- United States

- /

- Specialty Stores

- /

- NYSE:WSM

Pickleball Partnership and Earnings Beat Might Change the Case for Investing in Williams-Sonoma (WSM)

Reviewed by Simply Wall St

- In the past week, Mark & Graham announced a partnership with CityPickle to offer personalized pickleball products at CityPickle locations nationwide and online, supported by co-branded events featuring on-site customization in New York City.

- This marks the first time Mark & Graham's best-selling pickleball gear will be sold directly through a national pickleball platform, expanding its direct-to-consumer presence in a fast-growing sport.

- Let's consider how Williams-Sonoma’s quarterly earnings beat and raised full-year revenue guidance further shape its long-term investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Williams-Sonoma Investment Narrative Recap

To be a Williams-Sonoma shareholder right now, you have to believe in the company’s ability to expand through brand partnerships and digital direct-to-consumer channels while sustaining meaningful operating margins despite macro headwinds. The recent Mark & Graham and CityPickle collaboration is an exciting story for brand reach but is unlikely to materially shift the most important short-term catalyst: resilient consumer demand for home furnishings. Key risks remain constant, particularly those tied to costs and potential cyclical demand swings.

Of the company’s recent announcements, the upward revision in full-year revenue and margin guidance stands out most. This updated outlook signals continued optimism about top-line expansion and profitability, which supports the investment case even as new product and partnership initiatives generate buzz. But there’s a need to watch how this guidance aligns with broader economic trends.

However, if global tariffs increase unpredictably, that’s an area investors especially need to keep an eye on...

Read the full narrative on Williams-Sonoma (it's free!)

Williams-Sonoma's narrative projects $8.4 billion revenue and $1.2 billion earnings by 2028. This requires 2.6% yearly revenue growth and a $0.1 billion earnings increase from $1.1 billion today.

Uncover how Williams-Sonoma's forecasts yield a $194.16 fair value, in line with its current price.

Exploring Other Perspectives

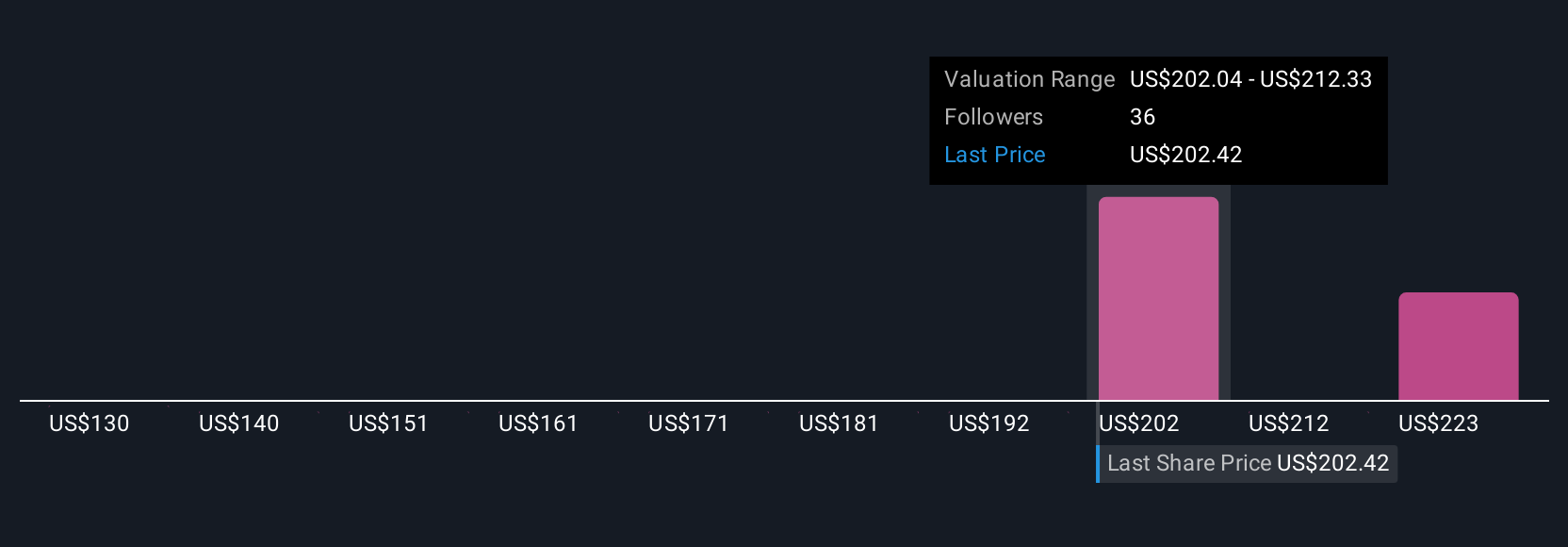

Four private investors from the Simply Wall St Community valued Williams-Sonoma between US$130 and US$231, indicating wide variation in growth expectations. While some see strong upside, persistent tariff volatility could still weigh on future performance, so consider these different viewpoints as you assess the company.

Explore 4 other fair value estimates on Williams-Sonoma - why the stock might be worth as much as 21% more than the current price!

Build Your Own Williams-Sonoma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Williams-Sonoma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams-Sonoma's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives