- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGM:DIBS

Strong week for 1stdibs.Com (NASDAQ:DIBS) shareholders doesn't alleviate pain of one-year loss

It's nice to see the 1stdibs.Com, Inc. (NASDAQ:DIBS) share price up 14% in a week. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact, the price has declined 37% in a year, falling short of the returns you could get by investing in an index fund.

While the stock has risen 14% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for 1stdibs.Com

SWOT Analysis for 1stdibs.Com

- Currently debt free.

- Expensive based on P/S ratio compared to estimated Fair P/S ratio.

- Shareholders have been diluted in the past year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Not expected to become profitable over the next 3 years.

1stdibs.Com wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year 1stdibs.Com saw its revenue fall by 11%. That's not what investors generally want to see. Shareholders have seen the share price drop 37% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

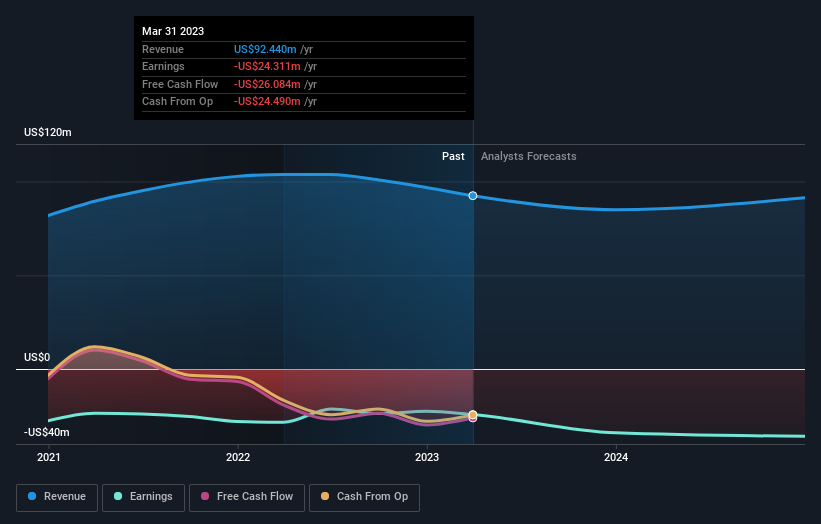

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at 1stdibs.Com's financial health with this free report on its balance sheet.

A Different Perspective

Given that the market gained 6.9% in the last year, 1stdibs.Com shareholders might be miffed that they lost 37%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 1.2% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand 1stdibs.Com better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for 1stdibs.Com (of which 1 can't be ignored!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:DIBS

1stdibs.Com

Operates an online marketplace for luxury design products worldwide.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives