- United States

- /

- Healthtech

- /

- NasdaqGM:CCLD

Promising US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As U.S. markets experience fluctuations amid inflation data and interest rate speculations, investors are keenly observing potential opportunities across various sectors. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.43 | $1.94B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.86 | $6.25M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $144.14M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.89 | $87.66M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.83M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.49 | $49.17M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9113 | $81.96M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.84 | $410.03M | ★★★★☆☆ |

Click here to see the full list of 701 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Tandy Leather Factory (NasdaqCM:TLF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tandy Leather Factory, Inc. and its subsidiaries retail leather and leathercraft-related items in the United States, Canada, and Spain, with a market cap of $33.77 million.

Operations: The company generates revenue from its Apparel segment, totaling $74.76 million.

Market Cap: $33.77M

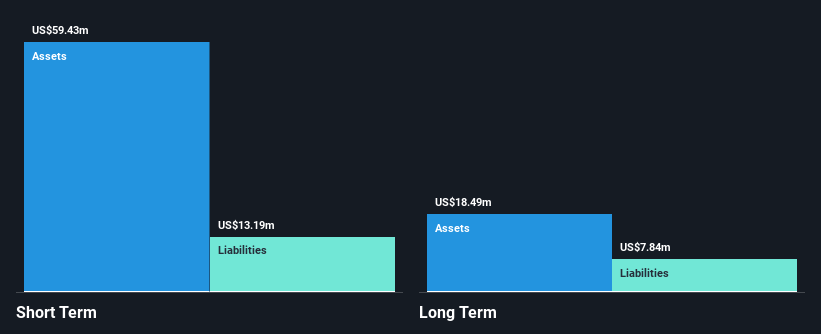

Tandy Leather Factory, Inc. has shown resilience in the penny stock market with a market cap of US$33.77 million and revenue of US$74.76 million from its Apparel segment. The company maintains strong financial health, with short-term assets of US$50.4 million exceeding both short-term and long-term liabilities, totaling US$15.4 million combined, and operates debt-free, eliminating interest payment concerns. Despite a recent net loss in Q3 2024 compared to profits last year, Tandy's earnings growth over five years remains robust at 66.6% annually on average but has slowed recently to 6.7%. A recent strategic move includes selling its headquarters for US$26.5 million while planning relocation by September 2025.

- Take a closer look at Tandy Leather Factory's potential here in our financial health report.

- Review our historical performance report to gain insights into Tandy Leather Factory's track record.

CareCloud (NasdaqGM:CCLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CareCloud, Inc. is a healthcare IT company offering cloud-based solutions and business services to healthcare providers and hospitals in the United States, with a market cap of $63.66 million.

Operations: The company's revenue is derived from two main segments: Healthcare IT, which contributes $96.76 million, and Medical Practice Management, accounting for $14.26 million.

Market Cap: $63.66M

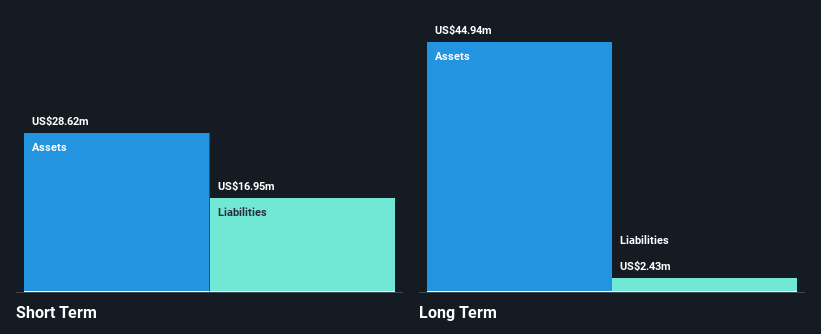

CareCloud, Inc., with a market cap of US$63.66 million, operates in the healthcare IT sector and recently reported third-quarter sales of US$28.55 million, slightly down from last year but achieving a net income of US$3.12 million compared to a previous loss. Despite being unprofitable overall, CareCloud has managed to maintain positive free cash flow and has sufficient cash runway for over three years if current conditions persist. The company reduced its revolving credit line from US$25 million to US$10 million, reflecting prudent financial management while securing assets against obligations with Silicon Valley Bank.

- Click here and access our complete financial health analysis report to understand the dynamics of CareCloud.

- Examine CareCloud's earnings growth report to understand how analysts expect it to perform.

Protalix BioTherapeutics (NYSEAM:PLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Protalix BioTherapeutics, Inc. is a biopharmaceutical company focused on developing, producing, and commercializing recombinant therapeutic proteins using its proprietary ProCellEx plant cell-based protein expression system, with a market cap of $124.44 million.

Operations: The company generates revenue of $45.67 million from its biotechnology startups segment.

Market Cap: $124.44M

Protalix BioTherapeutics, Inc., with a market cap of US$124.44 million, recently reported third-quarter revenue of US$17.96 million, up from US$10.35 million the previous year, and achieved a net income of US$3.24 million compared to a prior loss. Despite being unprofitable over the long term, the company has reduced losses by 21.9% annually over five years and maintains sufficient cash runway for more than three years due to positive free cash flow growth. Protalix is debt-free and trades at a significant discount relative to its estimated fair value while having stable weekly volatility and no recent shareholder dilution.

- Unlock comprehensive insights into our analysis of Protalix BioTherapeutics stock in this financial health report.

- Assess Protalix BioTherapeutics' future earnings estimates with our detailed growth reports.

Taking Advantage

- Navigate through the entire inventory of 701 US Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CCLD

CareCloud

A healthcare information technology (IT) company, provides technology-enabled business solutions, Software-as-a-Service offerings, and related business services to healthcare providers and hospitals primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives