- United States

- /

- Specialty Stores

- /

- NYSE:WSM

Can Williams-Sonoma's (WSM) Wicked Film Tie-In Deepen Its Brand Loyalty Across New Customer Segments?

Reviewed by Sasha Jovanovic

- Universal Products & Experiences recently announced an exclusive collaboration with Williams Sonoma, Pottery Barn, and Pottery Barn Teen, unveiling home furnishings and kitchen collections inspired by the upcoming film Wicked: For Good.

- This partnership merges the film’s iconic story and colors with product innovation across Williams-Sonoma’s core brands, aiming to engage fans and tap into seasonal demand around the movie’s debut and the holidays.

- We'll examine how this film-inspired collection may support Williams-Sonoma's focus on exclusive partnerships and attracting new customer segments.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Williams-Sonoma Investment Narrative Recap

To be a Williams-Sonoma shareholder, you need confidence in the company’s ability to consistently attract new customers and drive sales through exclusive products and unique brand partnerships. The recent Wicked: For Good collaboration fits this approach, but its impact on near-term sales growth and margin resilience is unlikely to be material against the backdrop of ongoing macroeconomic uncertainty and persistent risks to consumer discretionary spending.

Among recent company updates, the Q2 2025 earnings report stands out, showing continued net income and sales growth despite challenging spending conditions. This result highlights Williams-Sonoma’s ability to execute on brand differentiation and exclusive partnerships, which remain critical catalysts for stabilizing demand and supporting premium positioning as competition intensifies.

But on the other hand, the real concern for investors lies in how sustained economic headwinds could pressure demand for premium home goods if...

Read the full narrative on Williams-Sonoma (it's free!)

Williams-Sonoma's outlook points to $8.7 billion in revenue and $1.2 billion in earnings by 2028. This is based on an annual revenue growth rate of 3.4% and a $0.1 billion increase in earnings from the current earnings of $1.1 billion.

Uncover how Williams-Sonoma's forecasts yield a $204.32 fair value, a 13% upside to its current price.

Exploring Other Perspectives

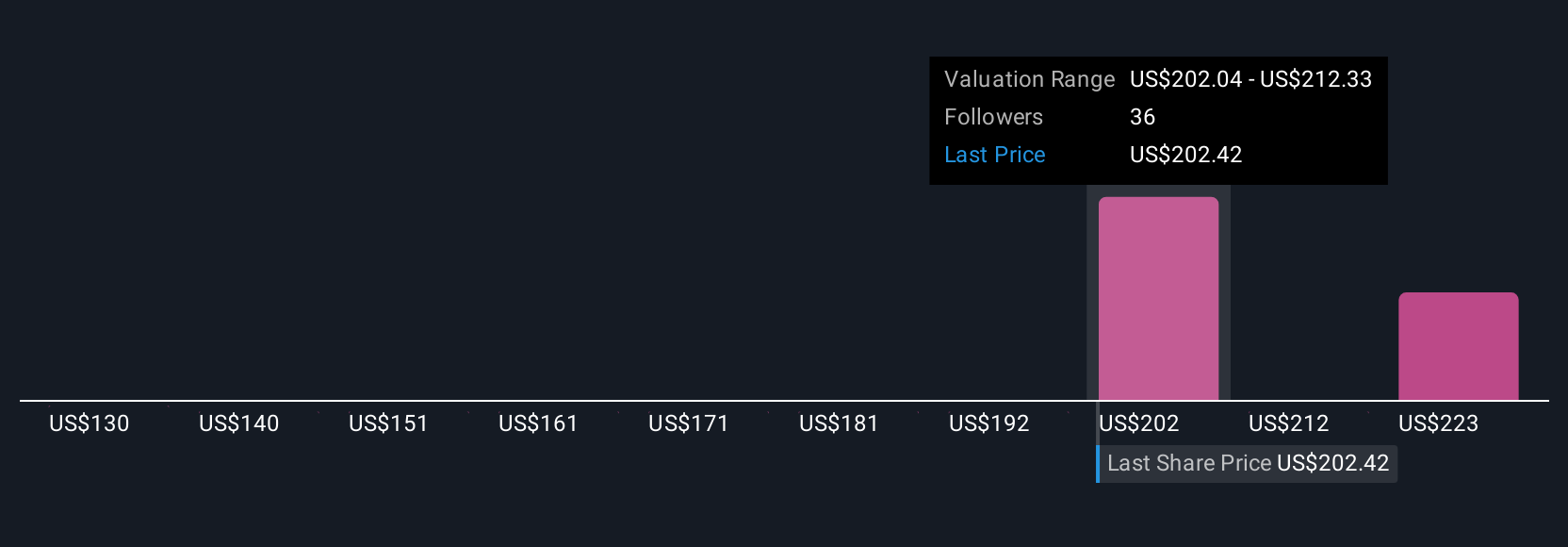

Four fair value estimates from the Simply Wall St Community span US$130 to US$230.63, reflecting a broad spectrum of outlooks on Williams-Sonoma’s potential. With consumer spending still a key risk, it's clear you will find sharply differing views on the road ahead.

Explore 4 other fair value estimates on Williams-Sonoma - why the stock might be worth as much as 27% more than the current price!

Build Your Own Williams-Sonoma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Williams-Sonoma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams-Sonoma's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives