- United States

- /

- Banks

- /

- NasdaqGS:MSBI

Top US Dividend Stocks For December 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed week with major indices like the Dow Jones and Nasdaq showing signs of recovery, investors are keenly observing shifts in large-cap tech stocks and interest rates. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking to balance growth with reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.24% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.62% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.73% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.53% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.70% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.68% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.71% | ★★★★★★ |

Click here to see the full list of 151 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

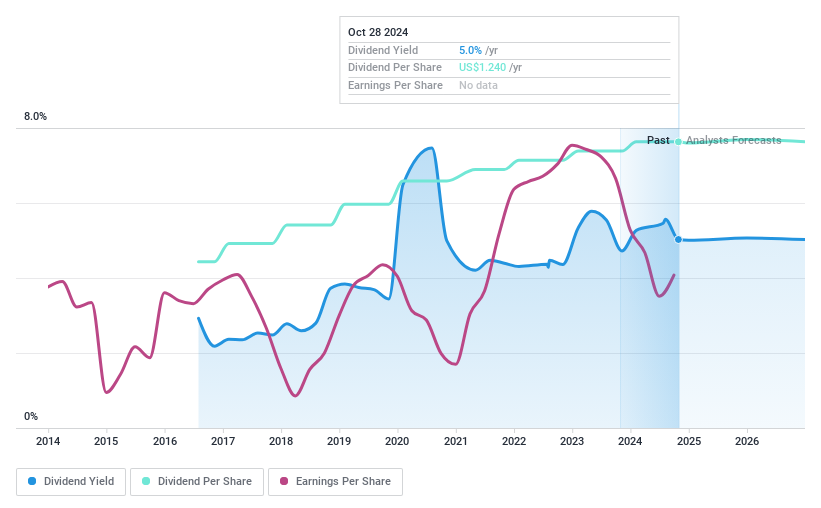

Midland States Bancorp (NasdaqGS:MSBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Midland States Bancorp, Inc. is a financial holding company for Midland States Bank, offering a range of banking products and services to individuals, businesses, municipalities, and other entities with a market cap of $526.48 million.

Operations: Midland States Bancorp, Inc.'s revenue segments include $241.67 million from Banking and $27.60 million from Wealth Management.

Dividend Yield: 5%

Midland States Bancorp's dividend payments have grown over the past 8 years, with a current yield of 5%, placing it in the top quartile of US dividend payers. The dividends are well-covered by earnings, with a payout ratio currently at 53.4% and forecasted to decrease to 41.9% in three years. Despite stable dividends, significant insider selling raises concerns. Recent financials show improved quarterly net income and earnings per share compared to last year but declining nine-month figures overall.

- Click here to discover the nuances of Midland States Bancorp with our detailed analytical dividend report.

- Our valuation report unveils the possibility Midland States Bancorp's shares may be trading at a discount.

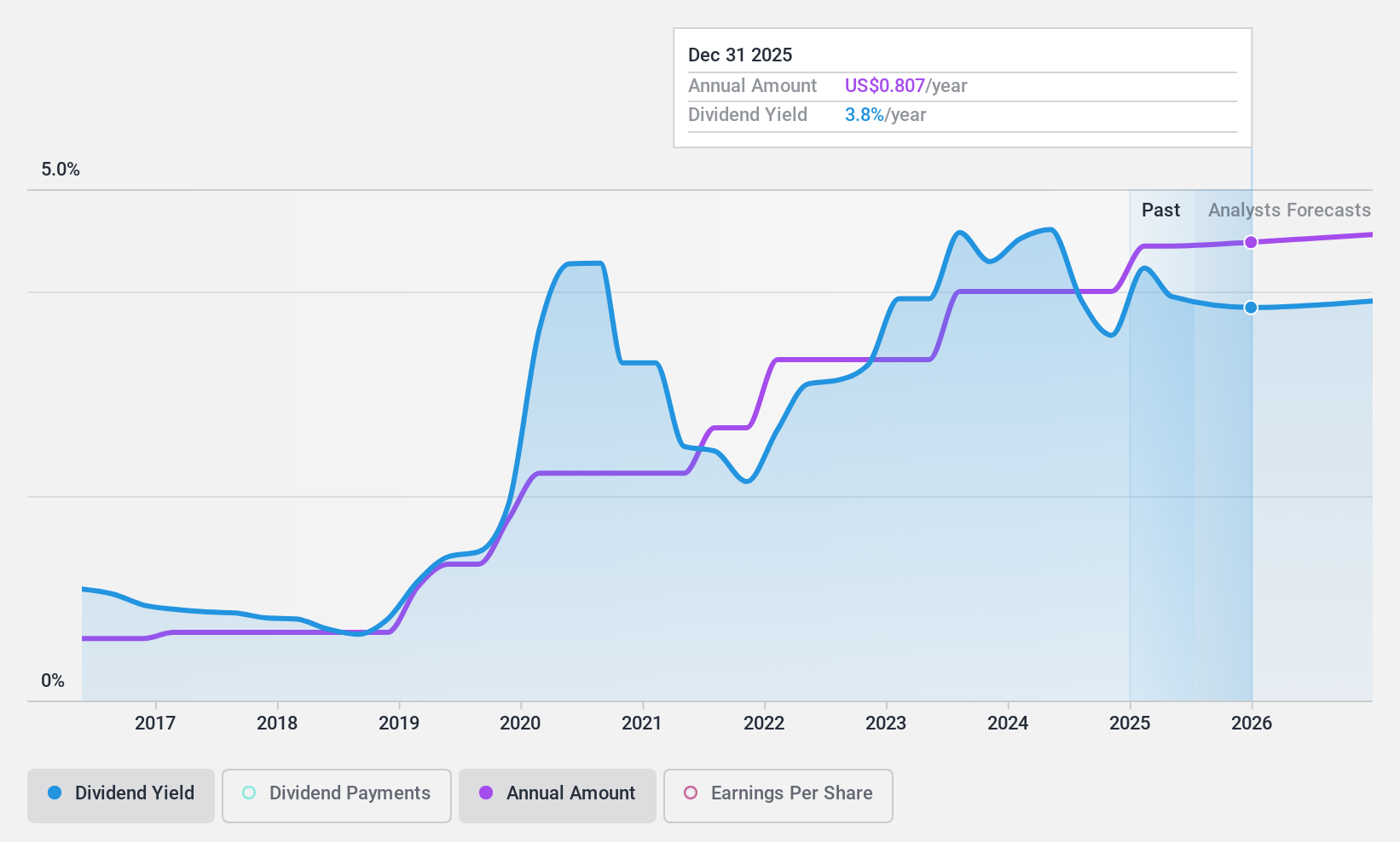

PCB Bancorp (NasdaqGS:PCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small to medium-sized businesses, individuals, and professionals in Southern California, with a market cap of $287.94 million.

Operations: PCB Bancorp generates revenue primarily from the banking industry, amounting to $94.83 million.

Dividend Yield: 3.5%

PCB Bancorp's dividend yield of 3.5% is below the top quartile of US dividend payers, yet its dividends are well-covered by earnings with a low payout ratio of 42.4%. The company has maintained stable and growing dividends over the past decade. Recent financials show slight improvements in quarterly net income and earnings per share, though nine-month figures have declined year-over-year. A recent quarterly cash dividend of $0.18 per share was affirmed by the board.

- Delve into the full analysis dividend report here for a deeper understanding of PCB Bancorp.

- The analysis detailed in our PCB Bancorp valuation report hints at an deflated share price compared to its estimated value.

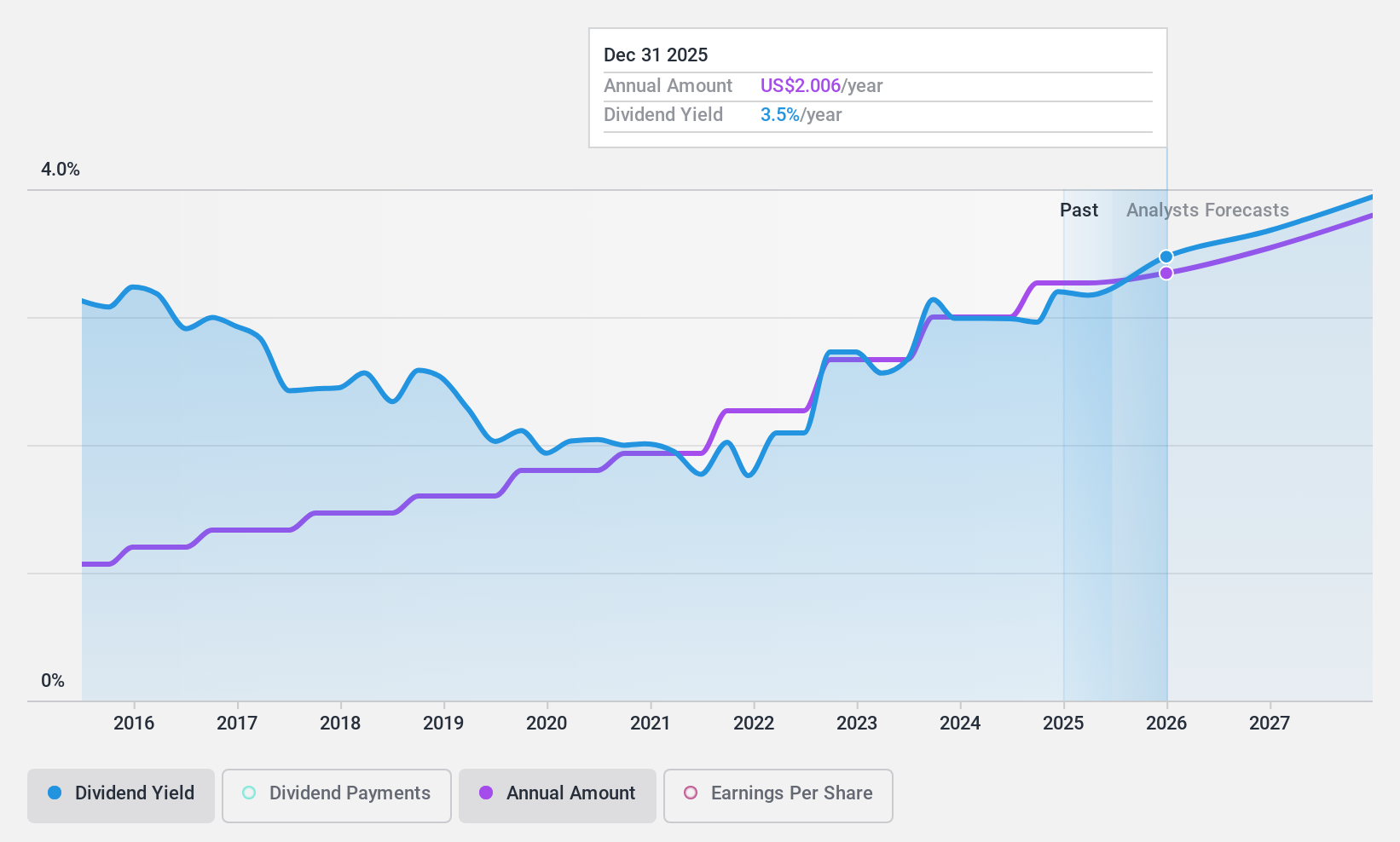

Terreno Realty (NYSE:TRNO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Terreno Realty Corporation acquires, owns, and operates industrial real estate in six major coastal U.S. markets with a market cap of approximately $5.89 billion.

Operations: Terreno Realty Corporation generates revenue of $365.40 million through its investments in industrial real estate.

Dividend Yield: 3.3%

Terreno Realty offers a stable dividend yield of 3.29%, though it falls short of the top quartile in the US market. Its dividends have been reliable and growing over the past decade, supported by a reasonable payout ratio of 74.9% and cash flow coverage at 88.7%. Recent expansions, including developments in California and Florida, highlight continued growth efforts with significant investments such as the $156.3 million acquisition in Brooklyn, potentially supporting future dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Terreno Realty.

- Our comprehensive valuation report raises the possibility that Terreno Realty is priced higher than what may be justified by its financials.

Key Takeaways

- Access the full spectrum of 151 Top US Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSBI

Midland States Bancorp

Operates as a financial holding company for Midland States Bank that provides various banking products and services to individuals, businesses, municipalities, and other entities.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives