- United States

- /

- Residential REITs

- /

- NYSE:UDR

UDR (UDR) Draws Investor Attention: Is the Stock Undervalued?

Reviewed by Simply Wall St

UDR’s Recent Moves Prompt Fresh Look From Investors

There has been a flurry of interest around UDR (UDR) lately, enough that you might be questioning what is really driving attention to the stock. While there is no headline-making event to point to this week, that relative calm can sometimes be just as interesting, especially for those who have been following its ups and downs. Investors are left asking: is this simply a pause, or could it be the start of something more meaningful for the apartment REIT?

Over the past year, UDR’s share price has drifted down around 9%, and recent weeks have not reversed that story, with the past month showing a bounce of just under 2%. It is a pattern that stands out when you look at the past five years, where the stock is still up 33%. Recent financials showed rising revenue and net income, suggesting the business itself is finding ways to grow even while investor enthusiasm stays in check.

With momentum lagging and all eyes on valuation, it is fair to ask: is UDR trading at a discount that represents a real buying opportunity, or is the market smartly pricing in everything that lies ahead?

Most Popular Narrative: 12.2% Undervalued

The broad analyst narrative suggests UDR is trading below its calculated fair value, with expectations for continued rent and revenue strength driving optimistic long-term projections.

Declining affordability of homeownership and persistent housing shortages are driving increased demand for multifamily rentals. This is evidenced by strong year-to-date occupancy (averaging near 97%) and record apartment absorption, positioning UDR for sustained revenue and rent growth.

Curious about why analysts think UDR is poised to outperform? There is a key ingredient powering their fair value estimate. This assessment hinges on sustained growth, rising margins, and bold profit assumptions. Want to uncover which forward-looking numbers help justify a premium price target? The answer might surprise you, and it is buried in the critical assumptions behind this narrative.

Result: Fair Value of $44.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply in key Sunbelt markets and potential new rent controls could dampen UDR’s expected revenue and profit growth trajectory.

Find out about the key risks to this UDR narrative.Another View: What Do Market Ratios Say?

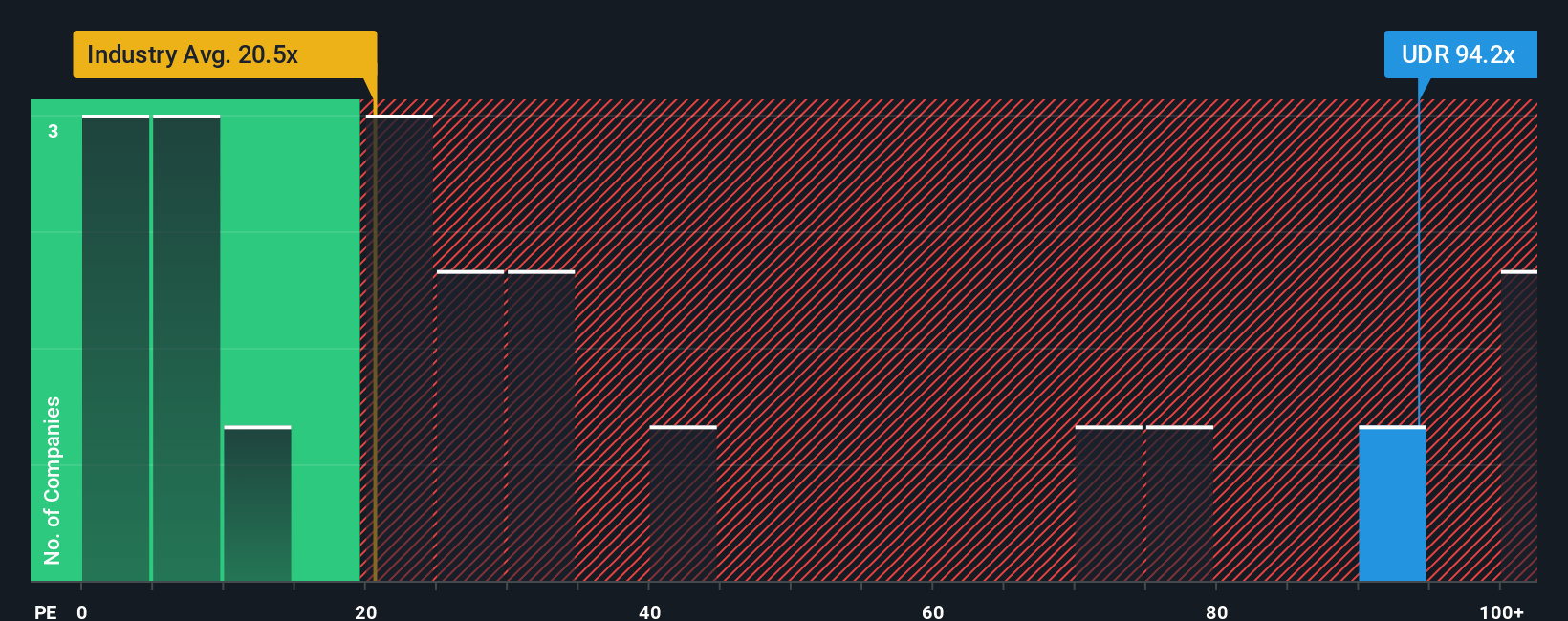

Not all valuation methods agree. When looking at how UDR is priced compared to other companies in its sector, the numbers suggest the stock might actually be trading at a premium rather than a discount. Could this signal that something is being missed, or is it simply the price of quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UDR Narrative

If you see the story differently or want to dig into the numbers on your own terms, creating a personal UDR narrative takes just a few minutes. Do it your way

A great starting point for your UDR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

If you want to broaden your horizons and spot your next standout investment, check out these powerful stock ideas. Your next smart move could be just a click away.

- Unlock dividend potential and secure steady income streams by checking out dividend stocks with yields > 3% that consistently yield over 3%.

- Capitalize on tomorrow’s healthcare breakthroughs with access to healthcare AI stocks at the forefront of medical innovation and AI-driven diagnostics.

- Beat the market by uncovering hidden gems with strong cash flow fundamentals through our exclusive list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:UDR

UDR

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)