- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

PDD Holdings (NasdaqGS:PDD) Reports Q1 Sales Growth But Decline In Net Income

Reviewed by Simply Wall St

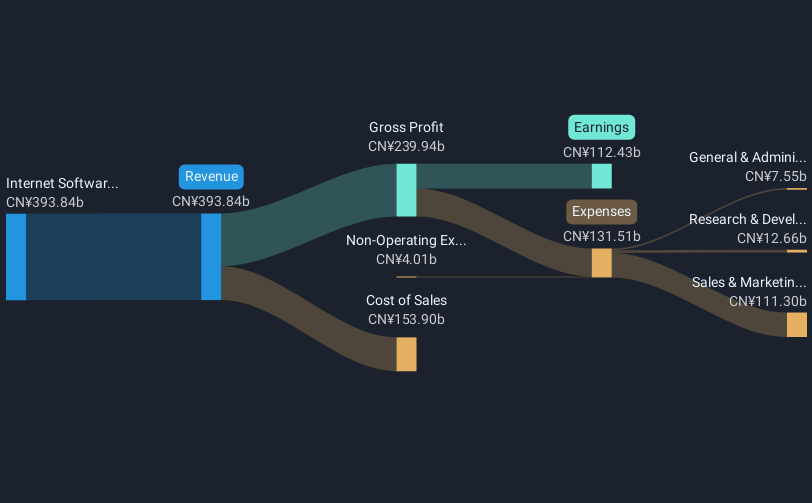

PDD Holdings (NasdaqGS:PDD) recently reported significant sales growth for the first quarter of 2025, reaching CNY 95,672 million, compared to the previous year's CNY 86,812 million. Despite this increase, the company's net income and earnings per share both fell, potentially influencing the flat share price movement observed over the past month. With major indices such as the S&P 500 and the Dow Jones showing little change during the same period, PDD Holdings' financial results may have contributed to the subdued performance without significantly deviating from broader market trends.

Buy, Hold or Sell PDD Holdings? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The recent increase in PDD Holdings' sales yet decline in net income highlights a complex scenario for investor sentiment. While the sales growth to CNY 95,672 million marks a positive development, the dip in earnings and flat share price could indicate market apprehension regarding profit sustainability. Over a longer frame, PDD Holdings achieved a total return of 104.53% over three years, illustrating a favorable trajectory when compared to the recent flat share price movements. However, within the past year, PDD Holdings has underperformed the broader US market, which returned 11.3%, and the US Multiline Retail industry, which returned 12.5%.

The supply chain investments and ecosystem enhancement strategies may lead to improved operational efficiencies and potential future revenue growth, consequently influencing long-term forecasts. Analysts project a 16.6% annual revenue growth over the next three years, acknowledging short-term strain on margins due to aggressive merchant support programs. Coupled with the anticipated earnings growth, this sets a foundation for the analysts' consensus target price of US$150.04, as the company's current share price of US$104.15 represents a near 30% discount to this target. The market seems to await tangible, positive outcomes from PDD Holdings’ investments before fully pricing in these expectations.

Upon reviewing our latest valuation report, PDD Holdings' share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)