Should You Be Adding MINISO Group Holding (NYSE:MNSO) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like MINISO Group Holding (NYSE:MNSO), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for MINISO Group Holding

MINISO Group Holding's Improving Profits

Over the last three years, MINISO Group Holding has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, MINISO Group Holding's EPS grew from CN¥1.82 to CN¥4.54, over the previous 12 months. It's a rarity to see 149% year-on-year growth like that.

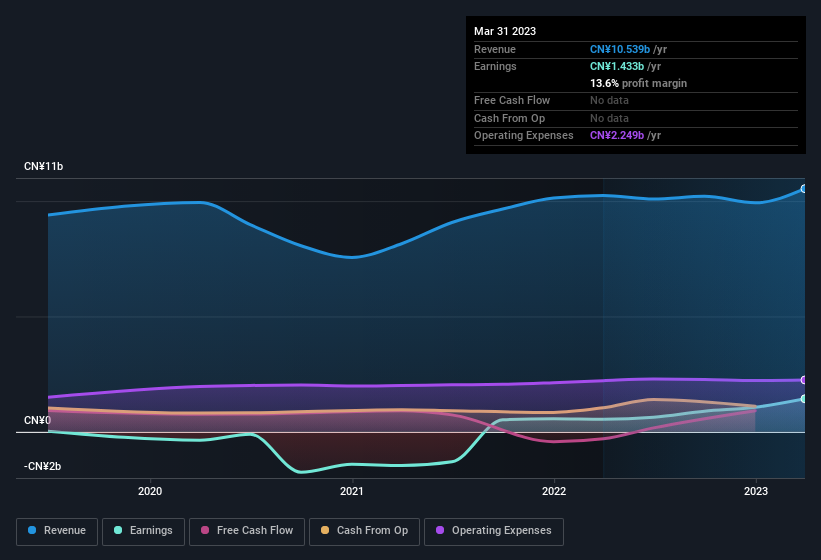

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that MINISO Group Holding is growing revenues, and EBIT margins improved by 8.7 percentage points to 16%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for MINISO Group Holding's future EPS 100% free.

Are MINISO Group Holding Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In twelve months, insiders sold CN¥96k worth of MINISO Group Holding shares. On a brighter note, we see that Founder Guofu Ye paid CN¥126k for shares, at an average acquisition price of CN¥5.25 per share. And that's a reason to be optimistic.

And the insider buying isn't the only sign of alignment between shareholders and the board, since MINISO Group Holding insiders own more than a third of the company. In fact, they own 70% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. at the current share price. That means they have plenty of their own capital riding on the performance of the business!

Does MINISO Group Holding Deserve A Spot On Your Watchlist?

MINISO Group Holding's earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe MINISO Group Holding deserves timely attention. Now, you could try to make up your mind on MINISO Group Holding by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Keen growth investors love to see insider buying. Thankfully, MINISO Group Holding isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MNSO

MINISO Group Holding

An investment holding company, engages in the retail and wholesale of lifestyle products and pop toy products in China, rest of Asia, the Americas, Europe, Indonesia, and internationally.

Flawless balance sheet with high growth potential.