- United States

- /

- Luxury

- /

- NYSE:WWW

3 Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing 5.3% in the last 7 days and rising by 12% over the past year, with earnings forecasted to grow by 14% annually. In this dynamic environment, identifying promising small-cap stocks can be key for investors seeking opportunities that align with current growth trends and insider activity signals potential confidence in these companies' future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Thryv Holdings | NA | 0.8x | 29.72% | ★★★★☆☆ |

| Forestar Group | 6.2x | 0.7x | -424.79% | ★★★★☆☆ |

| West Bancorporation | 13.0x | 4.1x | 36.25% | ★★★☆☆☆ |

| Wolverine World Wide | 19.0x | 0.8x | 48.69% | ★★★☆☆☆ |

| MVB Financial | 12.5x | 1.6x | 43.65% | ★★★☆☆☆ |

| Columbus McKinnon | 55.8x | 0.5x | 30.72% | ★★★☆☆☆ |

| Franklin Financial Services | 14.8x | 2.4x | 29.28% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -37.62% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.6x | -3042.49% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -445.69% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

ProFrac Holding (NasdaqGS:ACDC)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProFrac Holding operates in the oil and gas industry, providing services such as stimulation, manufacturing, and proppant production, with a focus on enhancing extraction processes.

Operations: ProFrac Holding's revenue is primarily driven by Stimulation Services, contributing significantly more than Manufacturing and Proppant Production. The company's gross profit margin has shown variability, with recent figures around 30.27%. Operating expenses have been substantial, with notable contributions from general and administrative costs.

PE: -3.8x

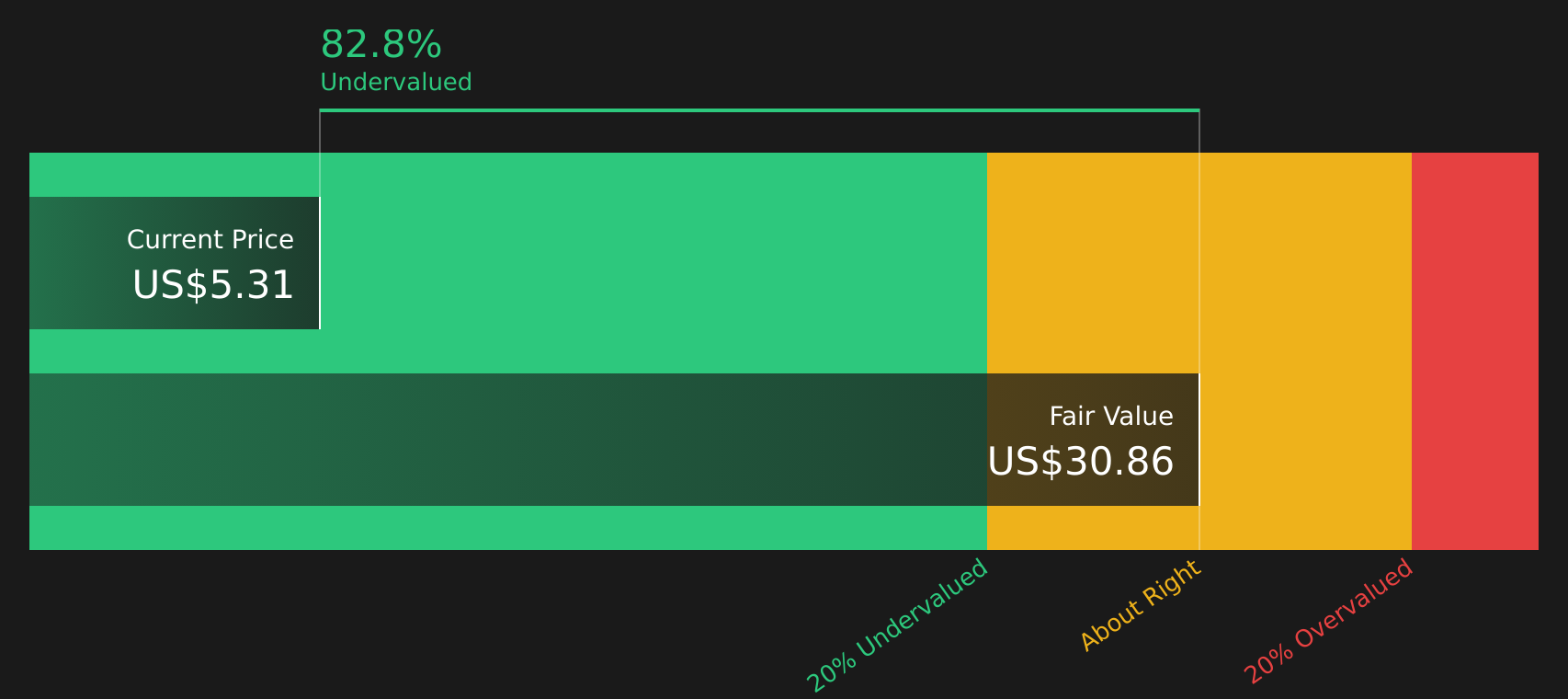

ProFrac Holding, a small U.S. company, recently reported Q1 2025 earnings with revenue of US$600.3 million, up from US$581.5 million the previous year, yet recorded a net loss of US$17.5 million compared to a net income of US$1.8 million last year. Despite current unprofitability and reliance on external borrowing for funding, insider confidence is evident as Johnathan Wilks purchased 338,756 shares worth approximately US$2.35 million in March 2025—an indicator of potential value recognition within the company’s operations and prospects for future growth amidst market volatility challenges.

- Take a closer look at ProFrac Holding's potential here in our valuation report.

Evaluate ProFrac Holding's historical performance by accessing our past performance report.

Pebblebrook Hotel Trust (NYSE:PEB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pebblebrook Hotel Trust is a real estate investment trust specializing in the acquisition and management of upscale, full-service hotels and resorts, with a market cap of approximately $2.05 billion.

Operations: Pebblebrook Hotel Trust's revenue primarily comes from its hotels and motels, with the latest reported revenue at $1.46 billion. The cost of goods sold (COGS) was $1.10 billion, leading to a gross profit margin of 24.69%. Operating expenses amounted to $282.68 million, while non-operating expenses were $129.02 million for the same period.

PE: -24.1x

Pebblebrook Hotel Trust, a smaller player in the U.S. market, faces challenges with higher-risk external borrowing as its sole funding source. Despite reporting a net loss of US$32.95 million for Q1 2025, revenue grew slightly to US$320.27 million from the previous year. While earnings guidance for 2025 has been lowered, insider confidence is evident through recent share purchases by company insiders during early 2025, suggesting potential belief in future growth prospects despite current financial hurdles.

Wolverine World Wide (NYSE:WWW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wolverine World Wide is a company that designs, manufactures, and markets a range of footwear and apparel products across various segments including work and active groups, with a market cap of $0.71 billion.

Operations: The company generates revenue primarily from its Active Group and Work Group segments, contributing significantly to overall sales. Over recent periods, the gross profit margin has shown variability, reaching as high as 44.85% in early 2025. Operating expenses have been a substantial part of the cost structure, with general and administrative expenses consistently forming a large portion of these costs.

PE: 19.0x

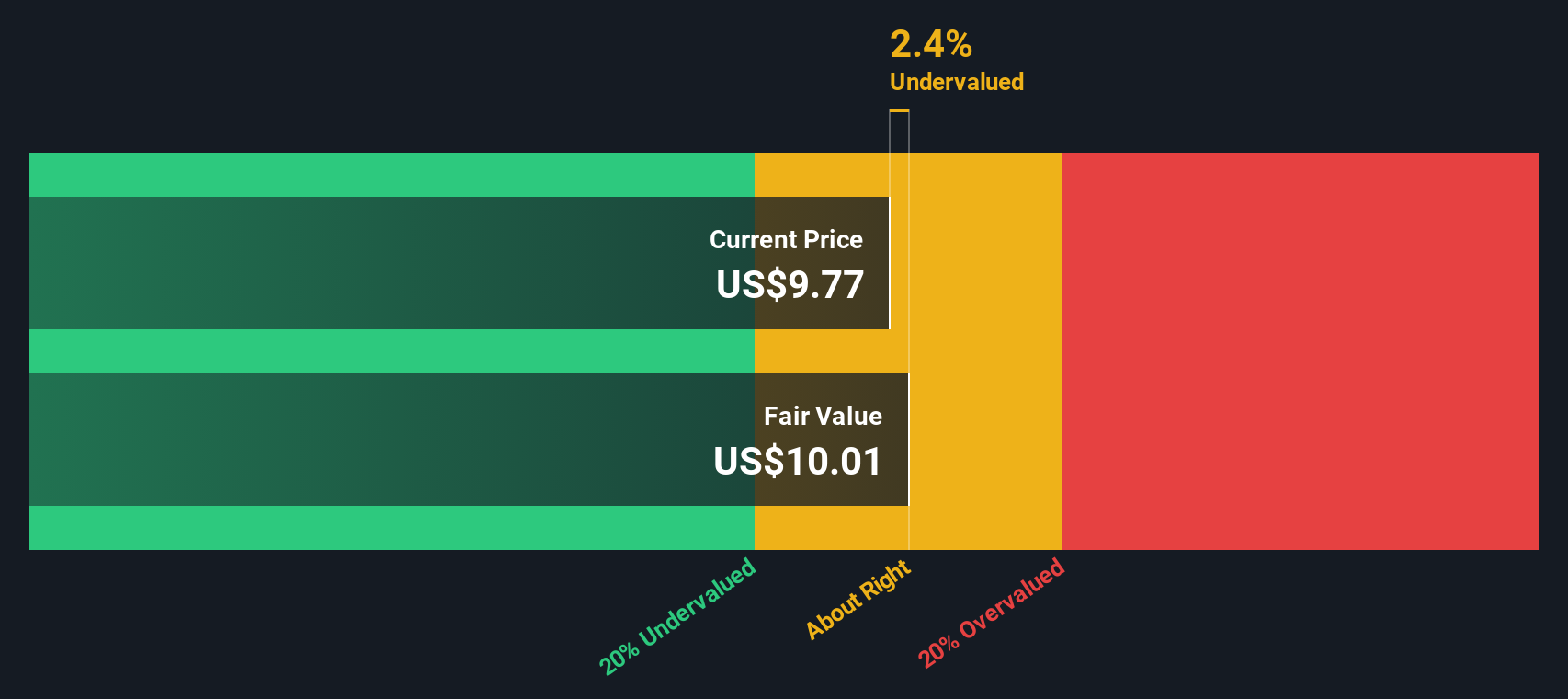

Wolverine World Wide, a footwear company with a small market presence, is drawing attention due to its recent insider confidence. Insiders have been buying shares in the past quarter, signaling potential value. The company's first-quarter results showed sales of US$412.3 million and net income of US$11.1 million, marking a turnaround from last year's losses. Despite withdrawing full-year guidance amid economic uncertainties, Wolverine anticipates second-quarter revenue between US$440 million and US$450 million. A new collaboration with Fishwife highlights their innovative approach to sustainability and product design.

- Click here to discover the nuances of Wolverine World Wide with our detailed analytical valuation report.

Understand Wolverine World Wide's track record by examining our Past report.

Taking Advantage

- Click this link to deep-dive into the 98 companies within our Undervalued US Small Caps With Insider Buying screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives