- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

3 Stocks That May Be Trading Below Estimated Value In July 2025

Reviewed by Simply Wall St

As the U.S. stock market hovers near record highs, investors remain cautious amid ongoing trade policy uncertainties and fluctuating economic indicators. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Roku (ROKU) | $88.99 | $174.03 | 48.9% |

| Robert Half (RHI) | $42.06 | $82.57 | 49.1% |

| Ligand Pharmaceuticals (LGND) | $121.70 | $240.64 | 49.4% |

| Insteel Industries (IIIN) | $39.60 | $77.32 | 48.8% |

| Definitive Healthcare (DH) | $3.92 | $7.82 | 49.8% |

| Carter Bankshares (CARE) | $17.99 | $35.50 | 49.3% |

| Camden National (CAC) | $42.58 | $83.14 | 48.8% |

| Atlantic Union Bankshares (AUB) | $33.14 | $65.45 | 49.4% |

| ACNB (ACNB) | $42.84 | $84.08 | 49% |

| Acadia Realty Trust (AKR) | $18.42 | $36.68 | 49.8% |

Let's explore several standout options from the results in the screener.

Hess Midstream (HESM)

Overview: Hess Midstream LP owns, operates, develops, and acquires midstream assets to provide fee-based services to Hess and third-party customers in the United States, with a market cap of approximately $8.07 billion.

Operations: The company's revenue is primarily derived from three segments: Gathering ($814.60 million), Processing and Storage ($586.40 million), and Terminaling and Export ($120.90 million).

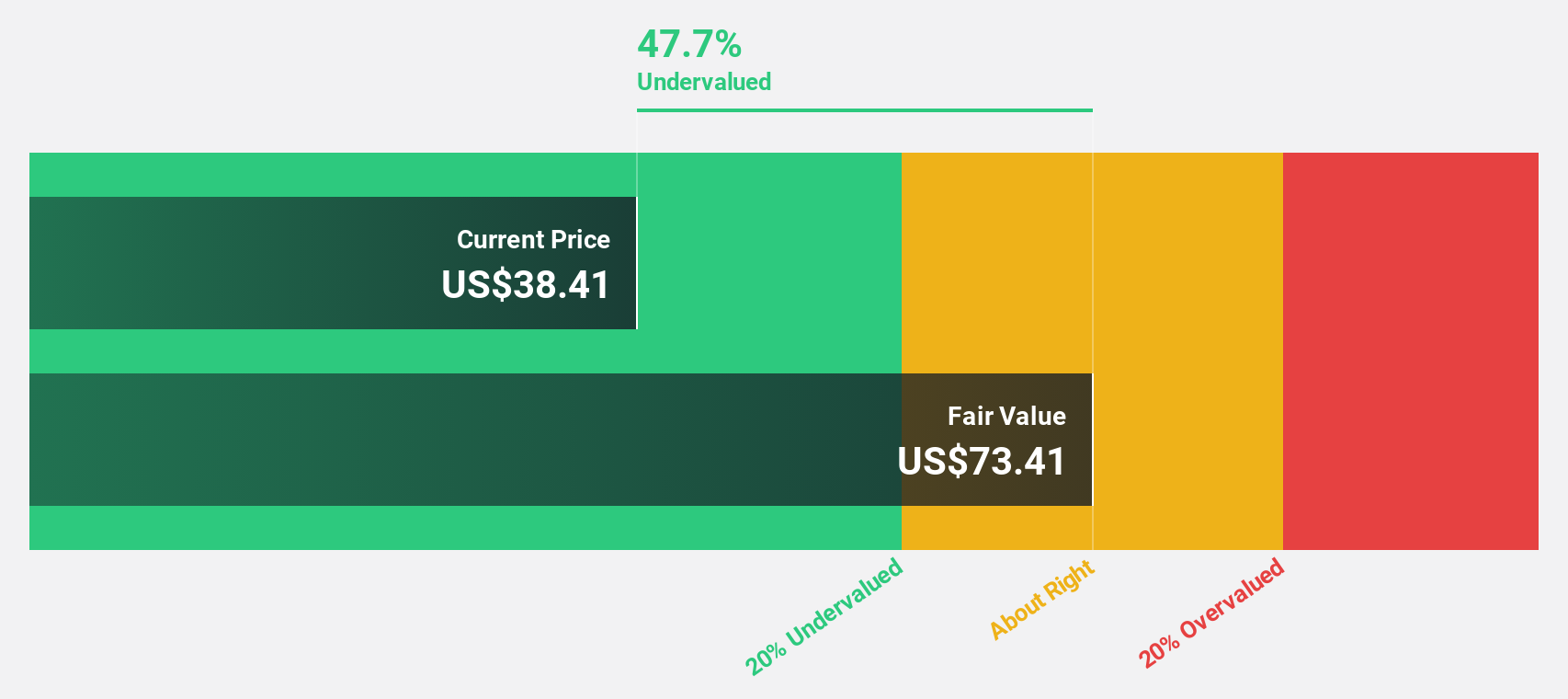

Estimated Discount To Fair Value: 47.6%

Hess Midstream appears undervalued based on cash flow, trading at US$38.44, significantly below its estimated fair value of US$73.29. Despite a high debt level and unsustainable dividend coverage, the company forecasts robust annual earnings growth of over 32%, surpassing the US market average. Recent events include a completed follow-on equity offering worth approximately $559 million and board changes following GIP's exit, which may influence governance dynamics positively for independent oversight.

- According our earnings growth report, there's an indication that Hess Midstream might be ready to expand.

- Dive into the specifics of Hess Midstream here with our thorough financial health report.

Redwire (RDW)

Overview: Redwire Corporation offers essential space solutions and infrastructure for government and commercial clients globally, with a market cap of $2.37 billion.

Operations: The company generates revenue primarily through its Space Infrastructure segment, which accounted for $277.70 million.

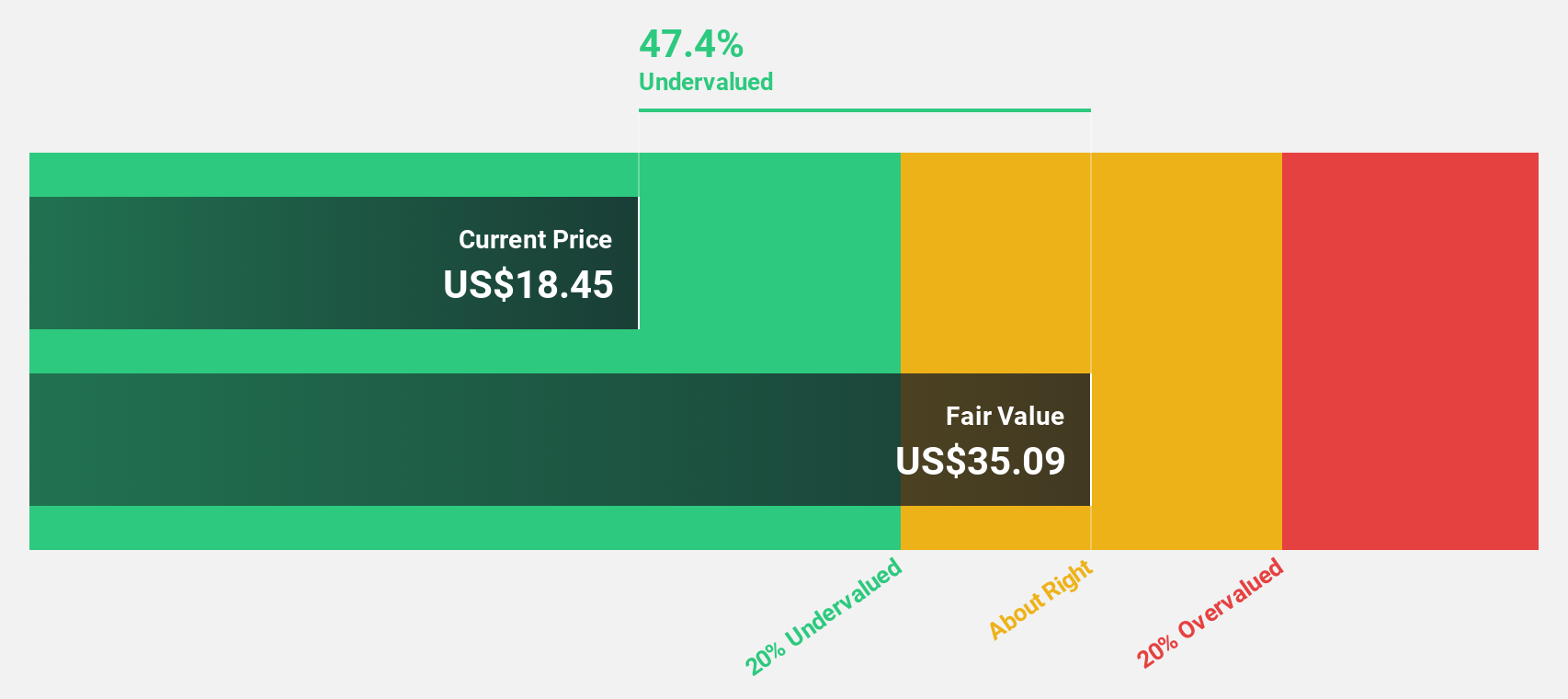

Estimated Discount To Fair Value: 15.1%

Redwire, trading at US$16.64, is undervalued relative to its estimated fair value of US$19.6. Despite recent volatility and shareholder dilution, the company is poised for significant revenue growth of 36.4% annually and expects profitability within three years. Recent collaborations with SpaceData Inc., ESA contracts, and advancements in space technology highlight strategic expansion efforts that could enhance cash flow potential despite being dropped from several Russell indices recently due to market dynamics.

- The analysis detailed in our Redwire growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Redwire.

Warby Parker (WRBY)

Overview: Warby Parker Inc. operates as a provider of eyewear products in the United States and Canada, with a market cap of approximately $2.70 billion.

Operations: The company generates revenue from its medical-optical supplies segment, totaling $795.09 million.

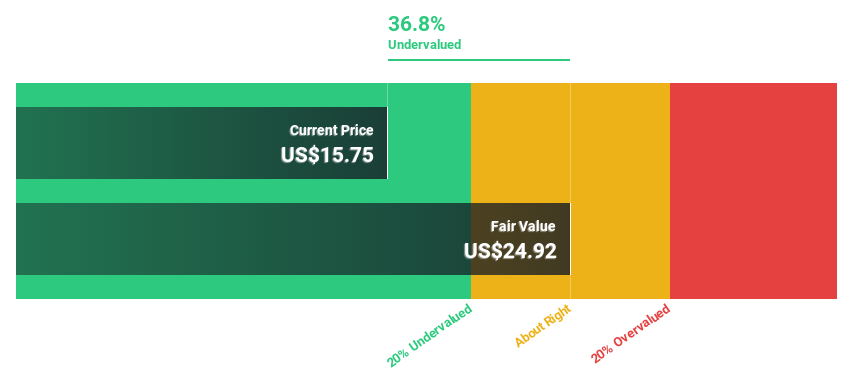

Estimated Discount To Fair Value: 13.2%

Warby Parker, trading at US$22.2, is undervalued compared to its estimated fair value of US$25.59. The company forecasts revenue growth of 13.3% annually and aims for profitability within three years, outperforming the broader market's growth rate. Despite insider selling and modest undervaluation, strategic alliances like the partnership with Google for AI-powered glasses could boost future cash flows significantly while recent earnings show a positive shift from losses to profits.

- In light of our recent growth report, it seems possible that Warby Parker's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Warby Parker's balance sheet health report.

Make It Happen

- Explore the 181 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives