- United States

- /

- Specialty Stores

- /

- NYSE:RH

A Fresh Look at RH’s Valuation After Prolonged Demand and Financial Challenges

Reviewed by Kshitija Bhandaru

RH (NYSE:RH) has just opened RH Manhasset, The Gallery at Americana, a 19,000 square foot, multi-level retail space that blends luxury home furnishings with rare global art and antiques. This new gallery concept arrives at a time when the company is navigating a challenging stretch with flat same-store sales and ongoing financial pressures.

See our latest analysis for RH.

The unveiling of RH Manhasset arrives as the company’s share price has seen steep declines, with a 1-year total shareholder return of -47.47% and year-to-date share price loss of 56.12%. While the new gallery reflects RH’s push toward innovation, weak demand and ongoing financial strains have weighed down investor confidence. Momentum has been fading, and the recent sharp drop in the stock reflects persistent questions about the company’s ability to turn things around.

If you’re open to finding compelling opportunities beyond RH, now is an ideal moment to explore fast growing stocks with high insider ownership.

With the stock now trading at a substantial discount to analyst targets, investors are left wondering if RH’s struggles are already reflected in the price or if this marks a true buying opportunity in the event that growth returns.

Most Popular Narrative: 33.9% Undervalued

Compared to RH’s last close of $173.37, the widely followed narrative values the company far higher, pointing to significant upside potential rooted in ambitious business model changes.

RH's platform expansion, including the opening of 7 Design Galleries and 2 Outdoor Galleries in 2025, is expected to create new opportunities for revenue growth and brand exposure across multiple markets. This could potentially boost overall sales revenue.

The introduction of new product lines, such as the RH Outdoor Sourcebook and RH Interiors Sourcebook, along with a significant brand extension planned for fall 2025, may enhance product differentiation and drive increased demand, which could positively impact future revenues.

Curious what drives this ambitious price target? Discover the bold growth plans, margin gains, and expansion bets underpinning these aggressive projections. Uncover the specifics behind the narrative’s high hopes for RH’s transformation.

Result: Fair Value of $262.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing market weakness and significant debt from past stock buybacks could quickly derail RH’s ambitious turnaround story.

Find out about the key risks to this RH narrative.

Another View: Market Multiples Tell a Different Story

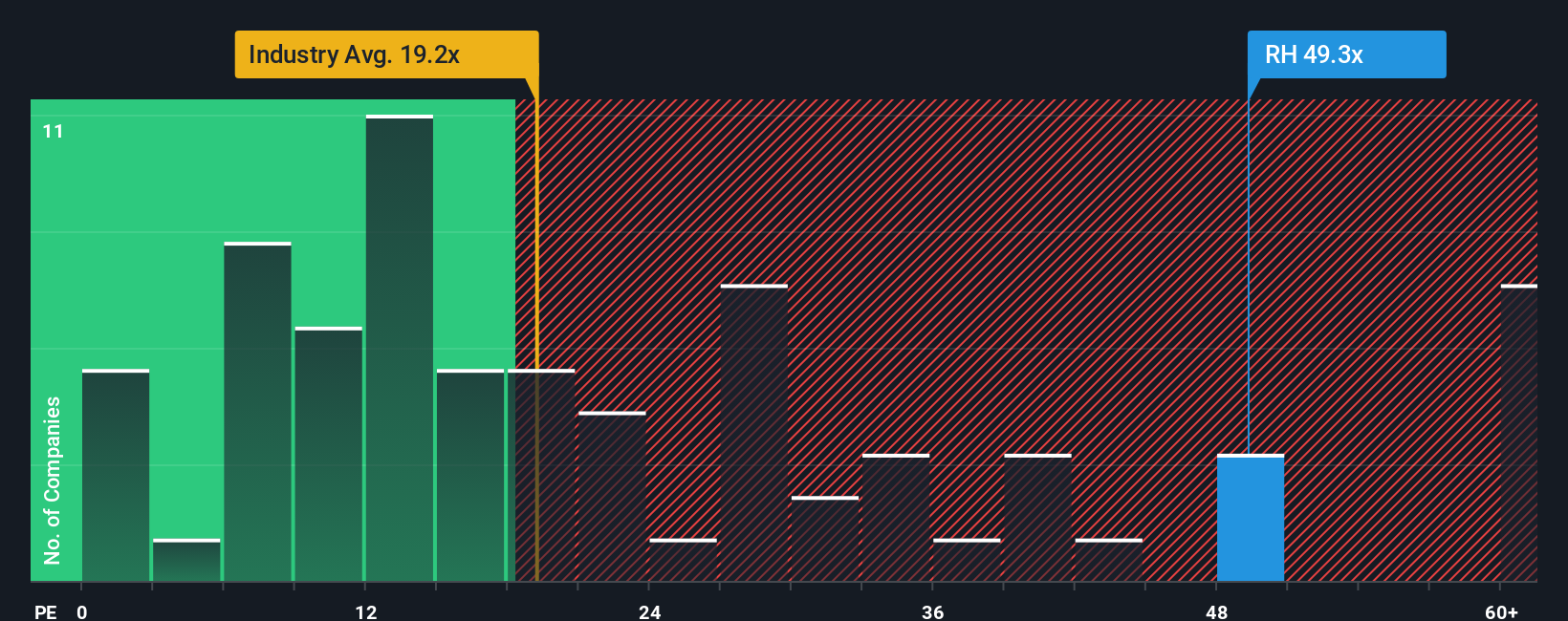

While fair value estimates suggest RH’s shares are undervalued, traditional valuation using the price-to-earnings ratio paints a less optimistic picture. RH is currently trading at 30.4 times earnings, much higher than both the US Specialty Retail industry average of 15.8 and its closest peers at 16. This premium increases valuation risk because the market could shift toward the fair ratio of 36.5 or could reprice sharply if growth does not meet expectations. Is the market overestimating RH’s potential, or will the company grow into its ambitious targets?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If you see things differently or want to dig deeper into RH’s outlook, you can explore the numbers and craft your own narrative in just a few minutes. Do it your way.

A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Never let market leaders pass you by. Expand your horizons by checking out more powerful opportunities using the Simply Wall St Screener. Your next bold move could be one click away.

- Tap into tomorrow’s potential with these 24 AI penny stocks and see which companies are pushing the boundaries of artificial intelligence across industries.

- Lock in consistent income by examining these 19 dividend stocks with yields > 3%, featuring stocks with yields over 3% and strong financials for steady returns.

- Catch the next market wave with these 79 cryptocurrency and blockchain stocks as blockchain and digital asset innovation reshape how companies compete and grow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives