- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

March 2025 Value Equities That Could Be Trading Below Estimated Worth

Reviewed by Simply Wall St

As of March 2025, U.S. stock markets have been experiencing a modest recovery, with major indices like the S&P 500 and Nasdaq Composite showing slight gains after rebounding from a recent selloff driven by tariff concerns and economic uncertainty. In this environment, identifying undervalued stocks can be particularly appealing to investors looking for opportunities that may offer potential growth as the market stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $17.44 | $34.67 | 49.7% |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.12 | $21.95 | 49.3% |

| ACNB (NasdaqCM:ACNB) | $41.35 | $81.98 | 49.6% |

| German American Bancorp (NasdaqGS:GABC) | $37.93 | $75.40 | 49.7% |

| KBR (NYSE:KBR) | $51.43 | $101.34 | 49.3% |

| Smurfit Westrock (NYSE:SW) | $45.57 | $90.04 | 49.4% |

| HealthEquity (NasdaqGS:HQY) | $90.19 | $179.14 | 49.7% |

| Veracyte (NasdaqGM:VCYT) | $33.69 | $66.76 | 49.5% |

| Constellium (NYSE:CSTM) | $11.27 | $22.38 | 49.7% |

| Haemonetics (NYSE:HAE) | $63.35 | $124.46 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

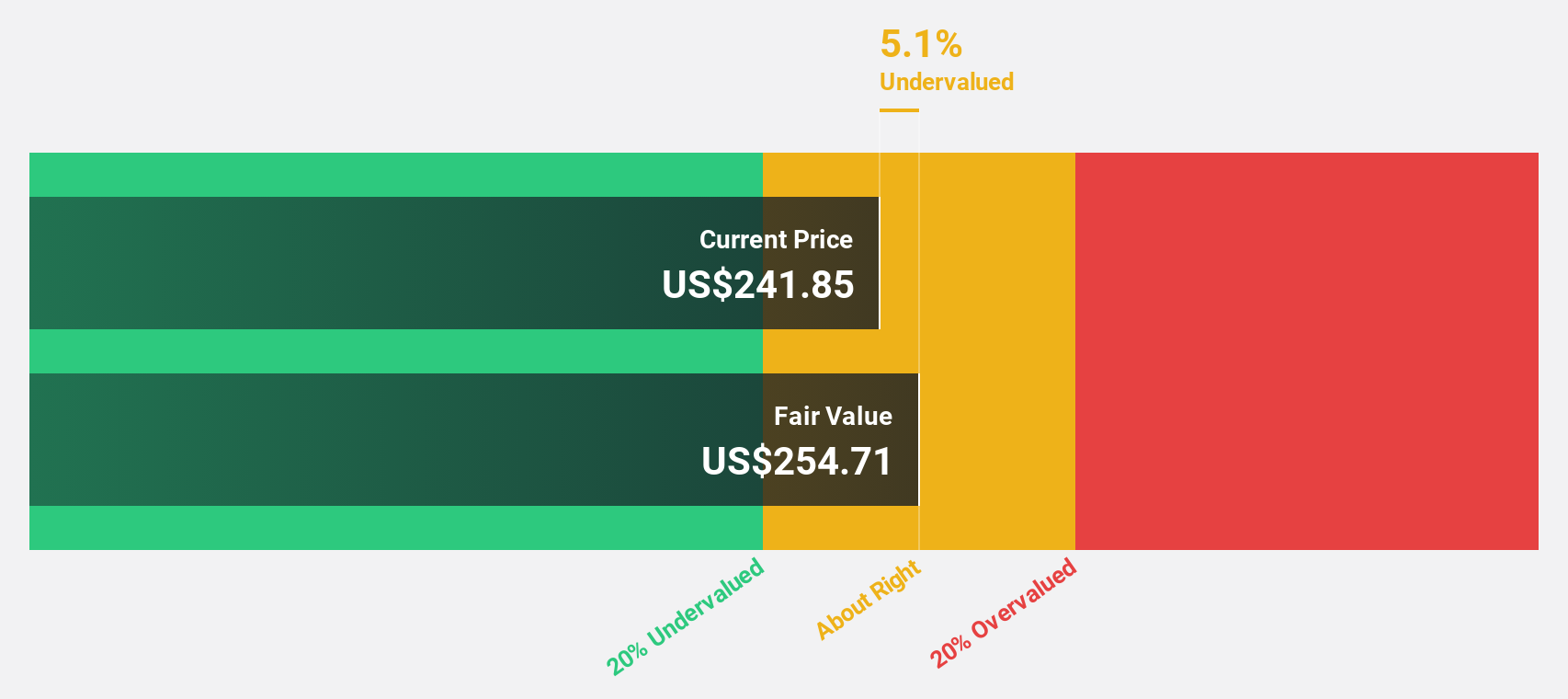

Analog Devices (NasdaqGS:ADI)

Overview: Analog Devices, Inc. designs, manufactures, tests, and markets integrated circuits, software, and subsystems globally with a market cap of approximately $105.32 billion.

Operations: The company's revenue is primarily derived from designing, developing, manufacturing, and marketing a broad range of integrated circuits, generating $9.34 billion.

Estimated Discount To Fair Value: 18.2%

Analog Devices is trading at US$213.58, below its estimated fair value of US$260.96, suggesting it may be undervalued based on cash flows. Despite a decrease in profit margins from 24.4% to 16.7%, the company's earnings are forecast to grow significantly at 24.8% annually, outpacing the broader U.S market growth rate of 14%. Recent product innovations and strategic partnerships enhance its competitive edge, though significant insider selling raises caution about potential risks ahead.

- Our expertly prepared growth report on Analog Devices implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Analog Devices with our detailed financial health report.

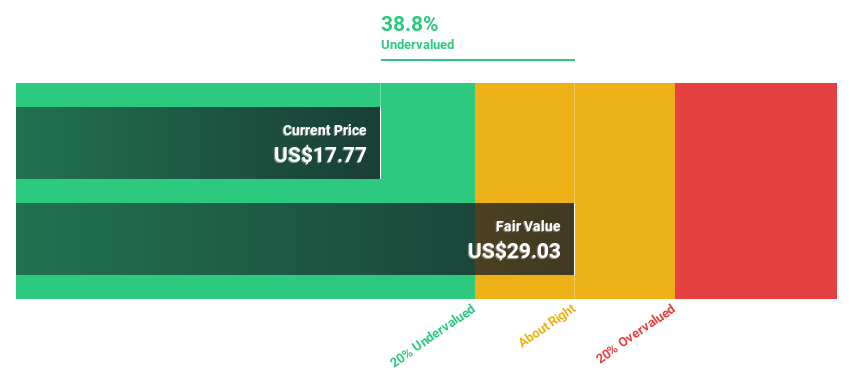

Mobileye Global (NasdaqGS:MBLY)

Overview: Mobileye Global Inc. develops and deploys advanced driver assistance systems and autonomous driving technologies worldwide, with a market cap of approximately $12.39 billion.

Operations: Mobileye generates revenue primarily from its advanced driver assistance systems and autonomous driving technologies, totaling $1.61 billion.

Estimated Discount To Fair Value: 42%

Mobileye Global is trading at US$16.58, significantly below its estimated fair value of US$28.6, highlighting potential undervaluation based on cash flows. The company's revenue is projected to grow at 18.3% annually, surpassing the U.S market average of 8.5%. Despite a recent net loss and reduced sales figures, strategic alliances with Volkswagen Group for advanced driver assistance systems could bolster future performance and profitability prospects as it aims for profitability within three years.

- According our earnings growth report, there's an indication that Mobileye Global might be ready to expand.

- Take a closer look at Mobileye Global's balance sheet health here in our report.

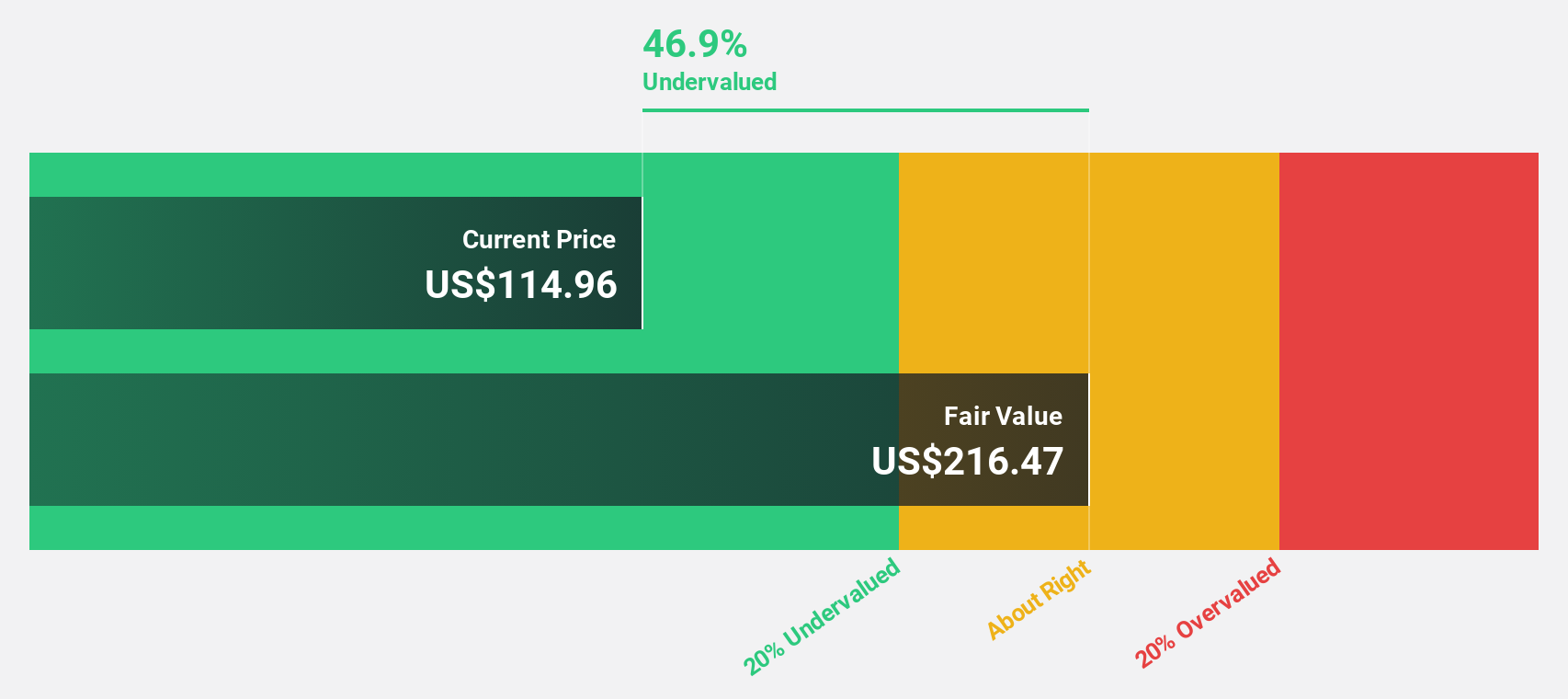

SharkNinja (NYSE:SN)

Overview: SharkNinja, Inc. is a product design and technology company that offers a range of consumer solutions globally, with a market cap of approximately $12.93 billion.

Operations: The company generates revenue from its Appliance & Tool segment, amounting to $5.53 billion.

Estimated Discount To Fair Value: 43.5%

SharkNinja, trading at US$91.58, is significantly undervalued with an estimated fair value of US$161.96 based on cash flows. Recent product innovations like the FlexBreeze™ lineup and TurboBlade™ fan enhance its portfolio, potentially boosting revenue growth forecasted at 9.1% annually—above the U.S market average of 8.4%. With earnings projected to grow by 18.39% per year and a strong return on equity outlook, SharkNinja presents compelling investment prospects amidst robust product expansion efforts.

- The growth report we've compiled suggests that SharkNinja's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of SharkNinja.

Key Takeaways

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 195 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives