- United States

- /

- Specialty Stores

- /

- NYSE:KMX

CarMax (KMX) Earnings Beat Five-Year Trend, Reinforcing Bullish Narratives on Profit Quality

Reviewed by Simply Wall St

CarMax (KMX) delivered earnings growth of 24.8% over the last twelve months, a sharp contrast to its five-year average of negative 18% per year. The stock is trading at $44.86, with earnings per share forecast to increase by 15.25% annually, just shy of the US market projection of 15.5% per year. While revenue growth is expected to lag at 0.5% per year, investors may be taking note of the company’s high-quality earnings and sector-relative value, tempered by a cautious outlook on financial position.

See our full analysis for CarMax.Next up, we’ll see how these headline numbers compare to the leading narratives and expectations from the market and experienced investors alike.

See what the community is saying about CarMax

Margins Set for a Comeback

- Analysts project CarMax’s profit margins to rise from 1.9% today to 3.1% over the next three years, even as wholesale gross profit per unit saw a recent decline that could challenge this outlook if it persists.

- According to the analysts' consensus view, the company’s recent cost reduction push, particularly in logistics and reconditioning, is expected to help offset macro pressures and support margin expansion.

- These operational savings are seen as critical to improving net margins, even as competitive vehicle sourcing and rising inventory costs pose headwinds.

- Consensus notes that digital channel expansion and enhanced sourcing capabilities are positioned as further levers to lift gross profit margins above current levels.

Consensus expects margin recovery to be the linchpin behind CarMax’s next phase. Will the improvement materialize? 📊 Read the full CarMax Consensus Narrative.

Lending Expands, Risks on Watch

- The expansion of CarMax’s full credit spectrum lending is expected to boost financing income and net interest margins, but brings a risk of higher loan losses if not carefully managed.

- Analysts' consensus view acknowledges that while this lending push should help drive sales and bottom-line growth, rising provisioning for loan losses could erode these gains.

- Bears highlight that a shift in credit profile might weaken future profitability, especially if economic conditions deteriorate.

- Analysts counter that operational efficiencies and new cost controls could help absorb this risk without derailing overall earnings growth.

Valuation: DCF Discount, Peer Premium

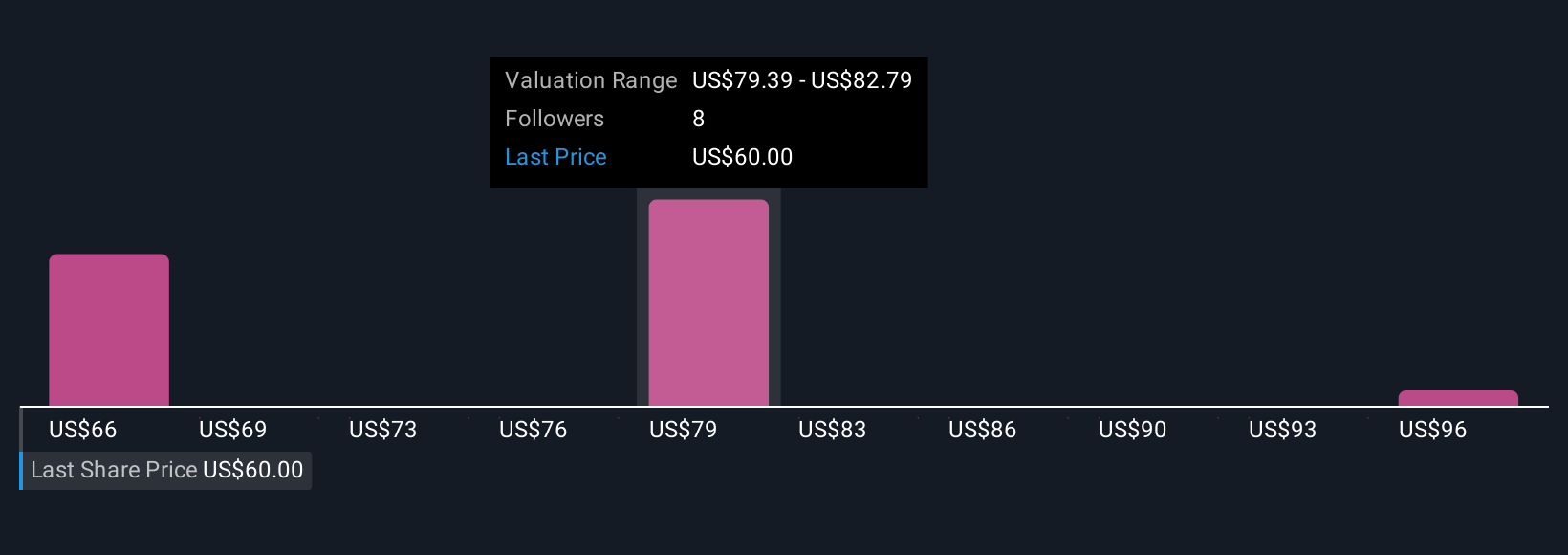

- Shares trade at $44.86, above the DCF fair value of $38.89, pricing in a premium over direct peers (12.9x PE at CarMax vs. 12.4x for peers) but at a discount to the broader US Specialty Retail industry average (17.7x PE).

- Analysts' consensus calls out that the current price is still below their $63.27 target, relying on assumptions that margins will reach 3.1% and earnings climb to $919.9 million by 2028.

- Consensus also cautions that unless CarMax can achieve these margin and earnings targets, a sustained re-rating closer to the industry multiple may not play out.

- This outlook positions CarMax as a value stock in its sector, but success hinges on overcoming cost and competitive risks outlined above.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CarMax on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.Want a fresh take on these numbers? Share your view and put your own narrative together in just a few minutes. Do it your way

A great starting point for your CarMax research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

CarMax’s future growth depends heavily on achieving ambitious margin recovery as well as overcoming risks from rising loan losses and competitive cost pressures.

If you’d rather look for stocks with steadier earnings momentum and less uncertainty, discover opportunities with consistent performance using our stable growth stocks screener for peace of mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives