- United States

- /

- Specialty Stores

- /

- NasdaqGS:ZUMZ

Some Shareholders May Object To A Pay Rise For Zumiez Inc.'s (NASDAQ:ZUMZ) CEO This Year

Key Insights

- Zumiez to hold its Annual General Meeting on 5th of June

- CEO Rick Brooks' total compensation includes salary of US$735.0k

- Total compensation is 77% below industry average

- Zumiez's three-year loss to shareholders was 57% while its EPS was down 83% over the past three years

Performance at Zumiez Inc. (NASDAQ:ZUMZ) has not been particularly rosy recently and shareholders will likely be holding CEO Rick Brooks and the board accountable for this. The next AGM coming up on 5th of June will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

See our latest analysis for Zumiez

How Does Total Compensation For Rick Brooks Compare With Other Companies In The Industry?

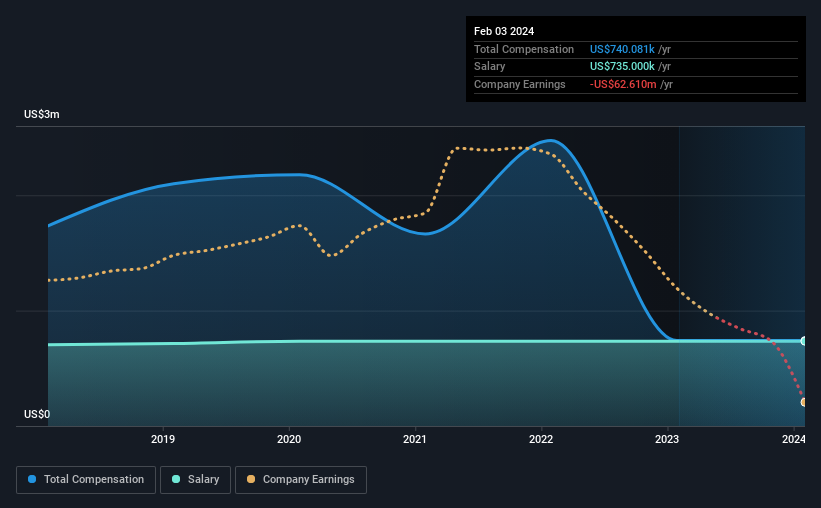

According to our data, Zumiez Inc. has a market capitalization of US$384m, and paid its CEO total annual compensation worth US$740k over the year to February 2024. This means that the compensation hasn't changed much from last year. Notably, the salary which is US$735.0k, represents most of the total compensation being paid.

On comparing similar companies from the American Specialty Retail industry with market caps ranging from US$200m to US$800m, we found that the median CEO total compensation was US$3.2m. That is to say, Rick Brooks is paid under the industry median. Moreover, Rick Brooks also holds US$50m worth of Zumiez stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$735k | US$735k | 99% |

| Other | US$5.1k | US$5.5k | 1% |

| Total Compensation | US$740k | US$740k | 100% |

On an industry level, around 17% of total compensation represents salary and 83% is other remuneration. Zumiez has gone down a largely traditional route, paying Rick Brooks a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Zumiez Inc.'s Growth

Zumiez Inc. has reduced its earnings per share by 83% a year over the last three years. In the last year, its revenue is down 8.4%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Zumiez Inc. Been A Good Investment?

With a total shareholder return of -57% over three years, Zumiez Inc. shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Rick receives almost all of their compensation through a salary. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for Zumiez that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zumiez might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ZUMZ

Zumiez

Operates as a specialty retailer of apparel, footwear, accessories, and hardgoods for young men and women in the United States, Australia, Canada, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)