- United States

- /

- Retail Distributors

- /

- NYSE:GPC

US Dividend Stocks Spotlight: Three Top Picks

Reviewed by Simply Wall St

As major U.S. indices like the S&P 500 and Nasdaq Composite continue to face declines, largely driven by a downturn in technology stocks, investors are increasingly turning their attention toward more stable options in a volatile market environment. In such times, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive choice for those seeking stability amidst market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.47% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.79% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.11% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.42% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.08% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.98% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.11% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

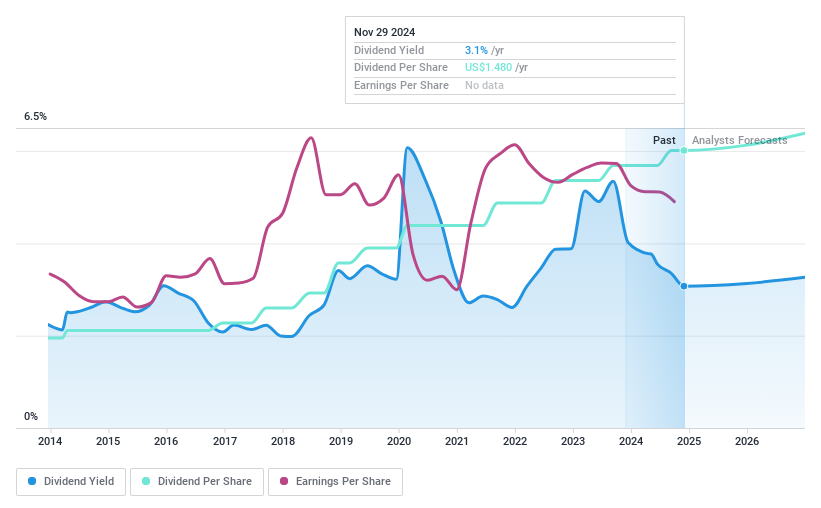

Fifth Third Bancorp (NasdaqGS:FITB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fifth Third Bancorp is a bank holding company for Fifth Third Bank, National Association, offering a variety of financial products and services in the United States with a market cap of approximately $28.72 billion.

Operations: Fifth Third Bancorp generates revenue from various segments, including $3.72 billion from Commercial Banking, $613 million from Wealth and Asset Management, and $4.94 billion from Consumer and Small Business Banking.

Dividend Yield: 3.4%

Fifth Third Bancorp offers a reliable dividend yield of 3.44%, with dividends well covered by earnings, reflected in a payout ratio of 45.6%. The company has consistently increased its dividend payments over the past decade, indicating stability and reliability for income-focused investors. Recent expansions, including new branches in underserved areas and a strategic push into Southeast markets, suggest potential for growth in customer base and revenues. However, insider selling could be a point of concern for some investors.

- Get an in-depth perspective on Fifth Third Bancorp's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Fifth Third Bancorp shares in the market.

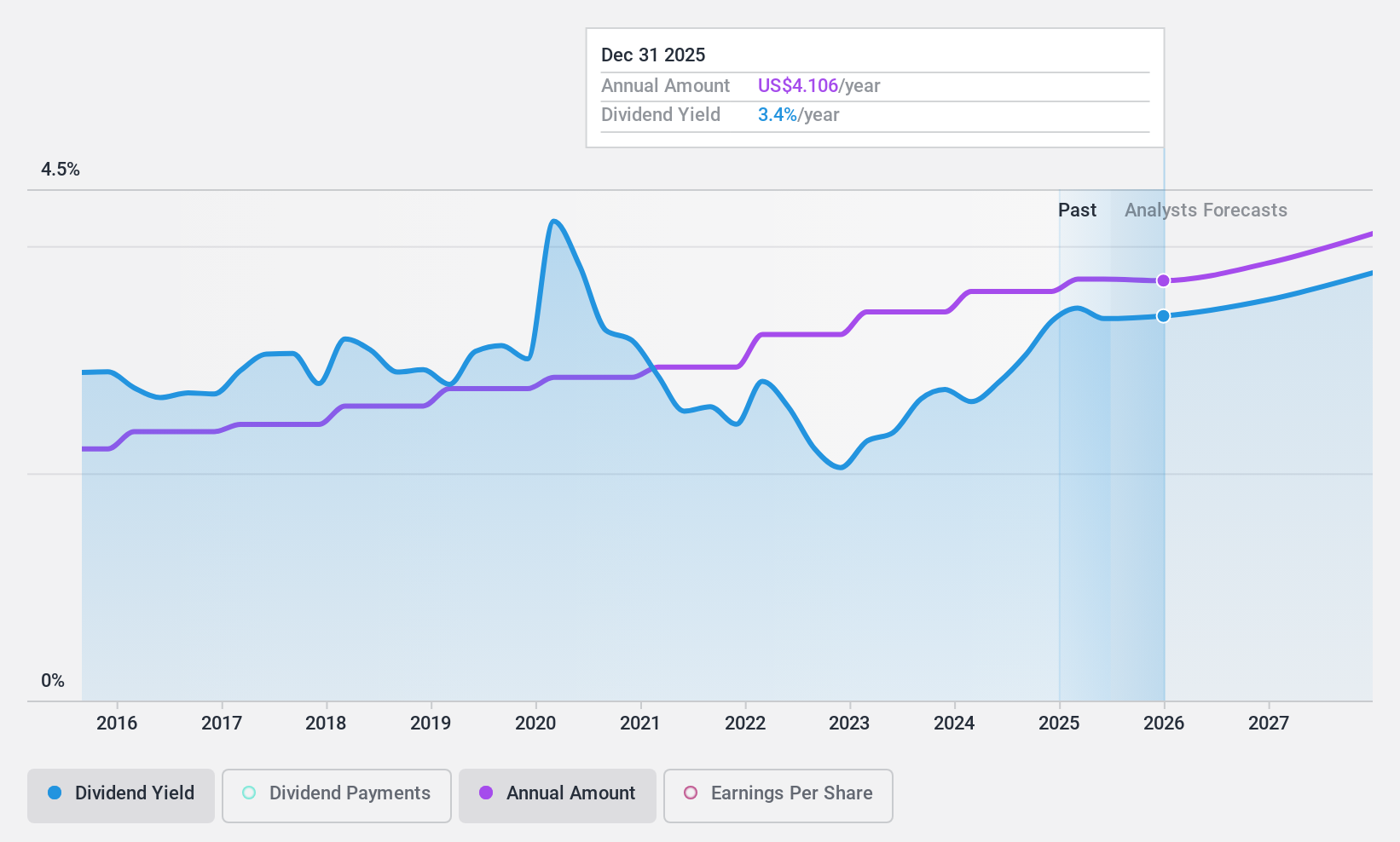

Genuine Parts (NYSE:GPC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Genuine Parts Company distributes automotive replacement parts and industrial parts and materials, with a market cap of $16.88 billion.

Operations: Genuine Parts Company's revenue is derived from two main segments: Automotive, which contributes $14.77 billion, and Industrial (including Electrical/Electronic Materials), which accounts for $8.72 billion.

Dividend Yield: 3.4%

Genuine Parts Company offers a stable dividend yield of 3.37%, supported by a reasonable payout ratio of 61.6% and cash coverage at 83.6%. Despite high debt levels, dividends have grown consistently over the past decade. Recent announcements include a quarterly dividend increase and plans for strategic bolt-on acquisitions to enhance capabilities, alongside efforts to reduce net debt in 2025, which may strengthen its financial position further amidst declining profit margins and earnings per share compared to the previous year.

- Click to explore a detailed breakdown of our findings in Genuine Parts' dividend report.

- According our valuation report, there's an indication that Genuine Parts' share price might be on the cheaper side.

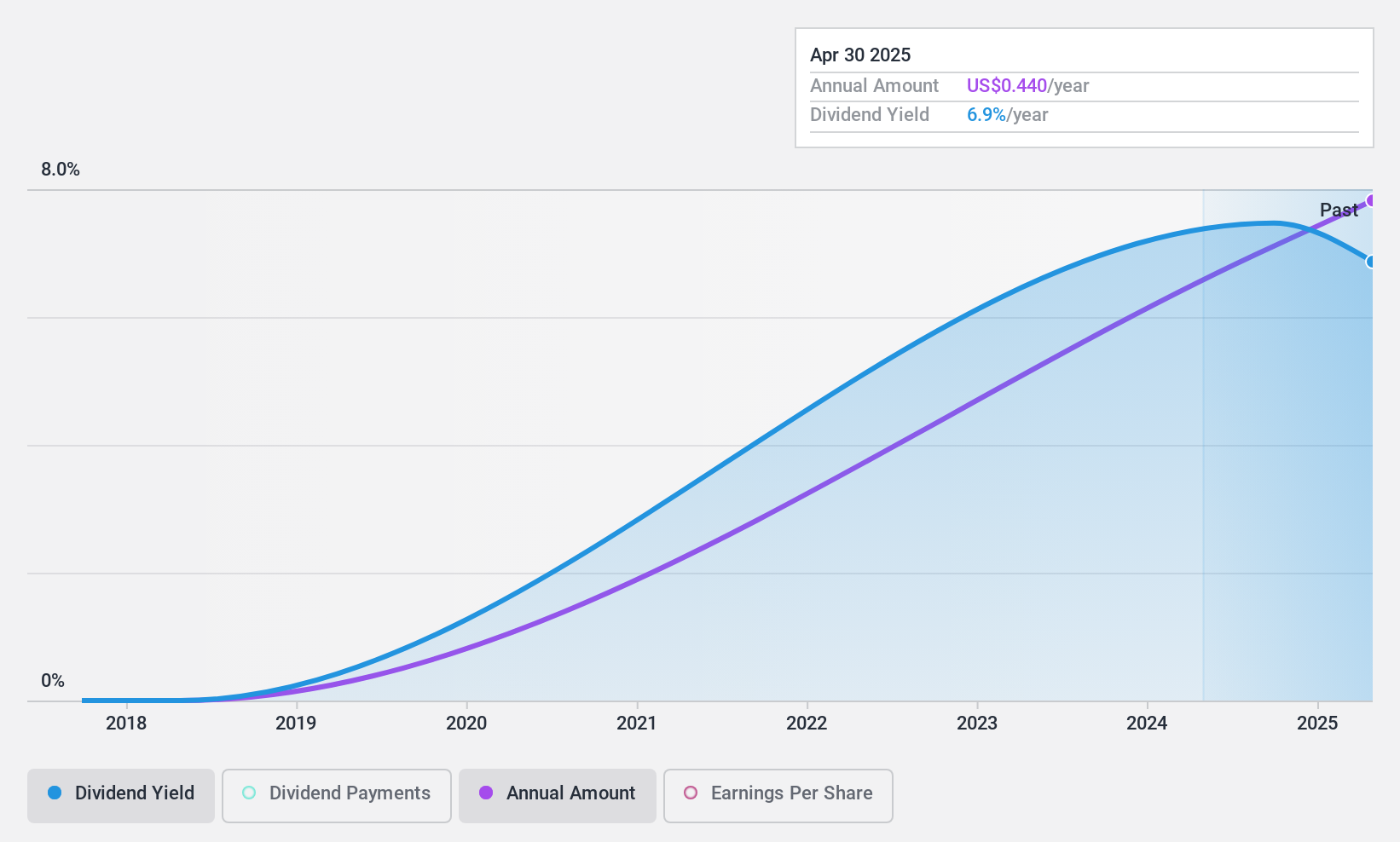

Yiren Digital (NYSE:YRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yiren Digital Ltd. operates an AI-powered financial services platform in China with a market cap of approximately $658.09 million.

Operations: Yiren Digital Ltd. generates revenue primarily from its Financial Services Business (CN¥3.21 billion) and Insurance Brokerage Business (CN¥400.14 million).

Dividend Yield: 5.9%

Yiren Digital's dividend is relatively new, making it difficult to assess its growth or reliability. However, the company's low payout ratio of 6.7% and cash payout ratio of 12.2% indicate dividends are well-covered by earnings and cash flows. Trading at a significant discount to estimated fair value, Yiren Digital offers a dividend yield of 5.9%, placing it in the top quartile among US dividend payers, yet stability remains uncertain due to its recent initiation.

- Navigate through the intricacies of Yiren Digital with our comprehensive dividend report here.

- Our expertly prepared valuation report Yiren Digital implies its share price may be lower than expected.

Taking Advantage

- Dive into all 143 of the Top US Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPC

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives