- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

OpenAI Partners With Broadcom (AVGO) To Develop AI Chip For Internal Use In 2026

Reviewed by Simply Wall St

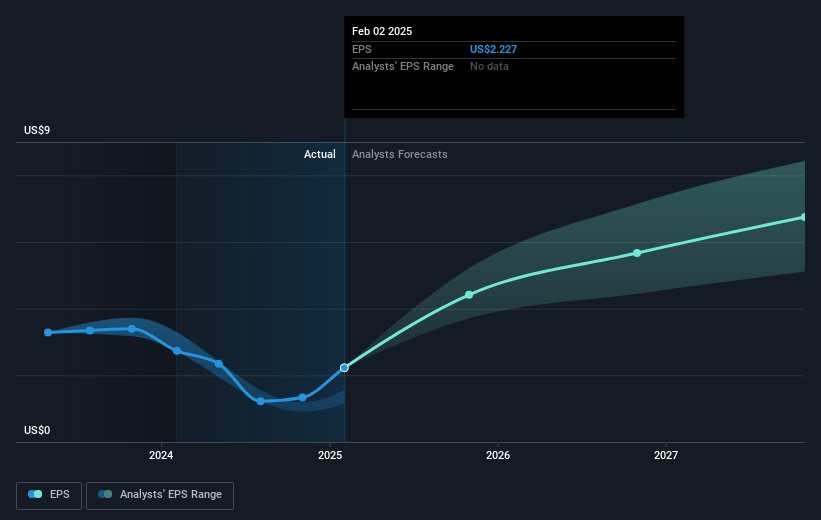

Broadcom (AVGO) has recently partnered with OpenAI to develop an AI chip, a pivotal move that aligns with its strategic goal of enhancing AI capabilities. This collaboration was announced around the same time the company posted impressive quarterly earnings, including a 63% increase in AI revenue, which likely played a role in the company's share price rising 36% last quarter. Market factors also supported this increase, with overall tech sector performance remaining steady and a positive outlook for interest rates potentially boosting investor confidence in growth stocks like Broadcom. Broadcom’s solid financial performance and promising AI-related ventures have reinforced its presence in the semiconductor space.

We've discovered 2 weaknesses for Broadcom that you should be aware of before investing here.

The recent collaboration between Broadcom and OpenAI could significantly influence Broadcom's narrative of investing in AI R&D and pursuing hyperscale partnerships. By focusing on AI chip development, this partnership may strengthen Broadcom's technological leadership and potentially accelerate its revenue and margin growth. Over the longer term, Broadcom's total shareholder return, which includes share price appreciation and dividends, was very large over the past five years. This impressive performance positions it well above the US semiconductor industry's 1-year return of 54.3% and the broader US market's 21.6% return over the last year.

The company's impressive financial results, bolstered by AI-driven revenue, underpin its positive outlook. Investing in next-generation accelerators and expanding its customer base in the AI segment may lead to further revenue growth and earnings stability. However, the company faces risks from reliance on a few hyperscale customers and geopolitical factors, which may impact AI-related projections. The recent price increase towards the analyst price target of US$350.06 suggests market confidence in Broadcom's growth trajectory, although the current share price of US$334.89 highlights a marginal discount of around 0.05% to this consensus. Careful monitoring of earnings forecasts and developments in AI initiatives will be crucial in understanding their impact on Broadcom's future financial performance.

Assess Broadcom's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026