- United States

- /

- Specialty Stores

- /

- NYSE:WSM

Williams-Sonoma (NYSE:WSM) Stock Jumps 18% Over Last Month

Reviewed by Simply Wall St

Williams-Sonoma (NYSE:WSM) recently unveiled a collaboration between its Pottery Barn Teen brand and designer Kendra Scott, focusing on an exclusive home decor collection. This announcement coincides with an impressive 18% increase in the company's share price over the last month, a period in which the overall market rose by 4%. The partnership is designed to tap into the aesthetic preferences of younger consumers with vibrant and stylish home solutions, potentially providing additional momentum to the company's stock, complementing the broader positive market trend.

Williams-Sonoma has 1 possible red flag we think you should know about.

The recent collaboration between Williams-Sonoma’s Pottery Barn Teen brand and designer Kendra Scott could positively impact the company's ongoing narrative of growth through innovation and strategic partnerships. This partnership aligns with Williams-Sonoma’s broader strategy of tapping into new consumer segments, such as younger audiences seeking vibrant home décor solutions. While the short-term share price surge of 18% suggests confidence in these new initiatives, the integration of creative designs could further elevate revenue and earnings forecasts by capitalizing on emerging consumer trends.

Over a longer five-year period, Williams-Sonoma delivered a very large total return of 465.12%. This impressive performance provides context for current movements, demonstrating strong historical profitability. However, over the past year, the company underperformed relative to the US Specialty Retail industry, which saw a 14% return. Such a comparison highlights potential challenges in maintaining competitive market positioning.

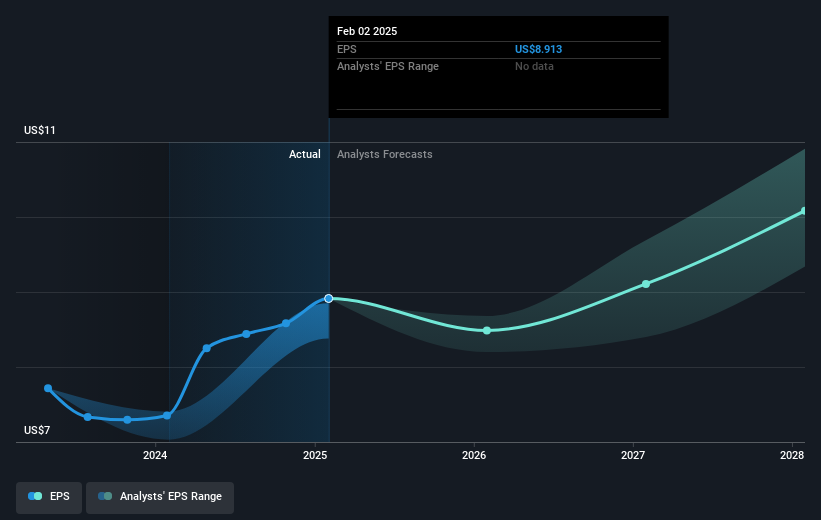

The stock's current share price increase appears in line with investor optimism surrounding the news, yet it remains below consensus analyst price targets of US$174.03, offering potential upside of 11.3% if projections hold. As analysts anticipate earnings of US$1.2 billion within three years, the impact of collaborations like the one with Kendra Scott could be crucial in meeting or exceeding these forecasts, supporting the company’s valuation targets and long-term growth prospects.

Understand Williams-Sonoma's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives