- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

Leadership Transition at MercadoLibre (NasdaqGS:MELI) as CEO Moves to Executive Chairman

Reviewed by Simply Wall St

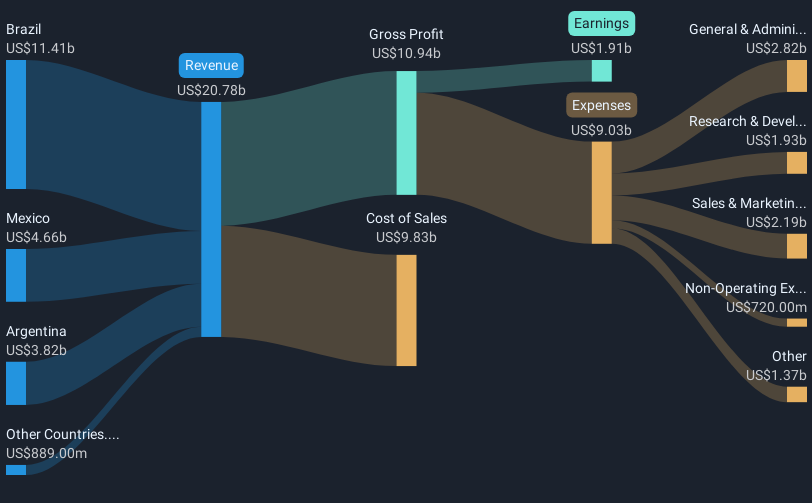

MercadoLibre (NasdaqGS:MELI) announced a significant leadership change with founder Marcos Galperin transitioning to Executive Chairman, while Ariel Szarfsztejn will become CEO in 2026. In tandem, the company reported strong Q1 financial performance, showcasing revenue and net income increases. Meanwhile, the broader market experienced fluctuations with slight rises in major indexes following a sell-off, amidst shifts in bond yields and record highs for Bitcoin. MercadoLibre's 27% share price rise over the last month aligns with these company-specific developments, reflecting investor confidence amid broader market trends that have seen a 1% decline.

Buy, Hold or Sell MercadoLibre? View our complete analysis and fair value estimate and you decide.

The leadership change at MercadoLibre with Marcos Galperin transitioning to Executive Chairman and Ariel Szarfsztejn set to become CEO in 2026 could have a significant impact on its growth strategies, especially in logistics and financial services. Investors seem optimistic about these developments, as reflected in the company's share price rise of 27% over the last month. Over the longer term, MercadoLibre's shares have delivered an impressive total return of 259.89% over the past three years, highlighting strong investor confidence in its ongoing initiatives and market position.

Compared to the broader market, which saw a 1% decline recently, MercadoLibre's stock has been outperforming, posting a one-year return exceeding the US market's return of 9.1% and the Multiline Retail industry's 11.5% return. The company's prospective expansion in Latin America's e-commerce and digital banking sectors is expected to enhance revenue and net income, with projected annual growth rates of 22.3% for revenue and 22.9% for earnings over the next three years.

As for the price movement, the current share price of US$2,229.00 presents a discount to the consensus analyst price target of US$2,474.37, indicating potential room for growth. This valuation reflects anticipated improvements in fulfillment efficiency and financial service offerings, but also acknowledges the risks associated with increased competition, high investment costs, and macroeconomic conditions. While investors can expect considerable revenue growth, achieving these forecasts will require navigating these challenges effectively.

Upon reviewing our latest valuation report, MercadoLibre's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade MercadoLibre, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives