- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (CVNA): Evaluating Valuation After Recent Slowdown in Share Price Momentum

Reviewed by Kshitija Bhandaru

Carvana (CVNA) stock has been on investors’ radar, showing a return of nearly 65% year to date. Even with some recent pullback over the past month, the company’s fundamentals continue to generate conversation in the market.

See our latest analysis for Carvana.

After a huge rally earlier in the year, Carvana’s share price momentum has cooled with a nearly 9% drop over the past month. Yet the longer-term story remains impressive: the total shareholder return over one year stands at 71%, and the three-year figure is a staggering 1,821%. Investors appear to be re-evaluating growth prospects following a period of remarkable gains, bringing some volatility but also fresh attention to the underlying business.

If you’re tracking bold moves and strong follow-through, now is a great time to broaden your search and explore fast growing stocks with high insider ownership

With Carvana’s valuation now sitting near all-time highs, the big question becomes clear: is the recent dip a real chance to buy into future growth, or is the market already reflecting all the optimism ahead?

Most Popular Narrative: 22% Undervalued

With Carvana’s fair value set at $421.95 according to the most popular narrative, and the last close price at $329.24, there is a clear gap that has market-watchers intrigued. Momentum has slowed, but expectations for future growth and profitability remain at the heart of the bullish case.

The acceleration in consumer preference for purchasing vehicles online and increased comfort with high-value e-commerce transactions positions Carvana to capture a larger share of the used vehicle retail market, supporting outsized long-term unit and revenue growth.

Want to know the math that fuels this rosy outlook? The narrative is built on aggressive growth targets and margin expansion, with assumptions that could shake up traditional sector benchmarks. Curious how analysts justify such a premium? Unlock the formula behind this valuation to see what is really moving the price target.

Result: Fair Value of $421.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated valuations and potential supply chain disruptions could quickly challenge the bullish narrative if execution falls short or if headwinds intensify.

Find out about the key risks to this Carvana narrative.

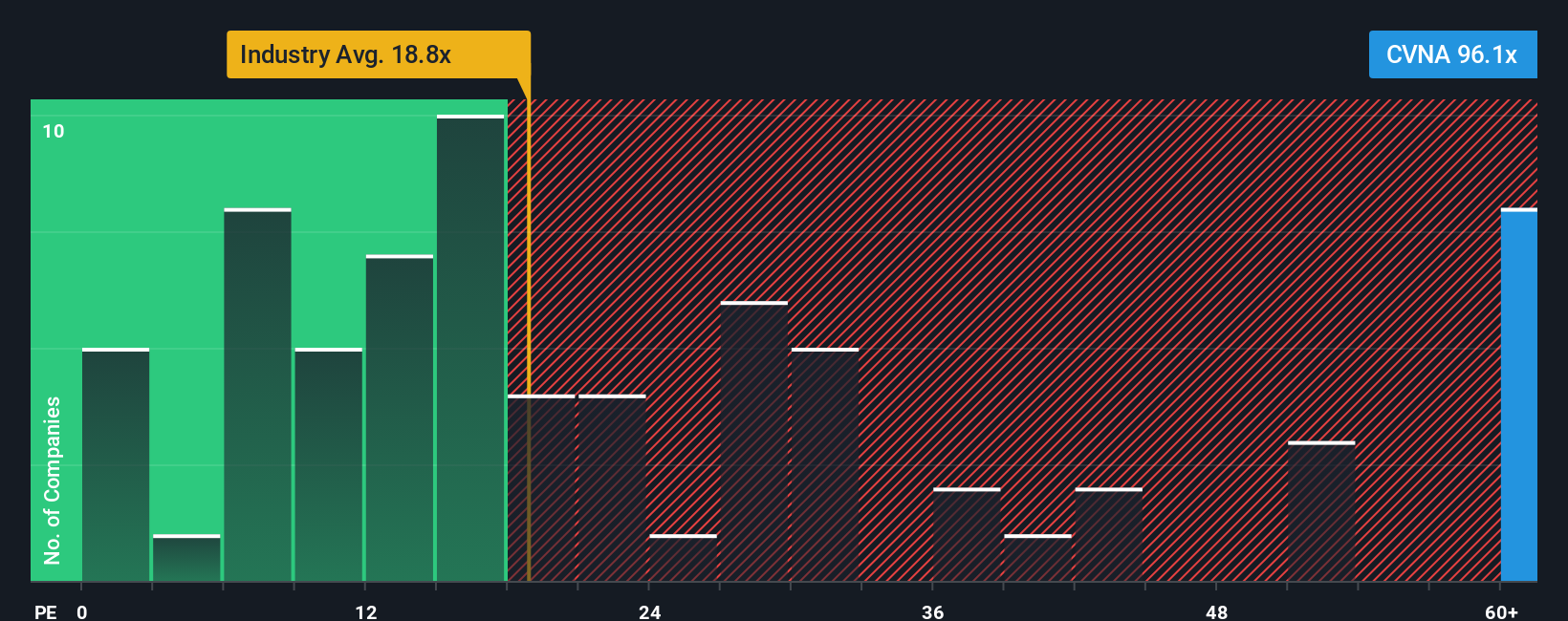

Another View: Valuation from Earnings Multiples

Looking from an earnings multiple angle, Carvana trades at 80.8 times earnings, which is dramatically higher than both the US Specialty Retail industry average of 15.8x and the peer average of 21.8x. Even compared to a fair ratio of 41.2x, the current price suggests investors are pricing in exceptional growth ahead. Does this premium offer an opportunity or is it a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carvana Narrative

If these numbers spark a different take or you want to dig into the details yourself, crafting your own Carvana story is quick and straightforward. Do it your way

A great starting point for your Carvana research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors never settle for just one idea. Level up your strategy by checking out other markets primed for momentum before everyone else catches on.

- Jump on new digital trends with these 79 cryptocurrency and blockchain stocks, where innovative companies are reshaping how finance and transactions work worldwide.

- Lock in reliable income streams by starting with these 19 dividend stocks with yields > 3%, which features companies paying yields above 3%. This is a great way to boost your portfolio’s returns.

- Ride the next wave of healthcare breakthroughs by browsing these 33 healthcare AI stocks, with opportunities at the cutting edge of artificial intelligence and medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives