- United States

- /

- Specialty Stores

- /

- NYSE:RH

Will RH's (RH) Luxe Gallery Expansion Reveal the Value of Experiential Retail Investments?

Reviewed by Sasha Jovanovic

- RH recently opened RH Manhasset, The Gallery at Americana, a three-level, 19,000-square-foot immersive retail destination on Long Island featuring luxury furnishings alongside rare art, antiques, and global artifacts.

- This expansion underlines RH's ongoing focus on physical retail investments and aims to offer an in-person sensory experience that cannot be matched online.

- We’ll now examine how RH’s investment in such immersive retail spaces may shape its overall business outlook and financial strategies.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

RH Investment Narrative Recap

To be a shareholder in RH today, one needs to believe the company’s immersive retail galleries, like the new RH Manhasset, can drive higher customer engagement and long-term sales, despite challenges from a sluggish housing market. However, this recent opening is not likely to materially impact the short-term catalyst for the stock, which remains rooted in revenue growth and effective management of operating margins in a tough external climate. The primary risk still centers on RH’s significant financial leverage and exposure to tariff uncertainties that could pressure margins if economic conditions worsen.

Among the latest updates, RH’s Q2 earnings report stands out, revealing solid revenue and net income growth with upgraded guidance for FY25. This performance is particularly relevant as it highlights strong operational momentum, which is crucial given the added pressure from ongoing physical expansion projects like Manhasset that require careful balancing of resources to maintain positive free cash flow and financial stability. But on the other hand, investors should also consider the company’s sizable debt load...

Read the full narrative on RH (it's free!)

RH's narrative projects $4.3 billion revenue and $442.6 million earnings by 2028. This requires 9.6% yearly revenue growth and a $358.5 million earnings increase from $84.1 million currently.

Uncover how RH's forecasts yield a $262.25 fair value, a 42% upside to its current price.

Exploring Other Perspectives

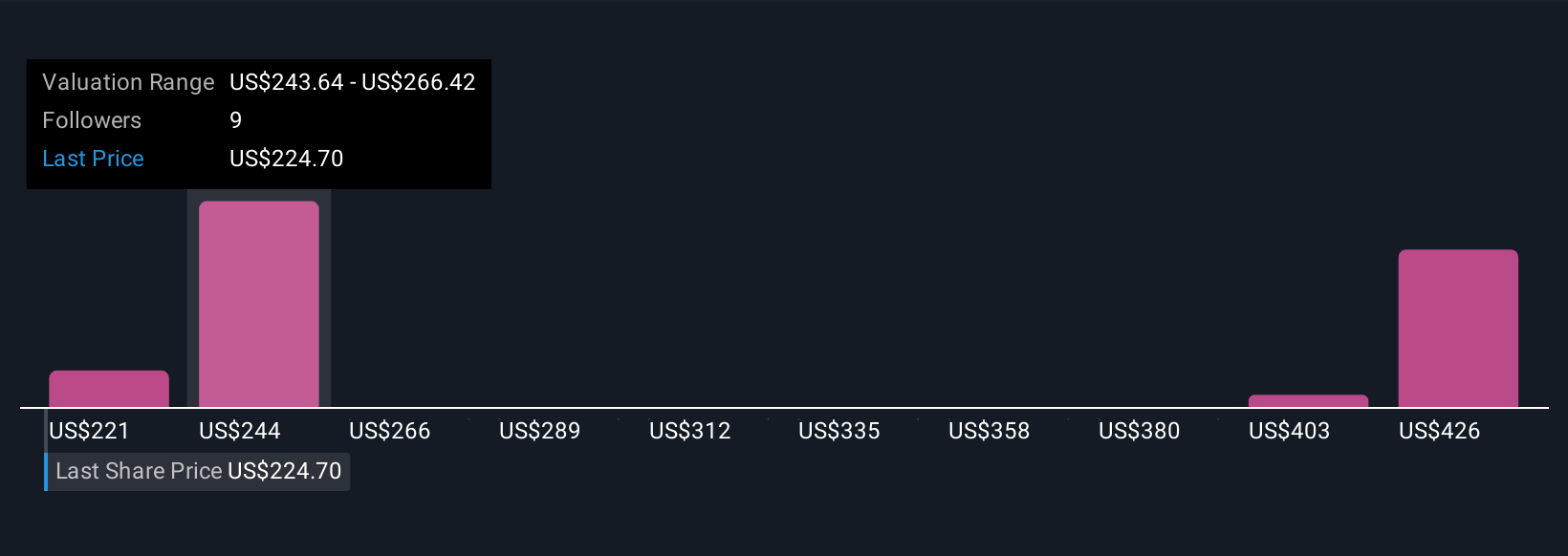

Five Simply Wall St Community contributors issued fair value estimates for RH ranging from US$220.85 to US$423.06, underscoring how widely opinions can differ. With RH’s ongoing investments in physical galleries demanding heavy capital, it is important to explore how you, as an investor, weigh expansion versus risk.

Explore 5 other fair value estimates on RH - why the stock might be worth over 2x more than the current price!

Build Your Own RH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free RH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RH's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives