- United States

- /

- Specialty Stores

- /

- NYSE:BKE

3 Dividend Stocks On US Exchange With 9% Yield

Reviewed by Simply Wall St

As the U.S. stock market flirts with record highs, investors are navigating a mixed landscape where major indexes like the S&P 500 and Nasdaq Composite have shown modest gains while others remain volatile. In this environment, dividend stocks offering yields of 9% can be particularly appealing for those seeking income stability, as they provide potential returns through regular payouts amid fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.25% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.88% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.34% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.27% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.86% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.75% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.82% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

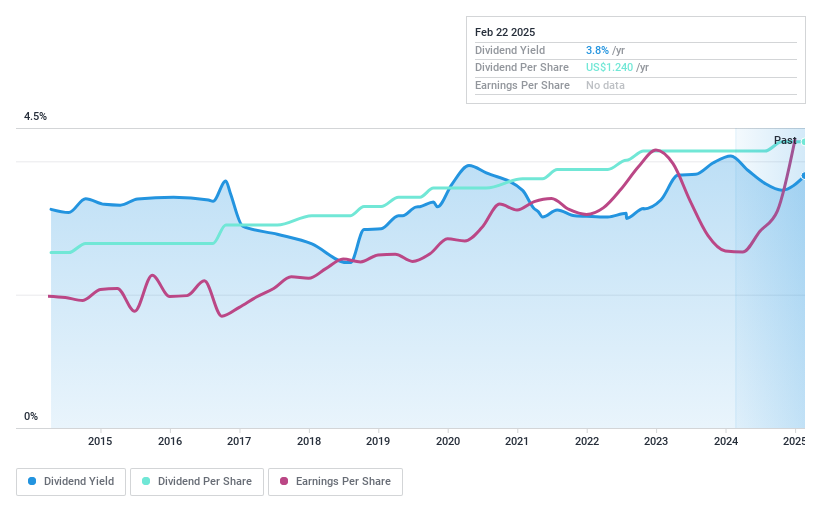

Eagle Financial Services (NasdaqCM:EFSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eagle Financial Services, Inc., with a market cap of $114.22 million, operates as the bank holding company for Bank of Clarke, offering a range of retail and commercial banking products and services in the Shenandoah Valley, Northern Virginia, and Frederick, Maryland.

Operations: Eagle Financial Services, Inc. generates revenue through its retail and commercial banking products and services offered in regions including the Shenandoah Valley, Northern Virginia, and Frederick, Maryland.

Dividend Yield: 3.8%

Eagle Financial Services recently transitioned to the NASDAQ Composite Index and completed a $50 million follow-on equity offering. The company reported strong earnings growth, with net income rising to US$15.34 million for 2024. Despite a dividend yield of 3.78%, below the top tier in the US, dividends have been stable and growing over the past decade, supported by a low payout ratio of 36.8%. A quarterly dividend of $0.31 was affirmed for February 2025.

- Take a closer look at Eagle Financial Services' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Eagle Financial Services is priced lower than what may be justified by its financials.

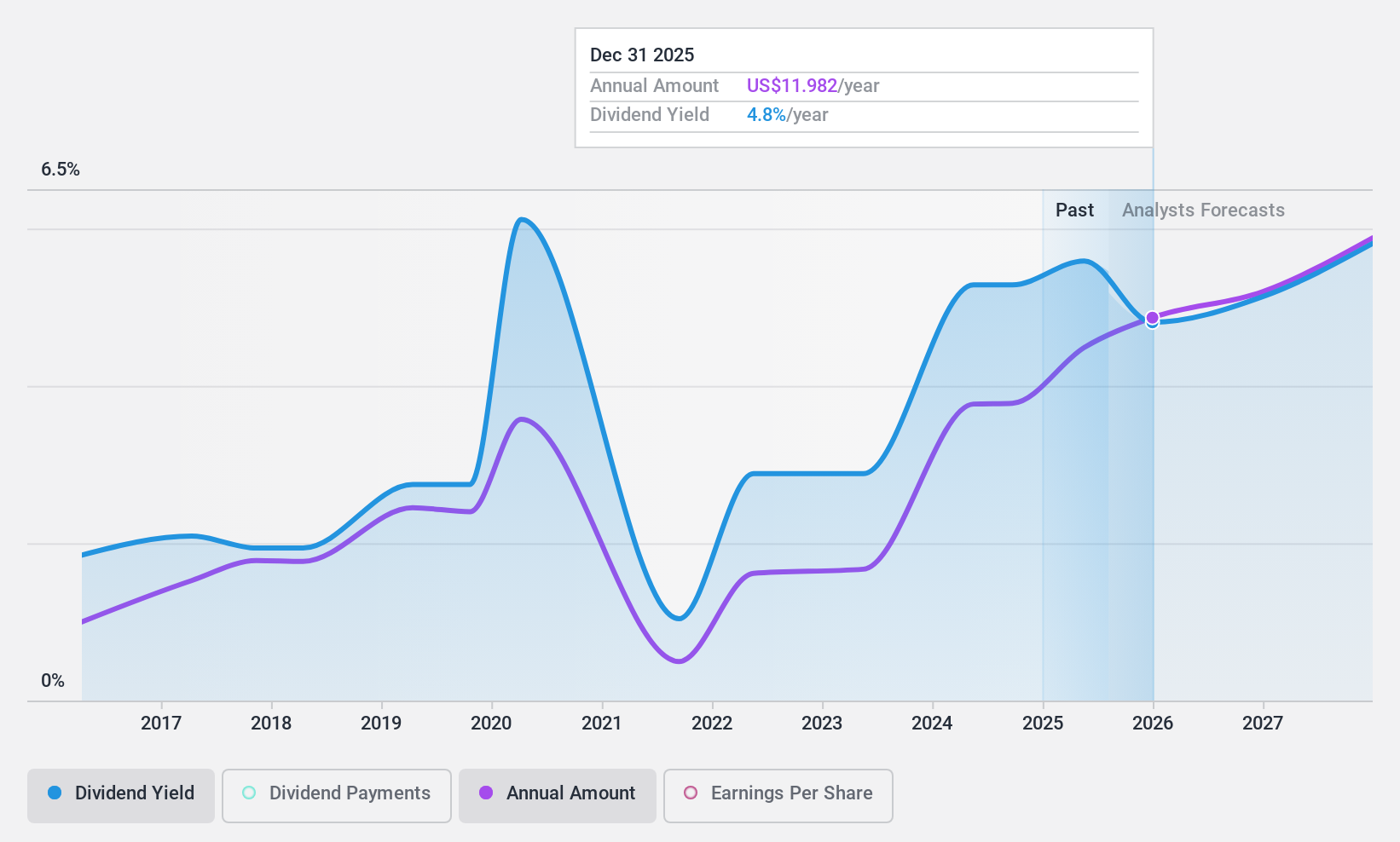

Credicorp (NYSE:BAP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credicorp Ltd. is a financial services company offering banking, insurance, and health products primarily in Peru and internationally, with a market cap of $14.78 billion.

Operations: Credicorp Ltd.'s revenue segments include banking services generating PEN 16.25 billion, insurance services contributing PEN 4.37 billion, and health services adding PEN 1.51 billion.

Dividend Yield: 5.1%

Credicorp's dividend payments have been volatile and unreliable over the past decade, despite a competitive yield of 5.06% placing it in the top 25% of US dividend payers. The company trades at a significant discount to its estimated fair value and peers, with dividends currently covered by earnings at a payout ratio of 53.3%, expected to improve to 47.5% in three years. However, concerns include high bad loans at 5.9%.

- Click here and access our complete dividend analysis report to understand the dynamics of Credicorp.

- Our valuation report unveils the possibility Credicorp's shares may be trading at a discount.

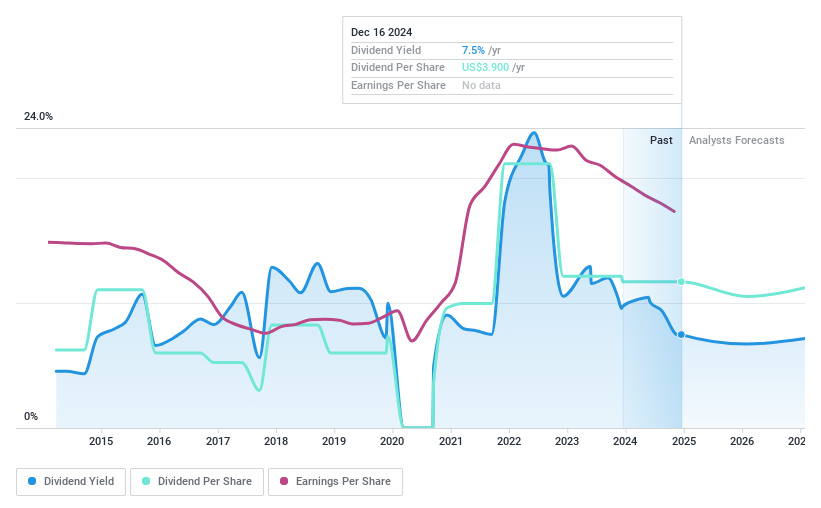

Buckle (NYSE:BKE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Buckle, Inc. is a U.S.-based retailer specializing in casual apparel, footwear, and accessories for young men and women, with a market cap of approximately $2.16 billion.

Operations: The Buckle, Inc. generates its revenue from the sale of casual apparel, footwear, and accessories, amounting to $1.22 billion.

Dividend Yield: 9%

Buckle's dividend yield of 9.01% ranks in the top 25% among US dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 103%, indicating dividends are not well-covered by free cash flows. Despite trading at good value compared to peers, Buckle's dividends have been volatile over the past decade. Recent sales results show a decline in net sales for fiscal year ending February 2025, impacting overall financial stability.

- Navigate through the intricacies of Buckle with our comprehensive dividend report here.

- Our valuation report here indicates Buckle may be undervalued.

Next Steps

- Click this link to deep-dive into the 135 companies within our Top US Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Buckle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKE

Buckle

Operates as a retailer of casual apparel, footwear, and accessories for young men and women in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives