- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Assessing Amazon (AMZN) Valuation After a Recent Pullback in the Share Price

Amazon.com (AMZN) has been drifting lower over the past month even as its longer term returns remain solid, and that disconnect is exactly what has investors wondering whether the pullback presents value.

See our latest analysis for Amazon.com.

Over the past year the share price return has been positive but unspectacular compared to Amazon.com’s three year total shareholder return of 157.20%, suggesting the market is reassessing growth and risk after a strong multi year run.

If Amazon’s recent pullback has you thinking about what else is setting up for the next leg higher, it could be worth exploring high growth tech and AI stocks as potential future winners.

With revenue and profits still growing double digits and the share price sitting below analyst targets, is the recent weakness a chance to pick up Amazon before its next potential move higher, or is the market already pricing in tomorrow’s growth?

Most Popular Narrative Narrative: 100% Undervalued

Zwfis sees Amazon’s fair value just above the last close, framing today’s price as an entry into a long runway of compounding growth.

Overall I was very impressed from the call and feel very good about the companies long term future. The only two negatives I took from it was AWS not growing to revenue expectations and then also during the Q and A they were asked about AI innovation and so on, and they never really never answered the questions and were just very vague.

Curious how a double digit growth runway, rising margins and a premium future earnings multiple all reconcile into that upside, according to Zwfis, fair value target? Dive in.

Result: Fair Value of $234.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained AWS underperformance and intensifying cloud competition could challenge Amazon’s premium growth narrative and limit the upside Zwfis is targeting.

Find out about the key risks to this Amazon.com narrative.

Another View on Valuation

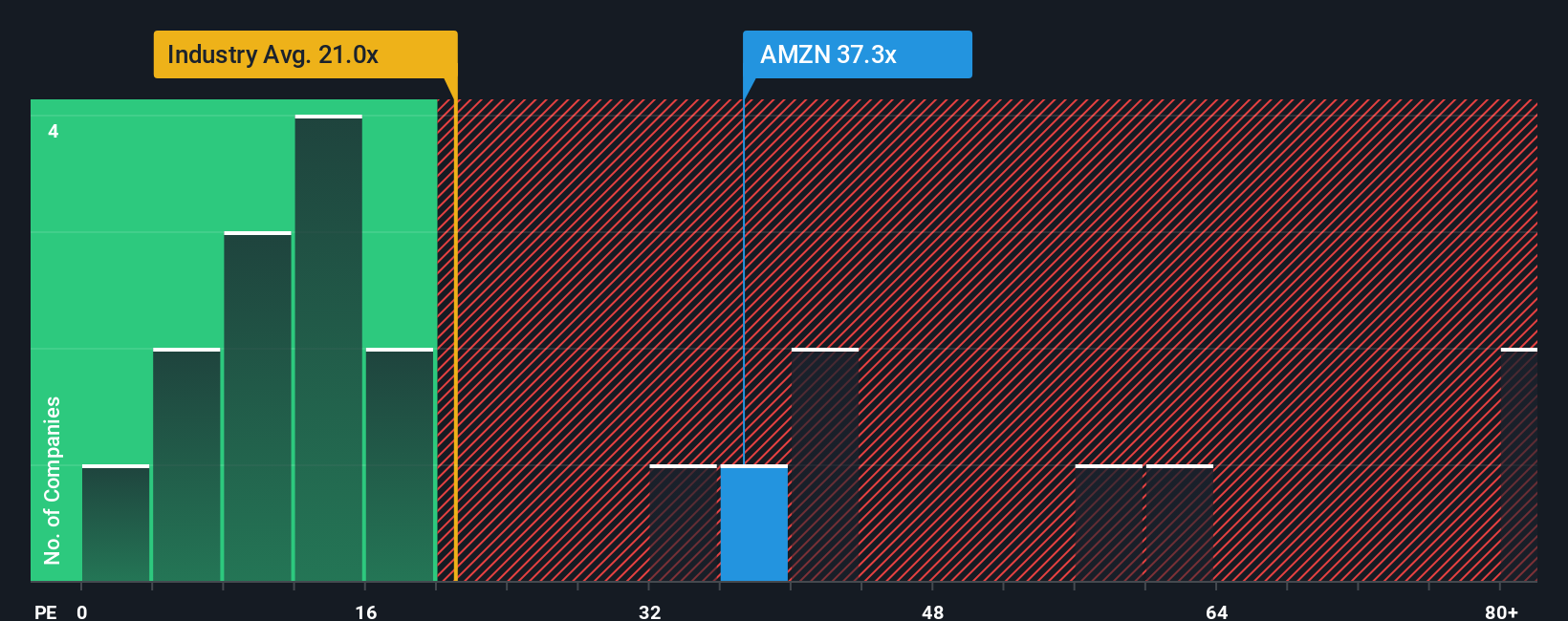

While Zwfis sees Amazon as clearly undervalued, a simple earnings multiple paints a trickier picture. The stock trades at about 32.5 times earnings, richer than the global multiline retail average of 20.1 times, yet slightly cheaper than close peers at 34.9 times and below a 40.2 times fair ratio. Is that a comfortable premium for quality, or a thinner margin of safety than it first appears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amazon.com Narrative

If this narrative does not quite fit your view or you would rather dig into the numbers yourself, you can build a personalized take in just a few minutes: Do it your way.

A great starting point for your Amazon.com research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Shift from watching one stock to actively shaping your portfolio, and use Simply Wall Street’s powerful screeners to pinpoint opportunities most investors are still overlooking.

- Capture mispriced quality by targeting companies flagged as undervalued on cash flows through these 916 undervalued stocks based on cash flows, before the market fully wakes up.

- Explore structural healthcare trends by focusing on innovators powered by machine learning and clinical data in these 30 healthcare AI stocks, where breakthroughs can influence valuations.

- Tap into the growth of digital assets and infrastructure with these 81 cryptocurrency and blockchain stocks, focusing on businesses building the backbone of blockchain and crypto adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!