- United States

- /

- Industrial REITs

- /

- NYSE:OLP

Shareholders Will Most Likely Find One Liberty Properties, Inc.'s (NYSE:OLP) CEO Compensation Acceptable

Key Insights

- One Liberty Properties' Annual General Meeting to take place on 5th of June

- Total pay for CEO Patrick Callan includes US$1.00m salary

- The total compensation is similar to the average for the industry

- One Liberty Properties' total shareholder return over the past three years was 14% while its FFO grew by 0.1% per year over the past three years

Under the guidance of CEO Patrick Callan, One Liberty Properties, Inc. (NYSE:OLP) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 5th of June. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for One Liberty Properties

Comparing One Liberty Properties, Inc.'s CEO Compensation With The Industry

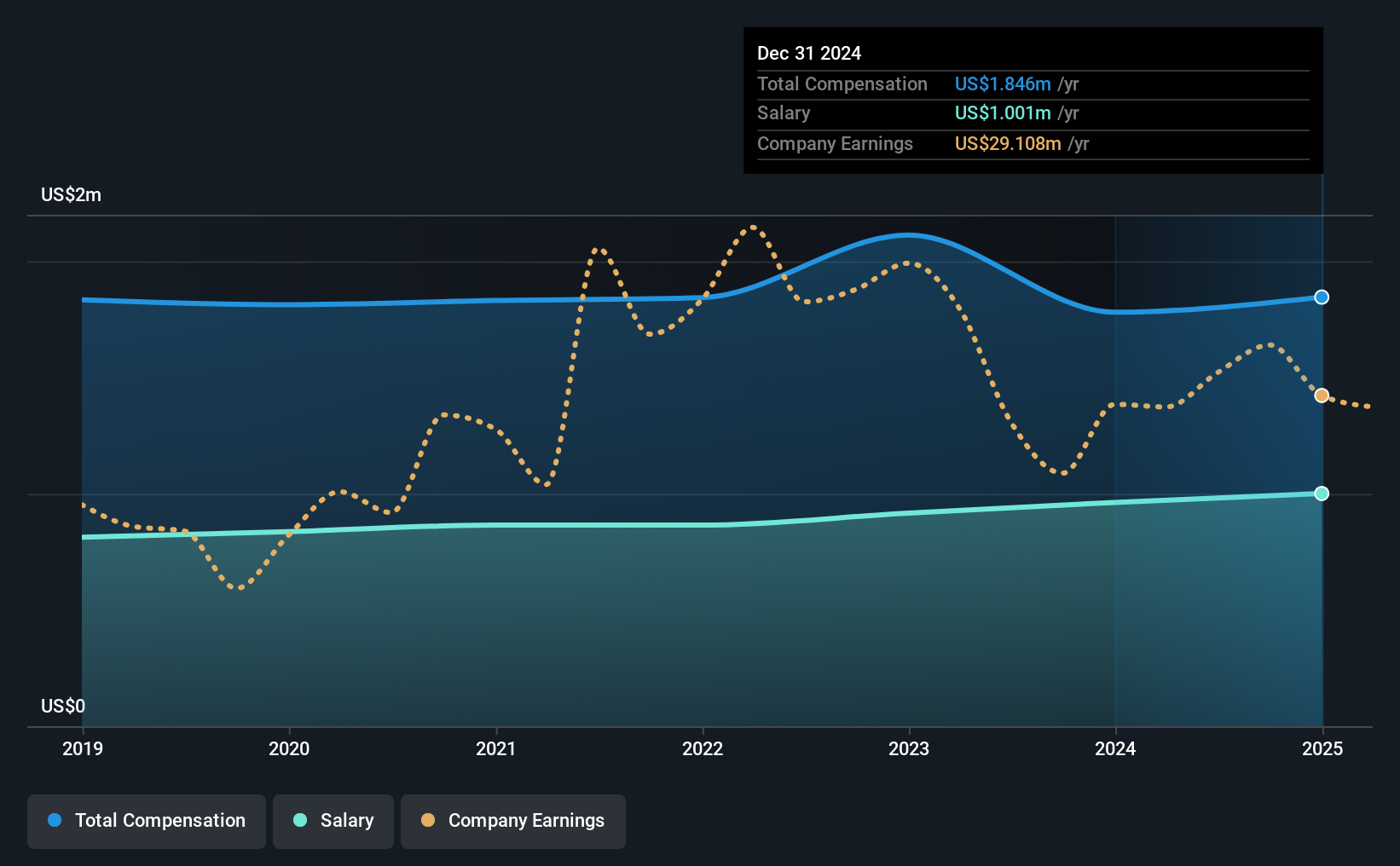

According to our data, One Liberty Properties, Inc. has a market capitalization of US$523m, and paid its CEO total annual compensation worth US$1.8m over the year to December 2024. That's a modest increase of 3.6% on the prior year. In particular, the salary of US$1.00m, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the American REITs industry with market caps ranging from US$200m to US$800m, we found that the median CEO total compensation was US$1.7m. So it looks like One Liberty Properties compensates Patrick Callan in line with the median for the industry. Moreover, Patrick Callan also holds US$10.0m worth of One Liberty Properties stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$1.0m | US$963k | 54% |

| Other | US$845k | US$819k | 46% |

| Total Compensation | US$1.8m | US$1.8m | 100% |

Speaking on an industry level, nearly 28% of total compensation represents salary, while the remainder of 72% is other remuneration. It's interesting to note that One Liberty Properties pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at One Liberty Properties, Inc.'s Growth Numbers

One Liberty Properties, Inc.'s funds from operations (FFO) stayed pretty flat over the last three years. In the last year, its revenue is up 3.3%.

We'd prefer higher revenue growth, but we're happy with the modest FFO growth. So there are some positives here, but not enough to earn high praise. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has One Liberty Properties, Inc. Been A Good Investment?

With a total shareholder return of 14% over three years, One Liberty Properties, Inc. shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 5 warning signs for One Liberty Properties (2 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OLP

One Liberty Properties

One Liberty is a self-administered and self-managed real estate investment trust incorporated in Maryland in 1982.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)