- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Is Carvana's (CVNA) New York Expansion a Sign of Scalable Efficiency or Just Incremental Progress?

Reviewed by Sasha Jovanovic

- Carvana recently announced the addition of Inspection and Reconditioning Center capabilities to its longstanding ADESA Long Island auction site in Yaphank, New York, marking its tenth such integration in 2025 and creating approximately 100 new jobs over time.

- This expansion not only boosts reconditioning capacity and delivery speed for retail and wholesale customers in the New York metropolitan area but also highlights Carvana's ongoing investment in infrastructure to enhance operational efficiency through its proprietary CARLI software platform.

- We'll explore how this expansion of reconditioning infrastructure further supports Carvana's ongoing investment narrative centered on scalable growth and operating efficiency.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Carvana Investment Narrative Recap

To be a Carvana shareholder, you need to believe that its vertically integrated e-commerce model and ongoing investments in reconditioning and logistics infrastructure will lead to continued revenue and margin growth. The recent ADESA Long Island IRC integration adds local capacity and supports efficiency, but its direct impact on the most important near-term catalyst, strong unit and top-line growth, appears incremental, while operational bottlenecks and underutilization remain the biggest immediate risks.

Among recent announcements, Carvana’s roll-out of same-day vehicle delivery in the San Francisco Bay Area is especially relevant. Like the latest initiative in New York, it reflects moves to shorten delivery times and enhance the customer experience, factors linked to better unit growth and more effective infrastructure use.

Still, despite impressive expansion, investors should be aware that sustained high growth depends on Carvana’s ability to scale new capacity efficiently in the face of...

Read the full narrative on Carvana (it's free!)

Carvana's outlook envisions $33.2 billion in revenue and $2.2 billion in earnings by 2028. This scenario depends on revenue growing 26.8% annually and a $1.6 billion increase in earnings from the current $563.0 million.

Uncover how Carvana's forecasts yield a $421.95 fair value, a 22% upside to its current price.

Exploring Other Perspectives

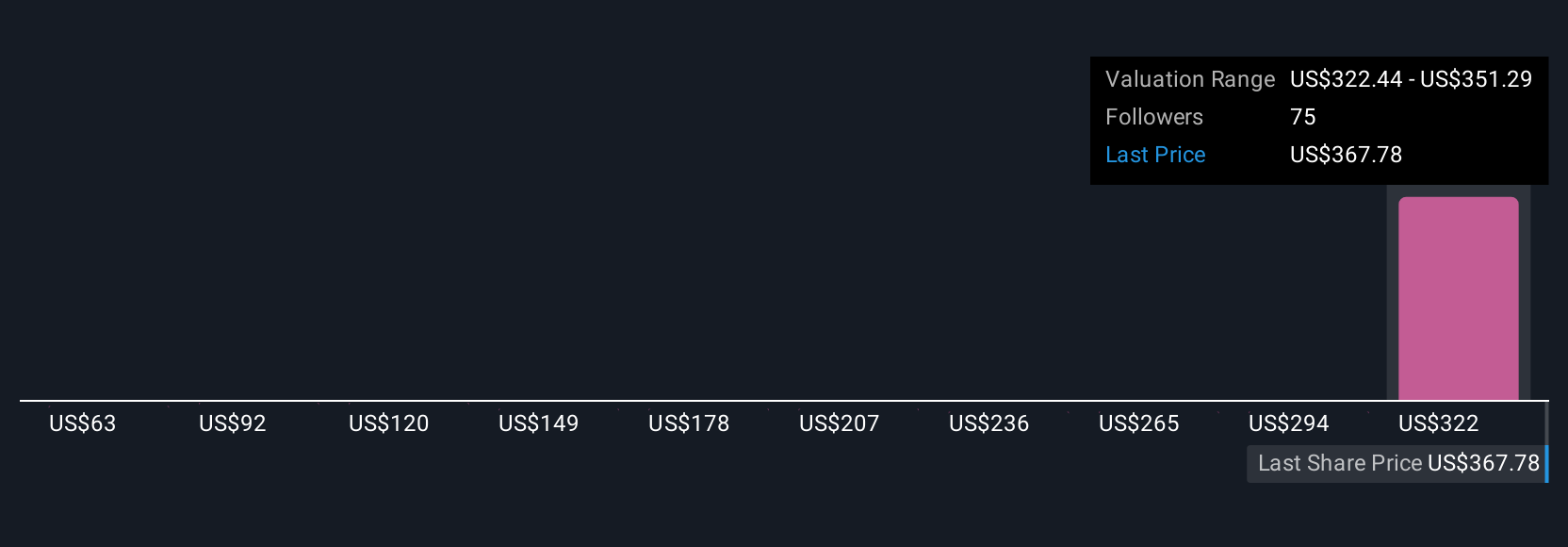

Sixteen fair value estimates from the Simply Wall St Community span US$62.76 to US$500, showing significant differences in how future prospects are judged. With operations expanding quickly, some participants emphasize the company’s need to efficiently ramp up utilization to protect margins in the months ahead.

Explore 16 other fair value estimates on Carvana - why the stock might be worth less than half the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives