- United States

- /

- Specialty Stores

- /

- NYSE:W

Could Wayfair’s (W) Debt Repurchase Reflect a Shift in Its Balance Sheet Priorities?

Reviewed by Simply Wall St

- Earlier this month, Wayfair Inc. presented at the 7th Annual Ai4 2025 Conference in Las Vegas, highlighting its focus on artificial intelligence and innovation, while also announcing the repurchase of approximately US$101 million of its 3.50% Convertible Senior Notes due 2028 as part of its liability management efforts.

- This recent note repurchase points to Wayfair's ongoing efforts to manage future debt obligations and address potential stock dilution while also responding to heightened market volatility amid uncertainty about interest rates.

- We'll explore how Wayfair’s debt repurchase initiative could influence its investment outlook and ongoing efforts to strengthen its balance sheet.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wayfair Investment Narrative Recap

Wayfair shareholders need confidence in the company’s ability to navigate an uncertain environment for big-ticket retail while harnessing efficiency improvements in logistics and customer engagement. The recent US$101 million convertible note repurchase reflects ongoing balance sheet management, but does not materially change the most important short-term catalyst, customer demand resilience, or address the biggest risk, which remains weak broader housing activity and interest-rate pressure on consumer spending.

Among recent announcements, the opening of a large-format Denver store in 2026 stands out, as it supports the catalyst of expanding Wayfair’s physical presence. This expansion aims to complement digital growth drivers like CastleGate and personalized shopping initiatives, offering new ways to boost engagement in core markets.

However, in contrast to these growth initiatives, investors should be aware of the risk if current advertising spend fails to translate into meaningful revenue growth in the months ahead...

Read the full narrative on Wayfair (it's free!)

Wayfair's outlook anticipates $13.9 billion in revenue and $124.9 million in earnings by 2028. This reflects a 4.9% annual revenue growth rate and a $424.9 million increase in earnings from the current -$300.0 million.

Uncover how Wayfair's forecasts yield a $80.62 fair value, a 4% upside to its current price.

Exploring Other Perspectives

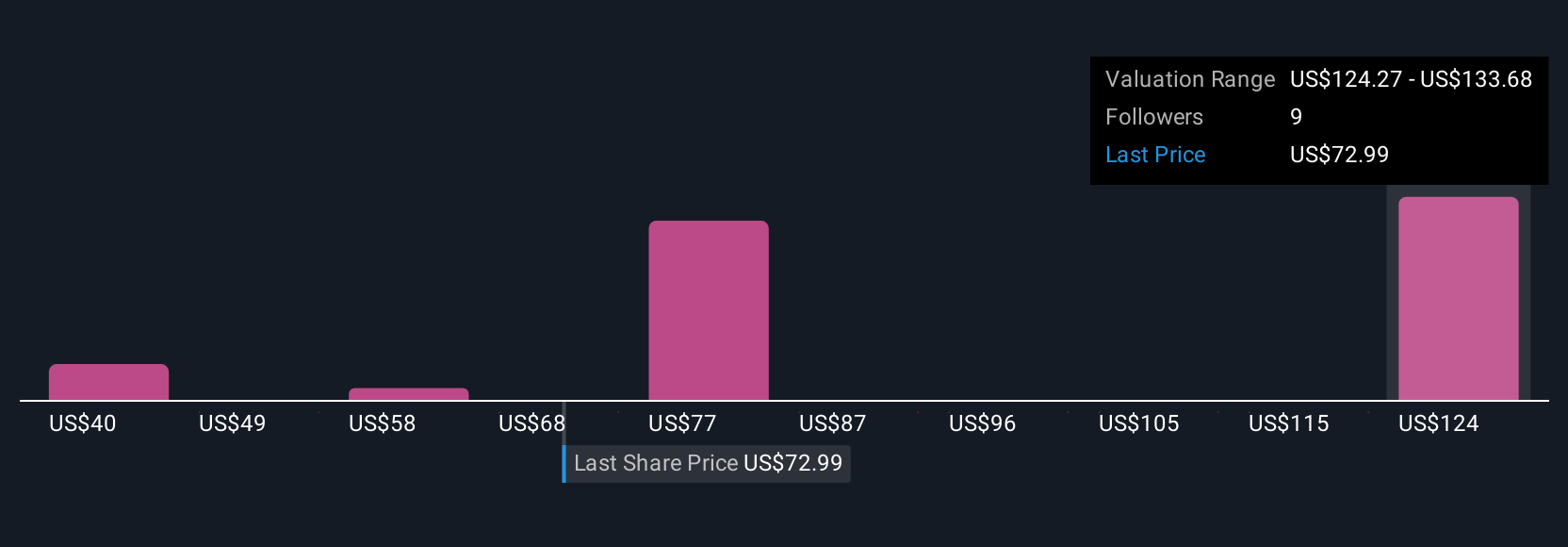

Simply Wall St Community members submitted five fair value estimates for Wayfair, ranging from US$39.54 to US$135.54. While this diversity of views is striking, many are considering whether recent volatility and housing market challenges could affect the company’s recovery prospects, offering food for thought as you compare these varied perspectives.

Explore 5 other fair value estimates on Wayfair - why the stock might be worth as much as 74% more than the current price!

Build Your Own Wayfair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wayfair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wayfair's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives