- United States

- /

- Specialty Stores

- /

- NYSE:W

Investors Appear Satisfied With Wayfair Inc.'s (NYSE:W) Prospects As Shares Rocket 36%

Wayfair Inc. (NYSE:W) shares have had a really impressive month, gaining 36% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 87%.

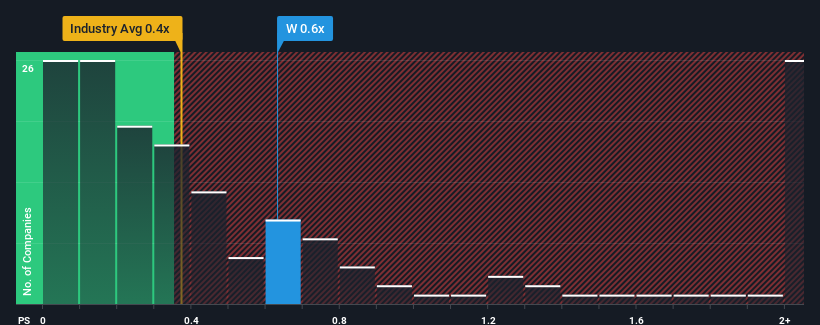

In spite of the firm bounce in price, it's still not a stretch to say that Wayfair's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Wayfair

How Wayfair Has Been Performing

While the industry has experienced revenue growth lately, Wayfair's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Wayfair's future stacks up against the industry? In that case, our free report is a great place to start.How Is Wayfair's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wayfair's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.1% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 7.8% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 6.2% per year over the next three years. That's shaping up to be similar to the 6.9% each year growth forecast for the broader industry.

With this information, we can see why Wayfair is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Wayfair's P/S?

Wayfair appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at Wayfair's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you settle on your opinion, we've discovered 3 warning signs for Wayfair (1 is potentially serious!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Wayfair, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Undervalued low.

Similar Companies

Market Insights

Community Narratives