Did New Milan and Dusseldorf Flagships Just Shift MINISO Group Holding's (MNSO) Experiential Retail Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, MINISO opened its first collectible toy store in Italy on Milan’s Corso Buenos Aires and its largest German store on Dusseldorf’s Flinger Strasse, both built around immersive, IP-driven experiences with extensive licensed product ranges.

- These flagship European locations underline how MINISO is using experiential, character-led retail to tighten its connection with Gen Z and pop-culture collectors across key urban shopping hubs.

- Next, we’ll examine how MINISO’s immersive Milan and Dusseldorf flagships fit into its experiential retail expansion and longer-term investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

MINISO Group Holding Investment Narrative Recap

To own MINISO, you need to believe its IP-led, experiential stores can keep driving traffic and margins while expansion stays efficient and costs under control. The Milan and Dusseldorf flagships reinforce the short term growth catalyst around higher quality international store rollouts, but they also slightly amplify existing risks around overexpansion and execution in IP merchandising rather than changing them in a material way.

The most relevant recent announcement here is MINISO’s guidance for around 25% revenue growth in 2025 with operating profit of RMB 3.65–3.85 billion, because it sets a clear yardstick for whether these new European flagships are supporting the broader push toward higher earnings and better store productivity. Against that backdrop, investors may watch closely how experiential, IP-driven formats impact selling and administrative expenses as directly operated overseas stores become a larger share of the mix.

But while the new Milan and Dusseldorf stores look exciting, investors should still be aware that rising selling and labor costs could...

Read the full narrative on MINISO Group Holding (it's free!)

MINISO Group Holding's narrative projects CN¥31.7 billion revenue and CN¥4.9 billion earnings by 2028. This requires 19.4% yearly revenue growth and a CN¥2.5 billion earnings increase from CN¥2.4 billion today.

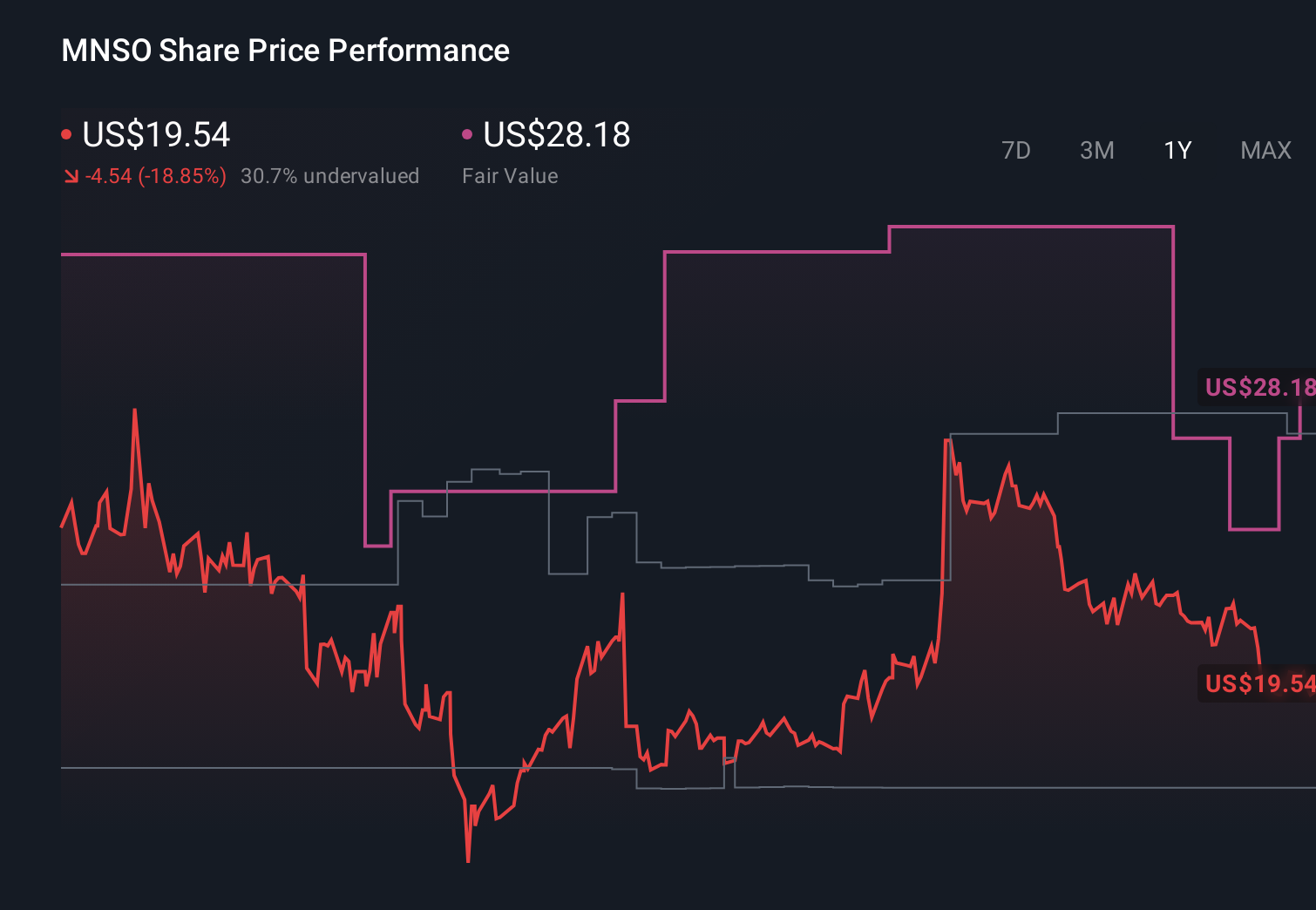

Uncover how MINISO Group Holding's forecasts yield a $26.87 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Five MINISO fair value estimates from the Simply Wall St Community range from US$26.20 to US$44.06, showing wide disagreement among private investors. Against that spread, MINISO’s push into immersive, IP-led European flagships highlights both the upside of global expansion and the ongoing risk of higher operating costs weighing on margins, so it can pay to compare several viewpoints before deciding how this growth story fits your portfolio.

Explore 5 other fair value estimates on MINISO Group Holding - why the stock might be worth just $26.20!

Build Your Own MINISO Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MINISO Group Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MINISO Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MINISO Group Holding's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNSO

MINISO Group Holding

An investment holding company, engages in the retail and wholesale of design-led lifestyle and pop toy products in Mainland China, the rest of Asia, North and Latin America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)