Macy's (M) Valuation After Tony Spring’s Overhaul, Store Closures, and Upgraded Earnings Guidance

Reviewed by Simply Wall St

Macy's (M) is back in the spotlight after CEO Tony Spring doubled down on a sweeping overhaul, closing roughly a third of U.S. stores while still raising full year 2025 sales guidance.

See our latest analysis for Macy's.

Those moves seem to be resonating with investors, with the share price at $23.84 and a strong year to date share price return of 43.96%, while the five year total shareholder return of 171.11% suggests this turnaround story has been building for a while.

If Macy's shake up has you rethinking retail, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

Yet with revenue under pressure and the share price racing ahead of analyst targets, the key question now is whether Macy's still trades at a discount to its true potential or if markets are already pricing in the turnaround.

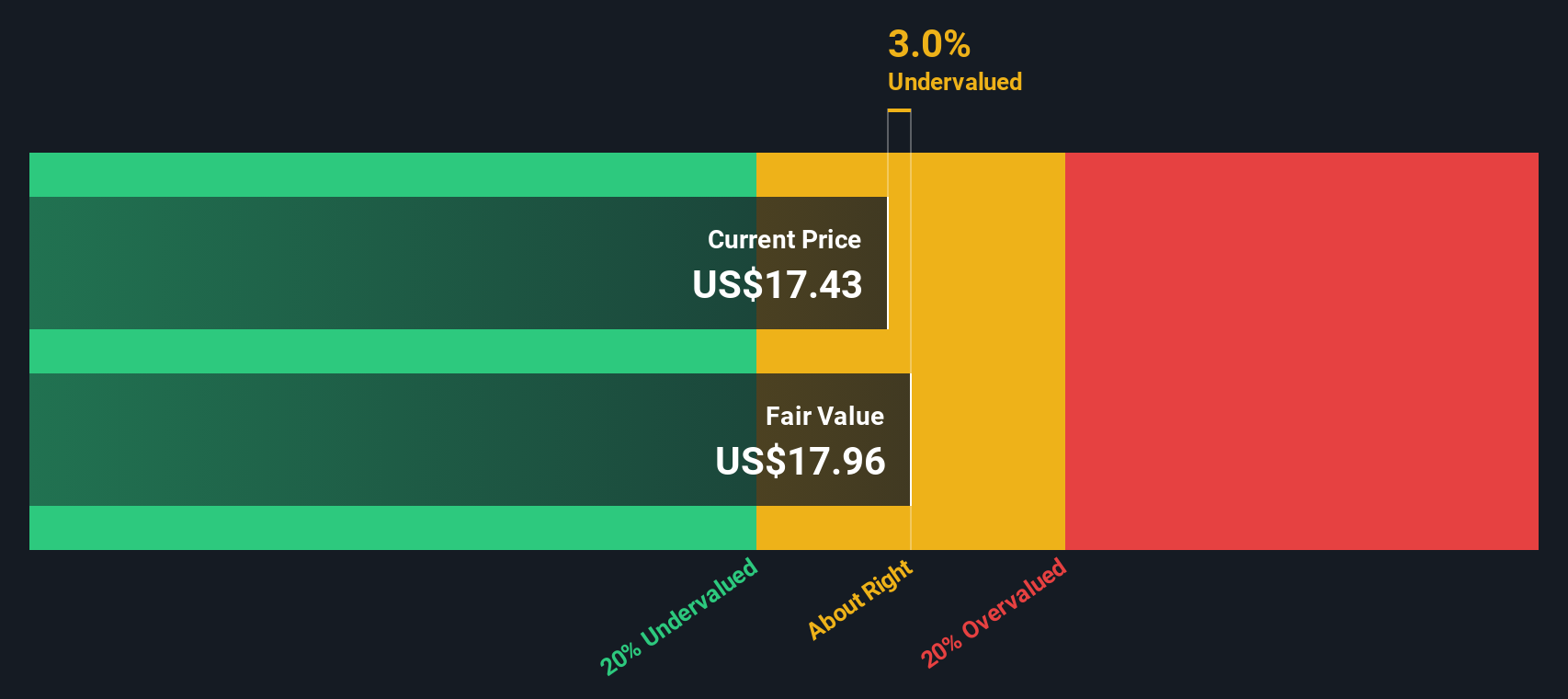

Most Popular Narrative: 9.9% Overvalued

Macy's last closed at $23.84, above the most followed narrative's fair value of $21.70, setting up a tension between market optimism and modeled fundamentals.

Ongoing modernization efforts, including end to end operational automation and technology upgrades, are expected to drive continued SG&A savings and supply chain efficiencies, supporting stronger adjusted EBITDA and longer term margin expansion as the company capitalizes on the need for seamless, tech enabled retail experiences.

If you want to see what kind of margin lift and earnings power those upgrades are meant to unlock, and what future multiple that could support, explore the full narrative for the detailed roadmap behind that $21.70 fair value and the assumptions that put Macy's slightly behind its current share price.

Result: Fair Value of $21.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent shifts to e commerce, along with pressure on margins from tariffs and pricing missteps, could undercut Macy's turnaround assumptions and valuation case.

Find out about the key risks to this Macy's narrative.

Another Angle on Value

While the most popular narrative sees Macy's as 9.9% overvalued, our DCF model points the other way. It estimates fair value at $28.15 per share, implying the stock is undervalued despite recent gains. Which story better captures the next leg of this turnaround?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Macy's Narrative

If you see the story playing out differently or want to dig into the numbers yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one turnaround story when you can scan the market for fresh opportunities that fit your strategy, risk appetite, and long term goals.

- Capitalize on mispriced opportunities by targeting these 906 undervalued stocks based on cash flows that could offer stronger upside as valuations normalize.

- Position yourself early in transformative tech by focusing on these 26 AI penny stocks powering real world breakthroughs in automation and intelligence.

- Lock in potential income streams through these 13 dividend stocks with yields > 3% that combine yield with the financial strength to keep paying shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)