- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Announces Ambitious US$10 Billion Share Repurchase Program

Reviewed by Simply Wall St

In recent developments, Broadcom (NasdaqGS:AVGO) introduced innovative products like Incident Prediction and expanded its optical solutions, which align with rising industry interests in cybersecurity and AI. Additionally, Broadcom's $10 billion share repurchase program highlights confidence in its financial standing. These strategic moves could have played a role in the company's 10% price increase over the past week. The overall market also saw gains, with the Nasdaq Composite up 0.4% amidst mixed performances owing to tariff uncertainties. This backdrop may have offered support to Broadcom's upward trajectory, aligning with broader tech advancements and investment sentiments.

Broadcom's recent moves in AI and cybersecurity reflect broader strategic goals to strengthen its technological leadership and expand into high-growth areas. These initiatives could positively influence future revenue and earnings by capitalizing on increasing demand in these sectors. Over the past five years, Broadcom shares have delivered a very large total return of 687%. More recently, over the past year, Broadcom also outperformed the US market, which returned 7.9%, and exceeded the US Semiconductor industry's return of 9.9% over the same period. This suggests strong investor confidence in the company’s strategic initiatives and long-term growth potential.

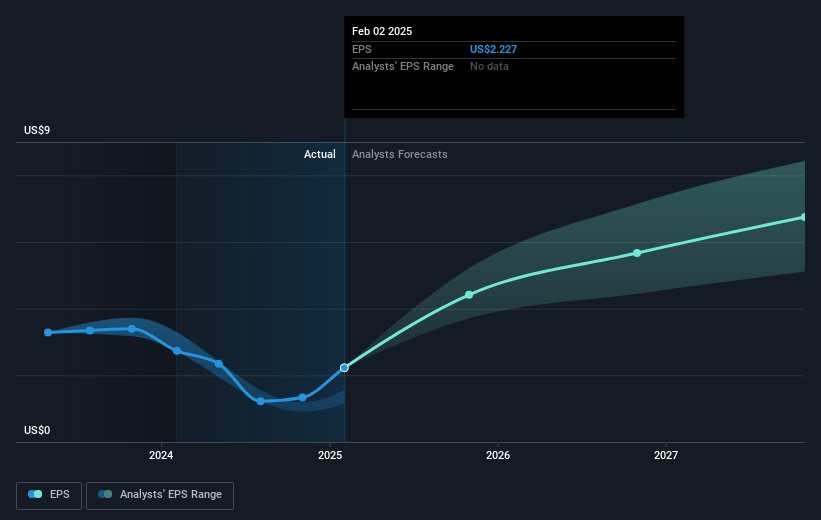

The introduction of new products and partnerships, particularly in AI, aligns with the narrative of reinforcing revenue streams. Analysts forecast robust revenue growth of 13.2% annually, bolstered by technological advancements and an expanding customer base. Earnings are projected to grow significantly, suggesting improved profit margins, although increased R&D expenditures and dependency on a few hyperscale customers pose risks. In terms of valuation, the current stock price of US$169.58 presents a 29.3% discount to the consensus analyst price target of approximately US$239.87, indicating potential room for appreciation if the company meets revenue and earnings expectations.

Unlock comprehensive insights into our analysis of Broadcom stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Broadcom, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives