- United States

- /

- Specialty Stores

- /

- NYSE:GPI

Group 1 Automotive (GPI): Assessing Valuation After the Recent Share Price Pullback

Reviewed by Simply Wall St

Group 1 Automotive (GPI) has quietly delivered strong multi year returns, even as the stock has slipped about 3% over the past day and 11% over the past 3 months. That disconnect has value investors taking a closer look.

See our latest analysis for Group 1 Automotive.

At around $413.74, the recent pullback in Group 1 Automotive’s share price contrasts with its substantial three and five year total shareholder returns. This suggests that momentum has cooled a little, even as the longer term story remains compelling.

If you are comparing Group 1 with its peers, this could be a good moment to scan other auto manufacturers via auto manufacturers and see what else fits your watchlist.

With earnings still growing, long term returns strong, and the share price trading below consensus targets, investors face a key question: is Group 1 Automotive modestly undervalued today, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 14.4% Undervalued

With the narrative placing fair value above the recent close, the gap between $413.74 and its implied worth hinges on a few specific profit drivers.

The sustained growth in the high margin parts and service (aftersales) segment, driven by an aging vehicle fleet and rising average vehicle age in both the U.S. and U.K., positions Group 1 to capitalize on increasing repair and maintenance needs, which should continue to expand recurring revenue and bolster margins. Ongoing expansion of technician headcount, investments in service capacity, and focus on customer outreach to owners of older vehicles are set to further increase aftersales throughput providing earnings stability and margin growth less correlated to vehicle sales cycles.

Want to see what kind of revenue engine sits behind that aftersales story? The narrative quietly bakes in rising margins and shrinking share count. Curious how far that stretches earnings power?

Result: Fair Value of $483.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, digital first competitors and faster than expected EV adoption could pressure Group 1’s margins and undermine the aftersales driven earnings narrative.

Find out about the key risks to this Group 1 Automotive narrative.

Another View: Market Ratios Tell a Different Story

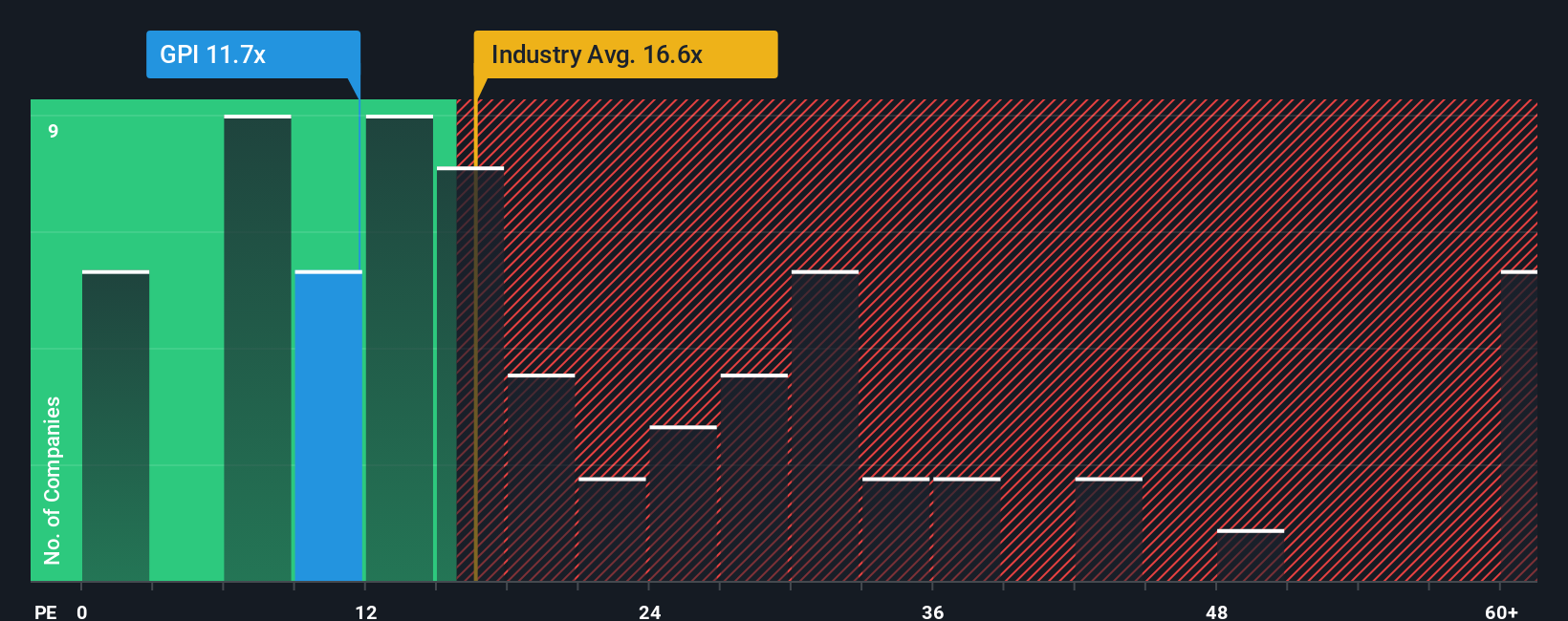

Look past the narrative and Group 1 trades at 13.8 times earnings, richer than peers at 11.9 times but below an 18.1 fair ratio that our model suggests the market could move toward. That mix hints at limited downside but also raises questions about how much upside is really left.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Group 1 Automotive Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Group 1 Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready for your next move? Use the Simply Wall Street Screener to pinpoint fresh opportunities before everyone else is talking about them.

- Capture potential multi baggers early by scanning these 3609 penny stocks with strong financials built on solid financial foundations instead of pure hype.

- Position yourself at the frontier of innovation by targeting these 26 AI penny stocks that harness artificial intelligence for scalable, real world solutions.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can support reliable cash returns alongside capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPI

Group 1 Automotive

Through its subsidiaries, operates in the automotive retail industry in the United States and the United Kingdom.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)