- United States

- /

- REITS

- /

- NYSE:WPC

Does W. P. Carey Still Offer Value After Its Strong 2024 Share Price Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether W. P. Carey is still a bargain after its recent run, or if most of the easy upside is already gone, you are not alone. That is exactly what we are going to unpack here.

- The stock is roughly flat over 3 years at -0.3%, but with a 20.9% gain over the last year and 19.7% year to date, recent moves suggest the market is rethinking both its growth potential and risk profile.

- Investors have been reacting to W. P. Carey’s ongoing portfolio repositioning and strategic focus on long-lease, mission-critical properties, which aim to improve long-term stability. There has also been renewed attention on interest rate expectations and REIT valuations more broadly, which helps explain some of the momentum in the share price.

- Right now, W. P. Carey scores a 2/6 on our valuation checks, suggesting pockets of undervaluation but not across the board. In the sections ahead, we will walk through what each major valuation approach indicates about that number, before finishing with a more holistic way to think about what the stock might be worth.

W. P. Carey scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: W. P. Carey Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model for W. P. Carey takes its adjusted funds from operations, projects them forward, and then discounts those future cash flows back to today in dollar terms. This helps estimate what the business might be worth right now based on the cash it can return to shareholders over time.

Starting from last twelve month free cash flow of about $1.04 billion, analysts expect this to rise to roughly $1.37 billion by 2028, with further growth thereafter based on more moderate extrapolations. Across the next decade, projected annual free cash flows climb toward almost $1.95 billion by 2035, with each year’s figure discounted to reflect risk and the time value of money.

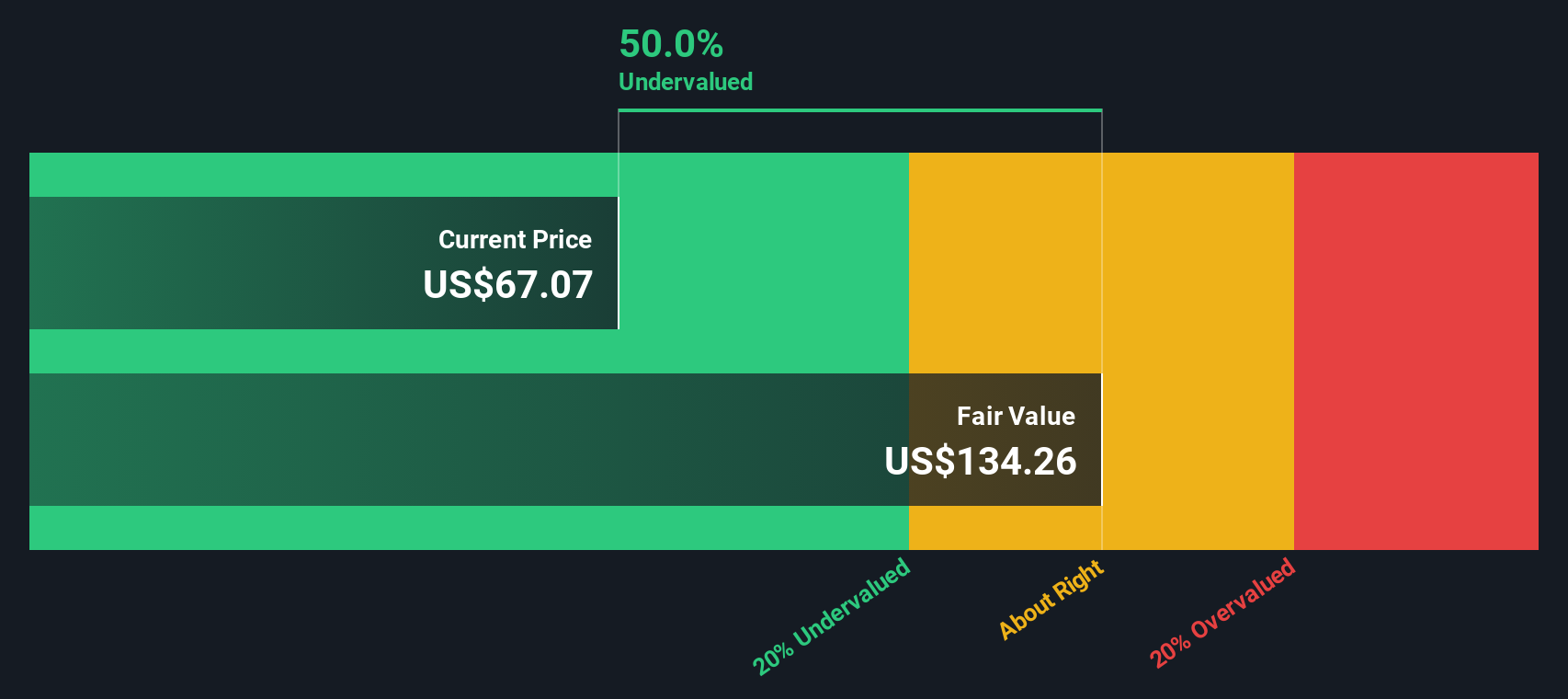

Adding up these discounted cash flows gives an estimated intrinsic value of about $152.02 per share. Compared with the current share price, this implies the stock trades at roughly a 57.2% discount to its DCF value. This suggests investors are pricing in significantly weaker long term prospects than the model assumes.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests W. P. Carey is undervalued by 57.2%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: W. P. Carey Price vs Earnings

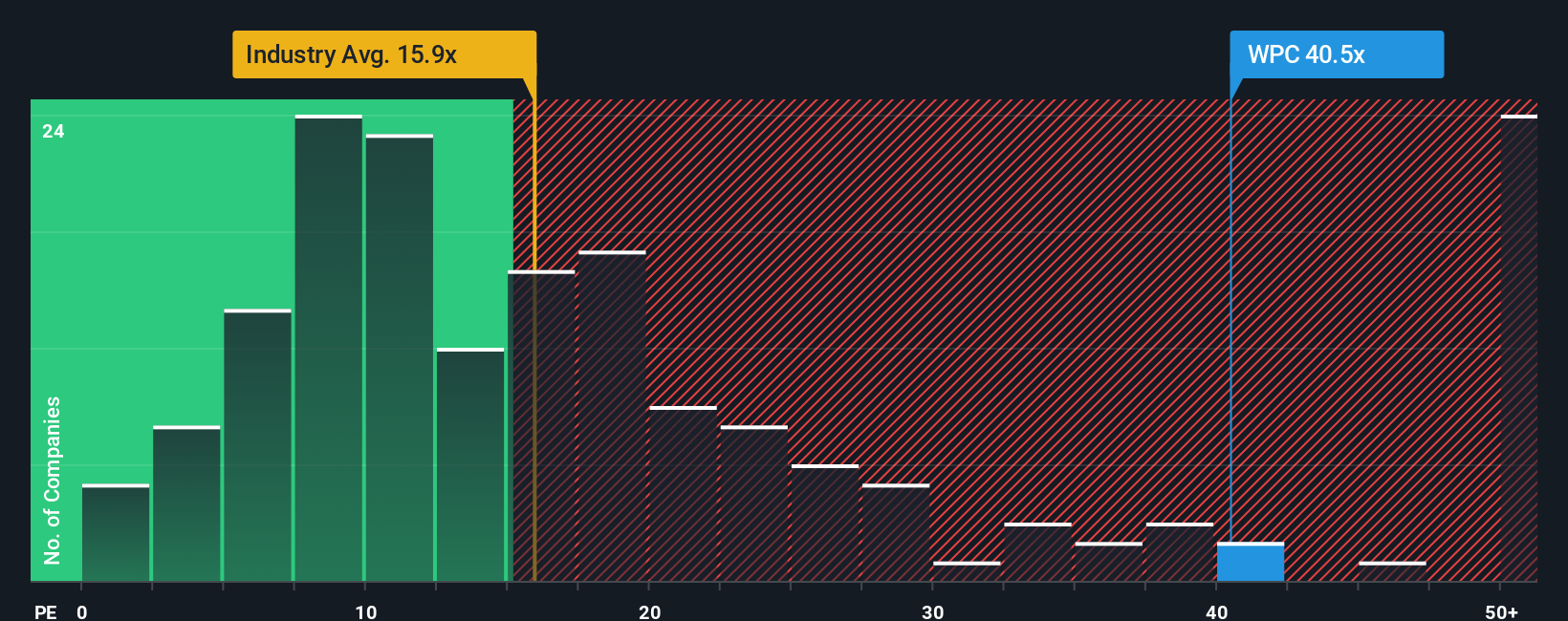

For a mature, profitable REIT like W. P. Carey, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower growth or higher uncertainty argue for a lower, more conservative PE.

W. P. Carey currently trades at about 39.0x earnings, which is well above the broader REIT industry average of around 16.0x and also higher than its peer group average of roughly 29.2x. On the surface, that suggests a premium valuation. However, Simply Wall St’s proprietary Fair Ratio framework estimates that, given W. P. Carey’s earnings growth profile, profit margins, industry, market cap and risk factors, a more appropriate multiple would be closer to 36.0x.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for company specific fundamentals rather than assuming all REITs deserve the same multiple. Comparing the Fair Ratio of 36.0x with the current PE of 39.0x indicates that W. P. Carey looks modestly expensive on this basis, but not wildly out of line with what its fundamentals support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your W. P. Carey Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you attach a clear story to your numbers by connecting your assumptions for W. P. Carey’s future revenue, earnings and margins to a forecast and then to a Fair Value you can compare against today’s share price to help you decide whether it looks like a buy, hold or sell.

A Narrative is essentially your investment thesis written into the model. Instead of passively accepting one set of projections, you can quickly choose or adapt a view that matches how you see W. P. Carey’s tenant quality, growth runway and risks. The platform, used by millions of investors, will automatically translate that story into updated financial forecasts and a Fair Value that refreshes whenever new information, like earnings or major news, comes in.

For example, one W. P. Carey Narrative on the Community page might assume stronger industrial demand, improving margins and a higher forward PE, leading to a Fair Value above the current price. A more cautious Narrative could factor in slower rent growth, higher funding costs and tighter multiples, producing a Fair Value below today’s market level and signaling limited upside.

Do you think there's more to the story for W. P. Carey? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WPC

W. P. Carey

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,600 net lease properties covering approximately 178 million square feet and a portfolio of 66 self-storage operating properties as of June 30, 2025.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)