- United States

- /

- Specialty Stores

- /

- NYSE:RH

RH (RH) Is Up 7.1% After Anticipated Earnings Growth Sparks Outlook Revisions and Investor Interest

Reviewed by Simply Wall St

- RH is set to release an earnings report that is widely anticipated to show substantial growth in both earnings per share and revenue compared to the previous year.

- Analysts and investors are closely monitoring revisions to forecasts and the company’s business outlook as key factors ahead of the earnings announcement.

- We’ll explore how anticipation around RH’s earnings report and outlook updates may influence the company’s investment narrative going forward.

AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

RH Investment Narrative Recap

To be a shareholder in RH, you have to believe in the company’s ability to drive sustained growth through luxury brand positioning, experiential gallery expansions, and product innovation, despite ongoing volatility in the housing market. The recent stock slide, ahead of an anticipated earnings report expected to show robust earnings and revenue growth, does not materially alter the biggest near-term catalyst, earnings clarity and forward guidance, but keeps demand risk top of mind due to fragile consumer sentiment in the home sector.

Among RH’s latest announcements, the June 2025 global expansion plans are particularly relevant, as the company prepares to open new Design Galleries across major international cities. This expansion is one of the key business developments investors are watching, since it could strengthen RH's revenue base and support higher earnings, but also comes with international startup costs that might weigh on margins in an uncertain economic climate.

Yet, while many anticipate strong earnings, investors should be mindful that, in contrast, the pressure from elevated debt and weak housing demand remains a risk...

Read the full narrative on RH (it's free!)

RH's outlook projects $4.3 billion in revenue and $442.6 million in earnings by 2028. This assumes a 9.4% annual revenue growth rate and an earnings increase of about $358.5 million from current earnings of $84.1 million.

Uncover how RH's forecasts yield a $257.24 fair value, a 20% upside to its current price.

Exploring Other Perspectives

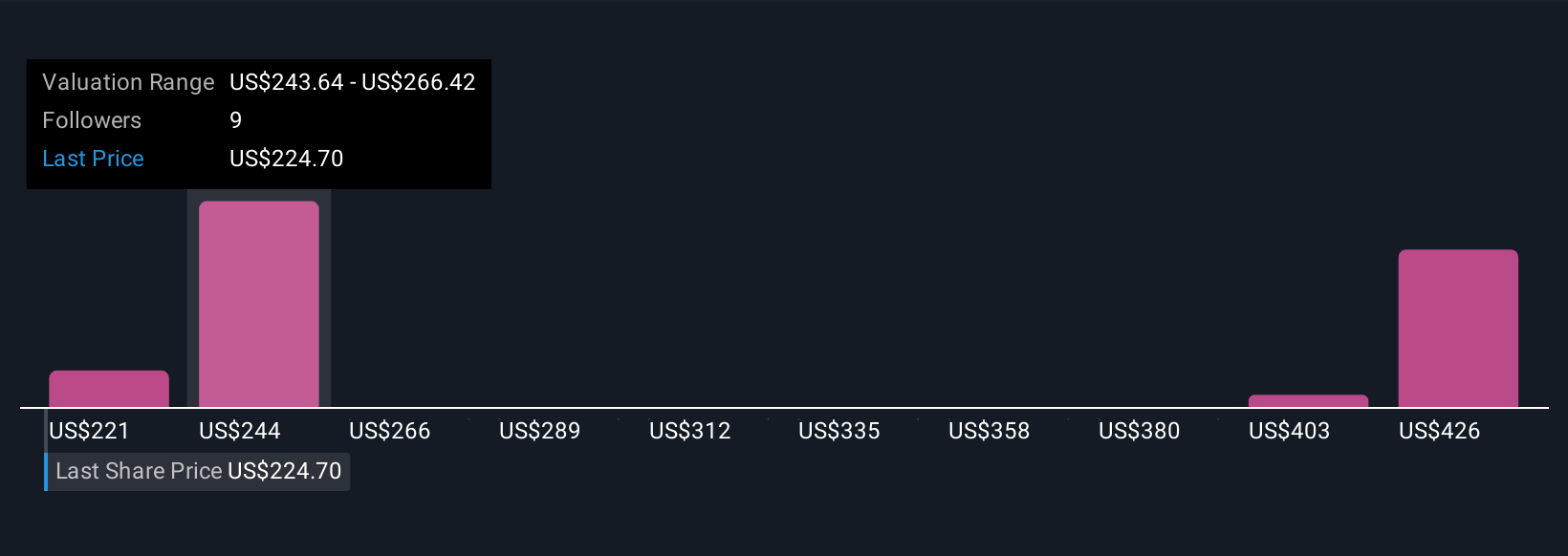

Five Simply Wall St Community members estimate RH’s fair value from US$220.85 to US$420.02 per share. While international gallery expansion aims for long-term sales growth, shifting consumer demand could impact near-term results, so consider several viewpoints.

Explore 5 other fair value estimates on RH - why the stock might be worth just $220.85!

Build Your Own RH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RH's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives