- United States

- /

- Banks

- /

- NasdaqCM:CZFS

March 2025's Best Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

Over the past week, the United States market has remained steady, while it has experienced an 8.5% rise over the last year with earnings projected to grow by 14% annually. In this context of stable yet promising growth, identifying small-cap stocks that are potentially undervalued and exhibit insider activity can be a strategic approach for investors seeking opportunities in a balanced market environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shore Bancshares | 10.5x | 2.3x | 7.27% | ★★★★★☆ |

| First United | 9.4x | 2.5x | 48.09% | ★★★★★☆ |

| MVB Financial | 11.3x | 1.5x | 28.28% | ★★★★★☆ |

| Thryv Holdings | NA | 0.8x | 14.45% | ★★★★★☆ |

| S&T Bancorp | 11.0x | 3.8x | 41.69% | ★★★★☆☆ |

| German American Bancorp | 17.0x | 5.7x | 49.54% | ★★★☆☆☆ |

| Citizens & Northern | 12.2x | 3.0x | 43.44% | ★★★☆☆☆ |

| West Bancorporation | 14.2x | 4.3x | 42.91% | ★★★☆☆☆ |

| PDF Solutions | 197.4x | 4.5x | 17.02% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -198.72% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Citizens Financial Services (NasdaqCM:CZFS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Citizens Financial Services operates primarily in the community banking sector, focusing on providing financial services and products, with a market cap of approximately $0.41 billion.

Operations: The company primarily generates revenue from community banking, with a recent quarterly revenue of $99.27 million. Over the years, the gross profit margin has consistently been at 100%, indicating no recorded cost of goods sold. Operating expenses have shown an upward trend, reaching $62.81 million in the latest period, impacting net income margins which have varied from 35.81% to as low as 19.70%. General and administrative expenses constitute a significant portion of operating costs, amounting to $49.95 million recently.

PE: 10.4x

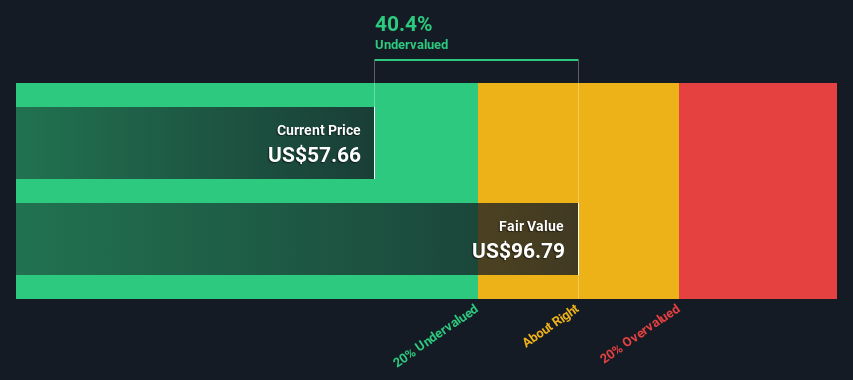

Citizens Financial Services showcases potential as an undervalued stock with insider confidence reflected through recent share purchases. The company reported a net income of US$27.82 million for 2024, up from US$17.81 million the previous year, highlighting financial growth despite maintaining a low allowance for bad loans at 84%. Additionally, they announced a quarterly dividend of US$0.495 per share payable on March 28, 2025. With earnings forecasted to grow annually by over 7%, Citizens holds promise in its sector.

Titan Machinery (NasdaqGS:TITN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Titan Machinery is a company that operates in the agriculture and construction equipment industry, with business segments in Europe, Australia, agriculture, and construction.

Operations: The company generates revenue primarily from its Agriculture and Construction segments, with significant contributions from Europe and Australia. The gross profit margin showed an upward trend, reaching 20.31% as of July 2023 before declining to 14.64% by January 2025. Operating expenses have consistently been a major component of the cost structure, impacting net income outcomes over time.

PE: -11.1x

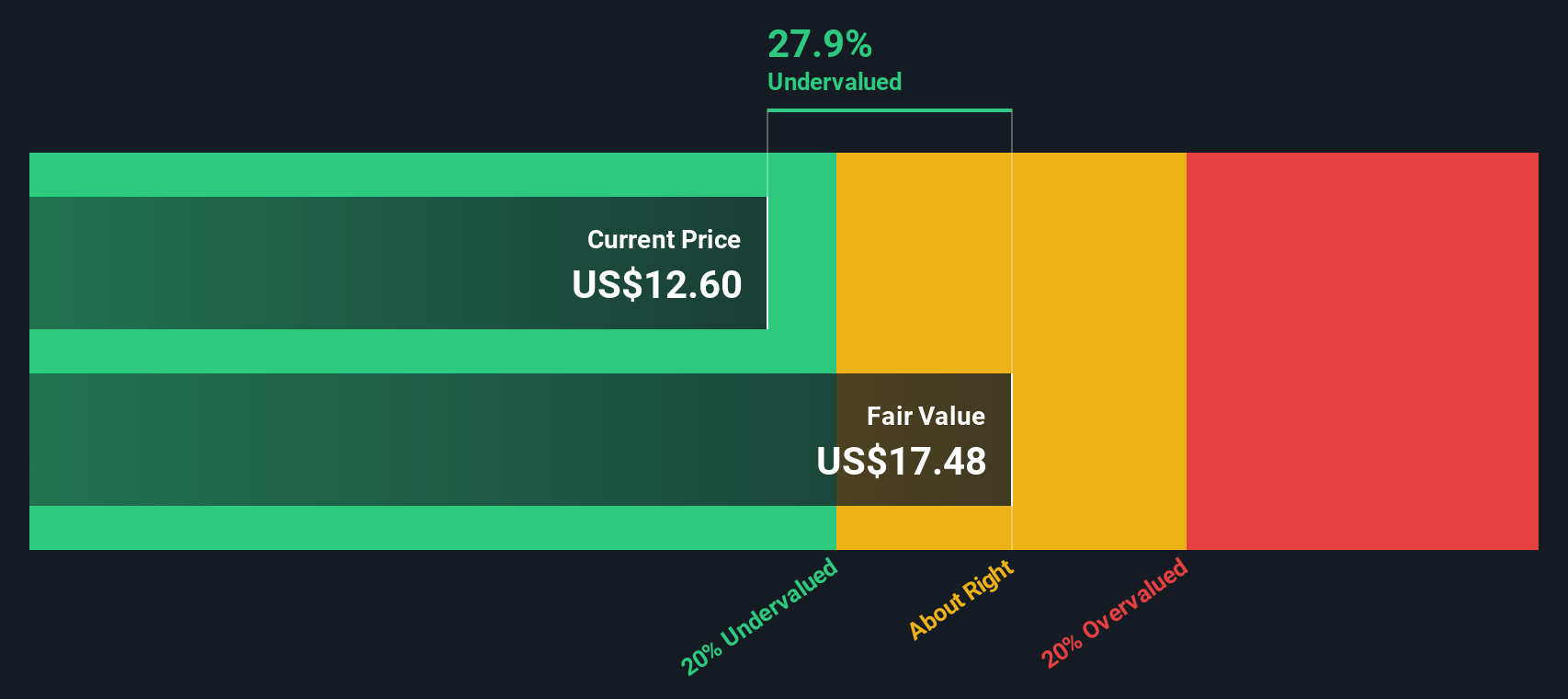

Titan Machinery, a small company in the U.S., has been facing financial challenges. Recent earnings showed a decline, with fourth-quarter revenue at US$759.92 million compared to US$852.13 million last year and a net loss of US$43.76 million versus a prior net income of US$23.96 million. The company anticipates further revenue declines into fiscal 2026 but expects less challenging comparisons later in the year. Despite these hurdles, insider confidence is evident as they have been purchasing shares recently, signaling potential long-term value amidst current volatility.

- Dive into the specifics of Titan Machinery here with our thorough valuation report.

Explore historical data to track Titan Machinery's performance over time in our Past section.

Whitestone REIT (NYSE:WSR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Whitestone REIT is a real estate investment trust specializing in the ownership and operation of commercial properties, with a market capitalization of approximately $0.53 billion.

Operations: The company generates revenue primarily from its commercial real estate operations, with a recent gross profit margin of 70.19%. Operating expenses and non-operating expenses are significant components of the cost structure, impacting net income margins, which stood at 23.92% in the latest period.

PE: 19.9x

Whitestone REIT, a smaller player in the real estate sector, recently reported an increase in annual net income to US$36.89 million from US$19.18 million, alongside revenue growth to US$154.28 million for 2024. Despite earnings forecasted to decline by 2.6% annually over the next three years, insider confidence is evident through recent share purchases. The lease with The Picklr at Terravita Marketplace signals strategic expansion and potential tenant growth benefits in Scottsdale's active community by late 2025.

- Unlock comprehensive insights into our analysis of Whitestone REIT stock in this valuation report.

Assess Whitestone REIT's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Reveal the 89 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZFS

Citizens Financial Services

A bank holding company, provides various banking products and services for individual, business, governmental, and institutional customers.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives