- United States

- /

- Specialty Stores

- /

- NYSE:WSM

Is Williams-Sonoma a Bargain After the Recent 9% Share Price Drop?

Reviewed by Bailey Pemberton

Thinking about whether to buy, sell, or hold Williams-Sonoma right now? You’re not alone. Even the savviest investors are grappling with what’s next for this home goods powerhouse, especially after its volatile performance in recent weeks. The stock took a 9.0% slide over just the last 7 days, and is currently down 7.9% over the past month. This reflects a market that’s been on edge about consumer discretionary stocks as housing and retail headlines shift tone. Yet, for anyone focused on the long game, Williams-Sonoma’s returns of 228.8% over three years and 280.9% over five years stand out in a crowded field, suggesting there’s more to the story than short-term swings.

If you’re tracking valuation, here’s a key figure: Williams-Sonoma scores a 3 out of 6 on undervaluation checks. That means it passes half of the classic valuation tests that suggest a stock is priced attractively. While some see the recent dip as a red flag, others wonder if it’s simply a reset before the next big move. What’s really driving this number, and does it suggest a bargain or a value trap?

Let’s dig into the details of how we assess valuation, method by method, and before we’re done, I’ll share a smarter way to make sense of whether Williams-Sonoma is a real opportunity right now.

Approach 1: Williams-Sonoma Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting future cash flows and discounting them back to today's dollars. This method is popular because it looks beyond short-term market mood swings, focusing instead on Williams-Sonoma's ability to generate cash in the years ahead.

Williams-Sonoma's latest reported Free Cash Flow stands at $1.05 billion. According to current analyst forecasts, FCF is expected to rise to $1.37 billion by 2028. Although Wall Street typically projects only about five years into the future, cash flows for Williams-Sonoma are extrapolated well into the 2030s, with anticipated figures reaching roughly $2.02 billion in 2035 based on steady growth rates.

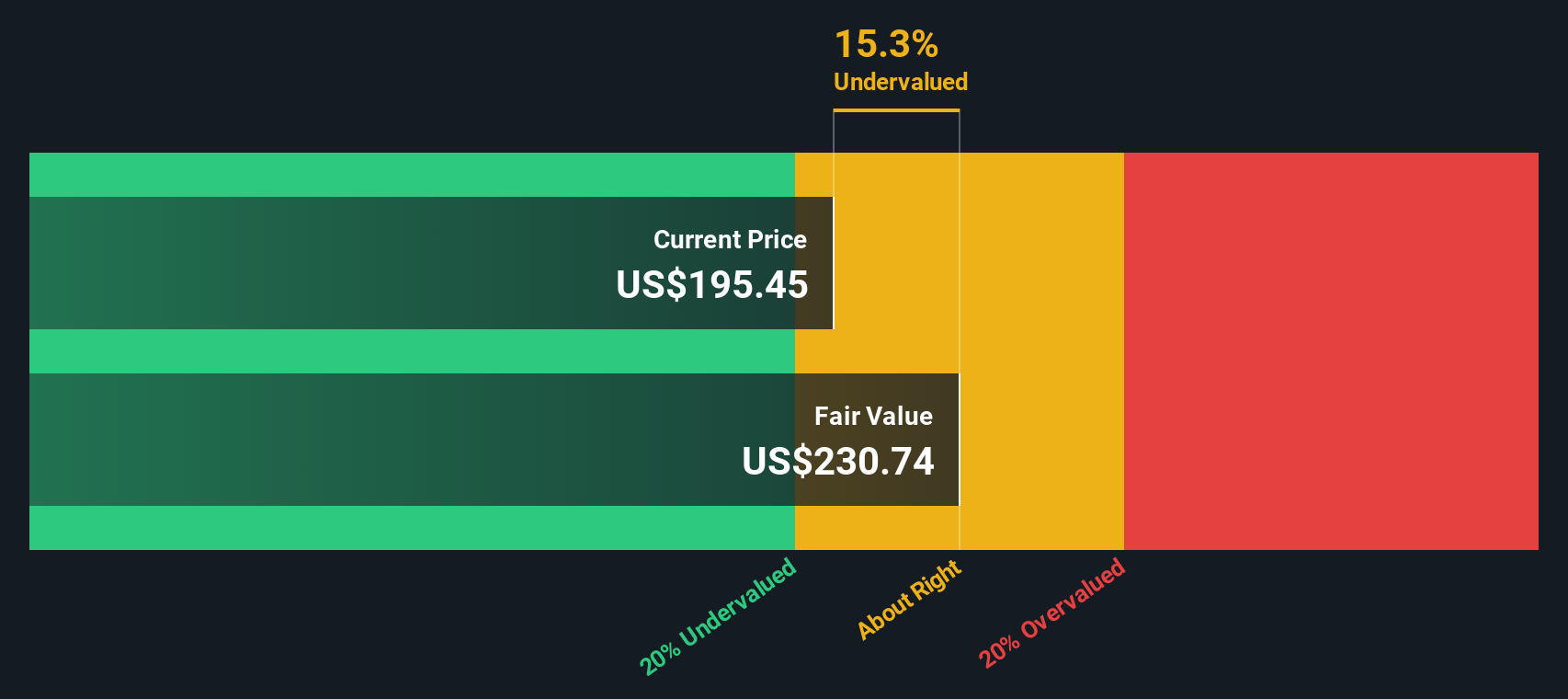

Factoring these projections, the DCF model puts Williams-Sonoma’s intrinsic fair value at $233.64 per share. That is 22.3% above where shares trade now, implying the stock is notably undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Williams-Sonoma is undervalued by 22.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Williams-Sonoma Price vs Earnings (PE)

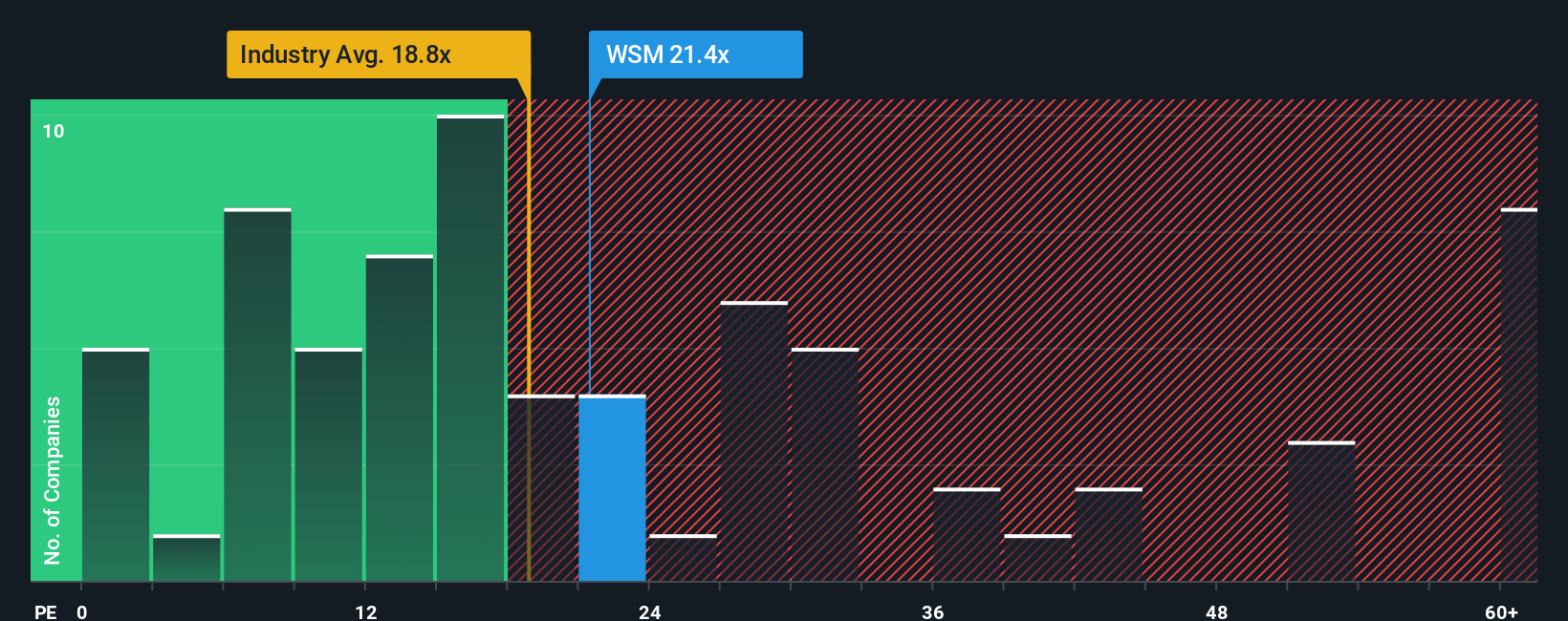

The Price-to-Earnings (PE) ratio is widely used to value established, profitable companies like Williams-Sonoma because it directly connects a company's current share price to its net earnings. This makes the PE ratio particularly relevant for evaluating firms with consistent profitability, as it relates investor expectations to what the business is already earning.

What constitutes a “fair” PE ratio depends on factors such as expectations for future growth, the company’s risk profile, and prevailing market sentiment. Fast-growing or low-risk companies often command higher PE ratios, while businesses with slower growth or greater risk tend to trade at lower multiples.

Williams-Sonoma currently trades at a PE ratio of 19.6x. Compared to the Specialty Retail industry average of 15.8x and its peer group average of 22.2x, Williams-Sonoma sits between its industry and peers. This suggests the market recognizes stronger performance or growth potential relative to the broader industry, but still gives it a modest discount compared to its closest competitors.

To get a more tailored view, we look at the Simply Wall St "Fair Ratio." Unlike industry or peer comparisons, the Fair Ratio incorporates Williams-Sonoma’s specific earnings growth outlook, profit margins, business risks, scale, and sector dynamics. Using this approach, investors get a more accurate indication of what multiple reflects the company’s true characteristics, rather than just a simple average.

Williams-Sonoma’s Fair PE Ratio currently stands at 18.3x, which is very close to its actual PE of 19.6x. Since the difference is small, this means shares are priced almost exactly where you would expect given the company’s fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Williams-Sonoma Narrative

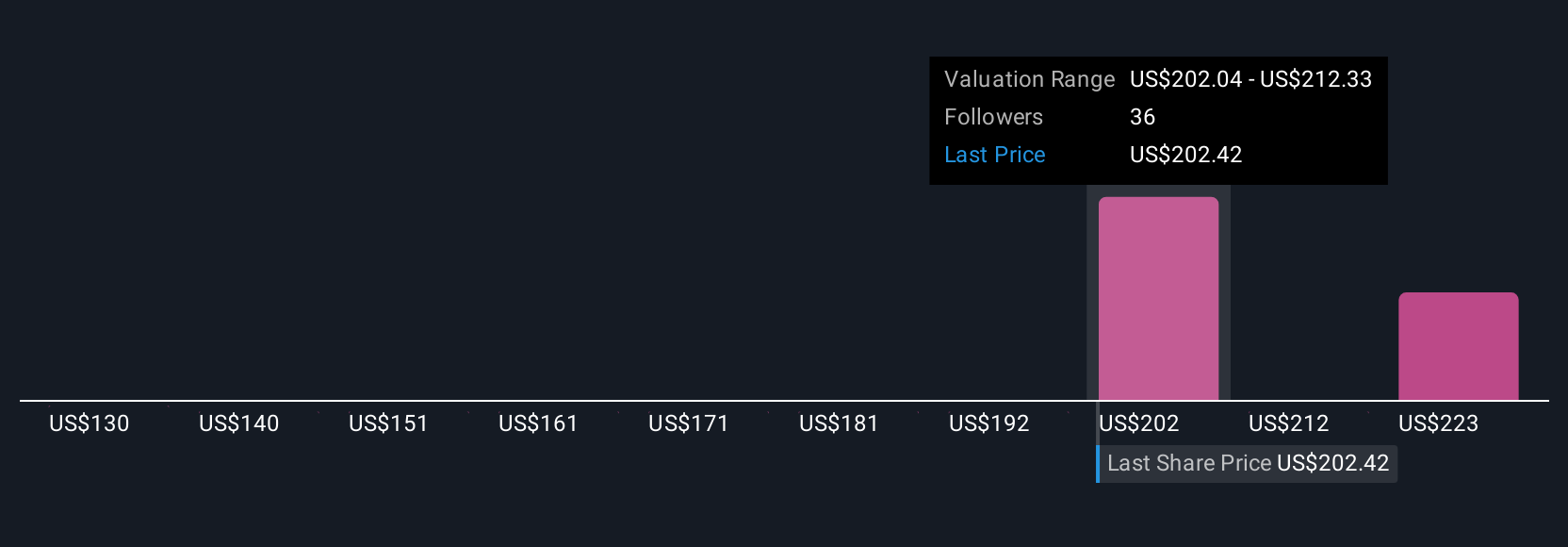

Earlier we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story about a company, a perspective that connects what you believe about Williams-Sonoma’s future to numbers like fair value, expected revenue, earnings, and profit margins. Instead of just relying on backward-looking ratios, Narratives let you map a company’s journey: you outline what could really drive future performance, translate those beliefs into a forecast, and then see an updated fair value instantly.

This approach isn’t just for experts. Narratives are easy to create and track on Simply Wall St’s Community page, where millions of investors actively share and compare their perspectives. When you build or follow a Narrative, you can see right away if current prices are above or below what your story suggests is “fair,” making it easier to decide when to buy or sell. Best of all, Narratives update automatically when key news or results land, so you’re never working from outdated assumptions.

For example, bullish investors on Williams-Sonoma think digital investments and global expansion will drive the stock to $230 per share, while more cautious voices, concerned about tariffs and housing, see fair value closer to $138. Narratives help you weigh these scenarios and choose your own path with confidence.

Do you think there's more to the story for Williams-Sonoma? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives