-growth benchmarks, it remains above the US market average. Earnings are projected to grow at 14.6% annually, slightly exceeding market expectations without recent insider trading activity impacting valuation perceptions.

- Take a closer look at Workday's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Workday is trading behind its estimated value.

Summing It All Up

- Click this link to deep-dive into the 197 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives