- United States

- /

- Specialty Stores

- /

- NYSE:KMX

CarMax (KMX): Assessing Valuation After Class Action Lawsuits, Weak Q2 Results and CEO Exit Shake Confidence

Reviewed by Simply Wall St

CarMax (KMX) is suddenly at the center of a legal storm, with multiple securities class actions piling up after weak Q2 fiscal 2026 results, tariff driven demand hangovers, and an abrupt CEO exit that shook investor confidence.

See our latest analysis for CarMax.

Despite the legal overhang, CarMax’s recent 30 day share price return of 19.11 percent hints at a tentative rebound, but that sits against a steep year to date share price decline and a deeply negative five year total shareholder return. This suggests momentum is stabilizing rather than truly turning.

If CarMax’s volatility has you rethinking where you look for ideas, it could be a good moment to explore auto manufacturers as a way to uncover other opportunities in the auto space.

With shares down sharply over one and five years yet screens flagging modest intrinsic undervaluation, are investors being compensated for taking on legal and execution risk here, or is the market already discounting any credible recovery in growth?

Most Popular Narrative: 3.1% Overvalued

With CarMax last closing at $41.01 against a narrative fair value just under $40, the story leans slightly cautious and hinges on execution.

CarMax's initiative to broaden its full credit spectrum lending capabilities through CarMax Auto Finance (CAF) is expected to increase CAF income and net interest margins over time. This initiative aims to capture more sales and improve financing income, impacting earnings positively.

Want to see what powers that confidence in earnings? The narrative leans on a careful blend of modest growth, margin repair, and a future earnings multiple that still implies upside. Curious which specific profit and revenue assumptions need to land perfectly for that math to hold together? The full narrative breaks down every moving piece.

Result: Fair Value of $39.77 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit losses or sustained margin pressure from weaker wholesale pricing could quickly undercut the recovery assumptions baked into today’s cautious fair value.

Find out about the key risks to this CarMax narrative.

Another Lens on Value

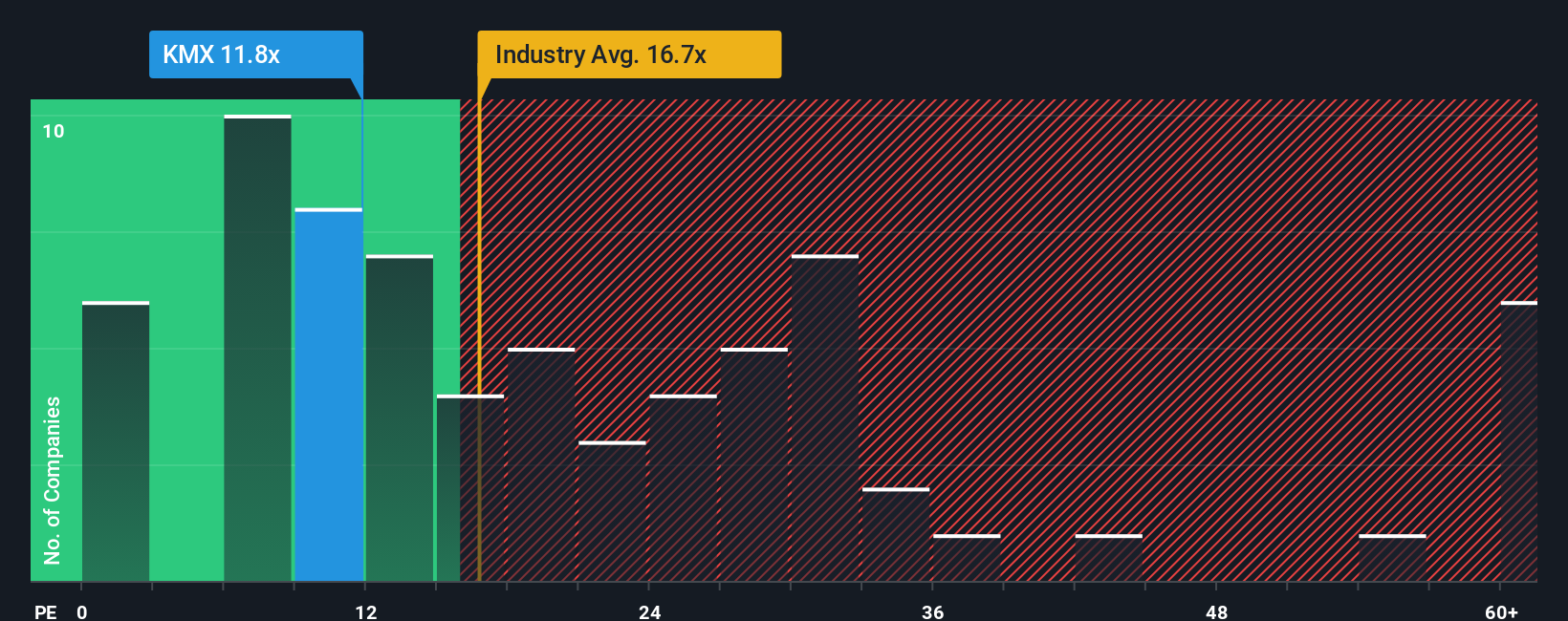

While the narrative fair value puts CarMax around $40 and flags mild overvaluation, its 11.6x price to earnings multiple is far cheaper than the Specialty Retail average of 20.2x and a fair ratio of 17.8x. This hints that the market may be over penalizing near term risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarMax Narrative

If you see the setup differently or want to pressure test every assumption yourself, you can build a custom CarMax view in just minutes: Do it your way.

A great starting point for your CarMax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Carve out time today to sharpen your watchlist with fresh, data backed opportunities using the Simply Wall St Screener, so you are not reacting after markets move.

- Capitalize on market mispricing by targeting companies trading below their estimated cash flow value through these 908 undervalued stocks based on cash flows before broader sentiment catches up.

- Explore structural healthcare themes by assessing innovators focused on diagnostics and patient outcomes with these 30 healthcare AI stocks while the story is still developing.

- Research potential opportunities in digital payments by filtering longer term candidates among these 80 cryptocurrency and blockchain stocks that align with your risk tolerance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion