- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (AMZN) Partners With West Loop Strategy To Modernize Business Intelligence

Reviewed by Simply Wall St

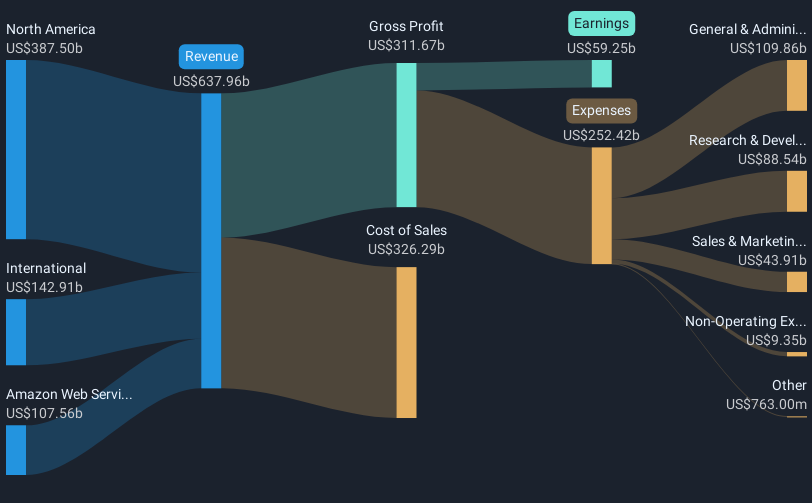

Amazon.com (AMZN) recorded a 10% gain in its share price over the last quarter, buoyed by a noteworthy collaboration between its subsidiary, Amazon Web Services (AWS), and West Loop Strategy to advance generative A.I. and business intelligence platforms. This partnership aligns with broader market optimism, especially after Federal Reserve Chair Jerome Powell's comments suggesting potential interest rate cuts. These developments likely supported the rally in Amazon's shares, alongside a general rebound in tech stocks amid market recovery. Furthermore, Amazon's robust Q2 2025 earnings report and positive Q3 guidance likely reinforced investor confidence in the company's growth trajectory.

Amazon.com has 1 weakness we think you should know about.

The recent collaboration between Amazon Web Services and West Loop Strategy to enhance generative A.I. capabilities could significantly bolster Amazon's long-term growth narrative. AWS's leadership in cloud and A.I. sectors is expected to drive substantial high-margin revenue growth, making this partnership a potentially influential factor in reinforcing AWS's position and expanding Amazon's market influence. This aligns with the narrative of cloud transition and A.I. adoption steering long-term expansion, providing the company with additional operational leverage through technological advancements.

Over a longer-term period, Amazon's total shareholder returns were 61.68% over three years, indicating strong performance relative to the overall market and industry movements. For context, over the past year, Amazon's value exceeded the US Multiline Retail industry, which returned 23.7%, and the US market, which returned 15.1%. This comparison showcases Amazon's robust performance amid a competitive landscape.

The recent boost in share price adds further context to Amazon's future revenue and earnings forecasts. Analysts predict a 10.6% annual revenue growth over the next three years, with earnings expected to reach US$112.3 billion by 2028. The developments and collaborations could underpin these forecasts by enhancing AWS's competitive edge and supporting incremental demand. Given the current share price of US$221.95, the price target of US$262.21 presents an 18% potential upside, suggesting that market optimism towards Amazon's strategic initiatives plays a crucial role in its valuation outlook. However, investors should balance this optimism with awareness of potential risks in regulatory scrutiny and market competition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives