- United States

- /

- Residential REITs

- /

- NYSE:UDR

UDR (UDR): Assessing Valuation After Recent Share Price Decline and Investor Sentiment Shift

Reviewed by Kshitija Bhandaru

See our latest analysis for UDR.

UDR’s momentum has softened lately, with a 1-month share price return of -6.93% and a year-to-date slide of -16.04%. Although the 1-year total shareholder return is down -15.12%, the three- and five-year figures show the company still delivered positive long-term gains. This highlights why many investors are keeping watch for a potential turnaround or improved sentiment from here.

If you’re interested in expanding your perspective beyond real estate, now is the perfect time to explore fast growing stocks with high insider ownership.

With UDR trading below analyst price targets and its intrinsic value, the key question for investors is whether current prices offer a compelling entry point or if future growth is already fully reflected in the market.

Most Popular Narrative: 17.9% Undervalued

UDR’s most widely followed narrative puts fair value at $43.48, noticeably above the latest close of $35.71. This gap has caught the attention of many investors, who are eager to understand the rationale and catalysts backing such a premium valuation.

Urban migration patterns, combined with better-than-expected job and wage growth in core coastal cities like San Francisco, Seattle, Boston, and D.C., are supporting ongoing high occupancy and high renewal rent growth. These factors could enhance UDR's top-line revenue and minimize downside risk.

Curious how surging rents and city migration data play into this bold price target? Dive in to discover the real profit trajectory and the surprising element analysts are factoring in to set such an ambitious valuation.

Result: Fair Value of $43.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if supply remains elevated in key Sunbelt markets or regulatory changes cap rent growth, UDR’s upside case could falter.

Find out about the key risks to this UDR narrative.

Another View: What Do the Multiples Say?

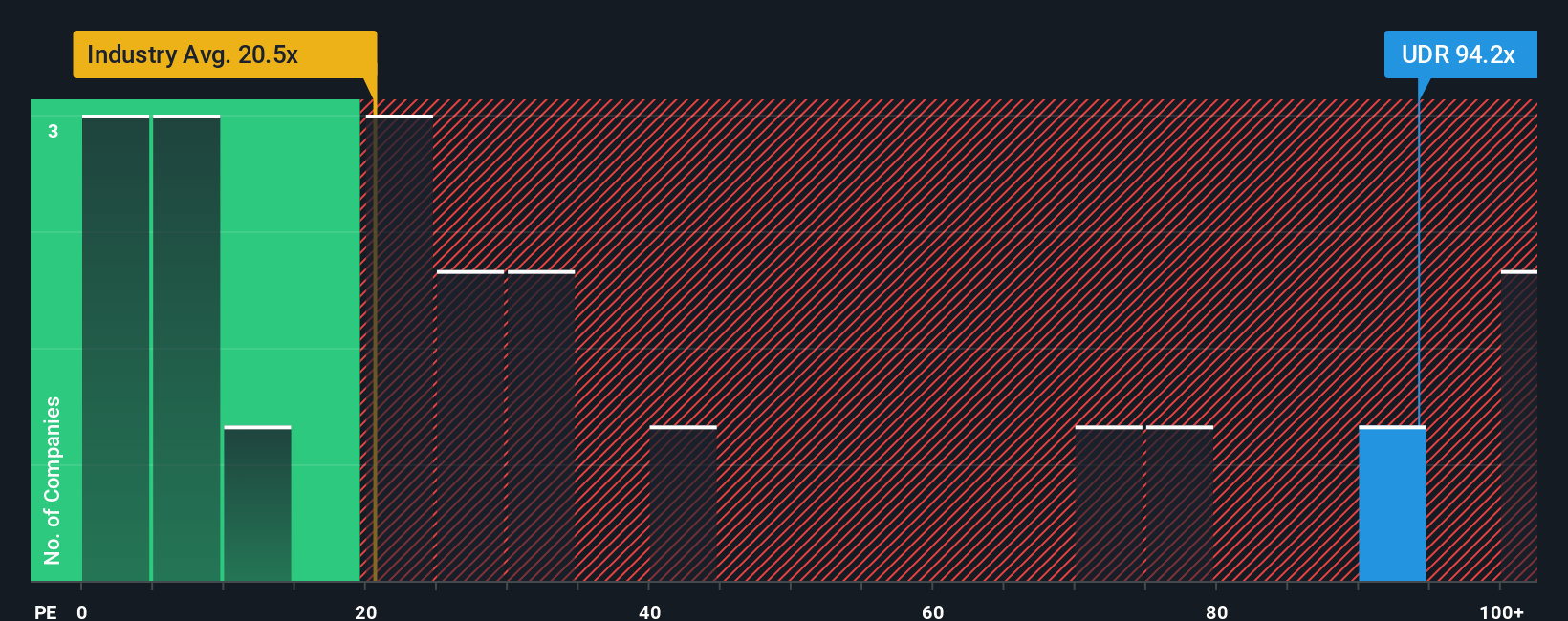

While analyst models lean toward a bullish fair value, looking at UDR’s price-to-earnings ratio paints a less optimistic picture. With the company trading at 93.1x, this is much higher than both the industry average of 19.7x and the peer average of 35.4x. The fair ratio stands at 37.8x, which implies UDR is richly valued by this measure. This creates valuation risk if the market shifts toward sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UDR Narrative

If these perspectives don't quite match your own or you want to see the numbers firsthand, it takes just a few minutes to analyze the data and shape your own view. Do it your way.

A great starting point for your UDR research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stick to just one path. Broaden your portfolio and get ahead of the crowd by tapping into powerful themes set to shape the next decade.

- Supercharge your search for high-growth tech trends by checking out these 24 AI penny stocks, which are pushing the frontiers of artificial intelligence and automation.

- Capture steady income and boost your yield strategy when you browse these 19 dividend stocks with yields > 3%, packed with companies paying substantial dividends above 3%.

- Position yourself for tomorrow’s breakthroughs by exploring these 26 quantum computing stocks, offering exposure to pioneers in revolutionizing computing and data security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UDR

UDR

UDR, Inc. (NYSE: UDR), an S&P 500 company, is a leading multifamily real estate investment trust with a demonstrated performance history of delivering superior and dependable returns by successfully managing, buying, selling, developing and redeveloping attractive real estate communities in targeted U.S.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.