- United States

- /

- Banks

- /

- NasdaqGS:PFIS

Exploring 3 Undervalued Small Caps With Insider Buying In The Global Market

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn led by declines in tech shares, small-cap stocks present an intriguing opportunity for investors navigating the current economic landscape shaped by recent Federal Reserve rate cuts. In this environment, identifying small-cap companies with strong fundamentals and insider buying can be key to uncovering potential value amidst broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 9.9x | 3.0x | 33.12% | ★★★★★☆ |

| Limbach Holdings | 31.3x | 2.0x | 39.56% | ★★★★★☆ |

| Peoples Bancorp | 10.3x | 1.9x | 42.34% | ★★★★★☆ |

| Tandem Diabetes Care | NA | 0.9x | 49.68% | ★★★★★☆ |

| Citizens & Northern | 11.5x | 2.8x | 40.23% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.8x | 2.8x | 47.46% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 32.32% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 18.04% | ★★★★☆☆ |

| Shore Bancshares | 10.6x | 2.7x | -92.00% | ★★★☆☆☆ |

| Farmland Partners | 7.2x | 8.7x | -46.84% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Tandem Diabetes Care (TNDM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tandem Diabetes Care is a medical device company specializing in the design, development, and commercialization of innovative insulin pump technologies and related products, with a market cap of approximately $1.56 billion.

Operations: The company's primary revenue stream is from insulin pumps and supplies, generating $1.00 billion. Over time, the gross profit margin has shown fluctuations, reaching 52.55% in the most recent period. Operating expenses are significant, with research and development being a notable component at $199.36 million. The net income margin remains negative at -20.51%, indicating ongoing financial challenges despite substantial revenues.

PE: -4.2x

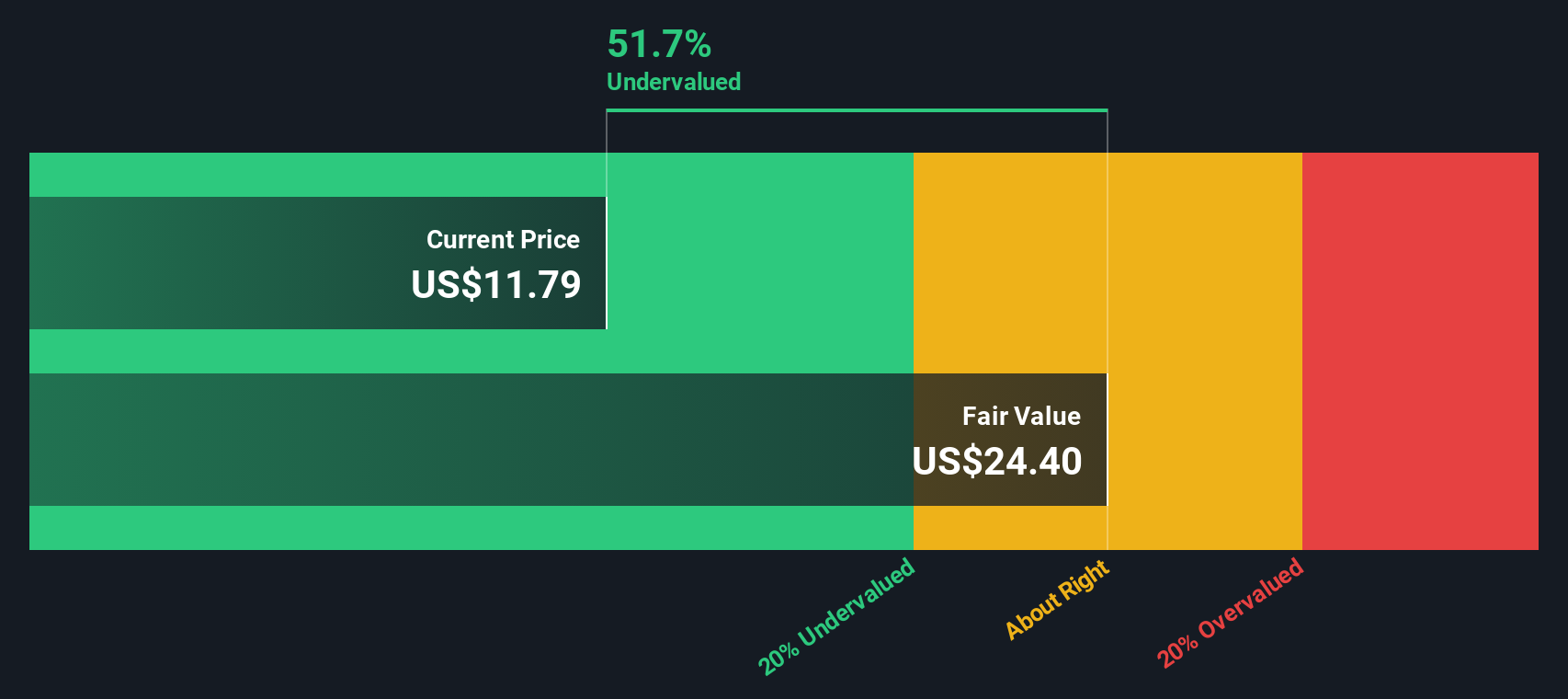

Tandem Diabetes Care, a company focusing on insulin delivery systems, recently received FDA clearance for its SteadiSet infusion set, enhancing its product lineup. Despite reporting a net loss of US$52.4 million in Q2 2025, sales increased to US$240.68 million from the previous year. Insider confidence is evident with recent purchases by executives over the past few months. The company forecasts annual sales of approximately US$1 billion for 2025 and anticipates earnings growth of 75% annually, indicating potential value despite current challenges in funding and product recalls.

- Dive into the specifics of Tandem Diabetes Care here with our thorough valuation report.

Understand Tandem Diabetes Care's track record by examining our Past report.

Peoples Financial Services (PFIS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Peoples Financial Services is a financial institution primarily engaged in providing banking services, with a market capitalization of approximately $0.47 billion.

Operations: The company generates revenue primarily from banking services, with recent figures reaching $165.60 million. Operating expenses have shown an upward trend, with the latest quarter reporting $98.63 million, largely driven by general and administrative expenses at $85.57 million. The net income margin has experienced fluctuations, recently recorded at 20.36%.

PE: 15.1x

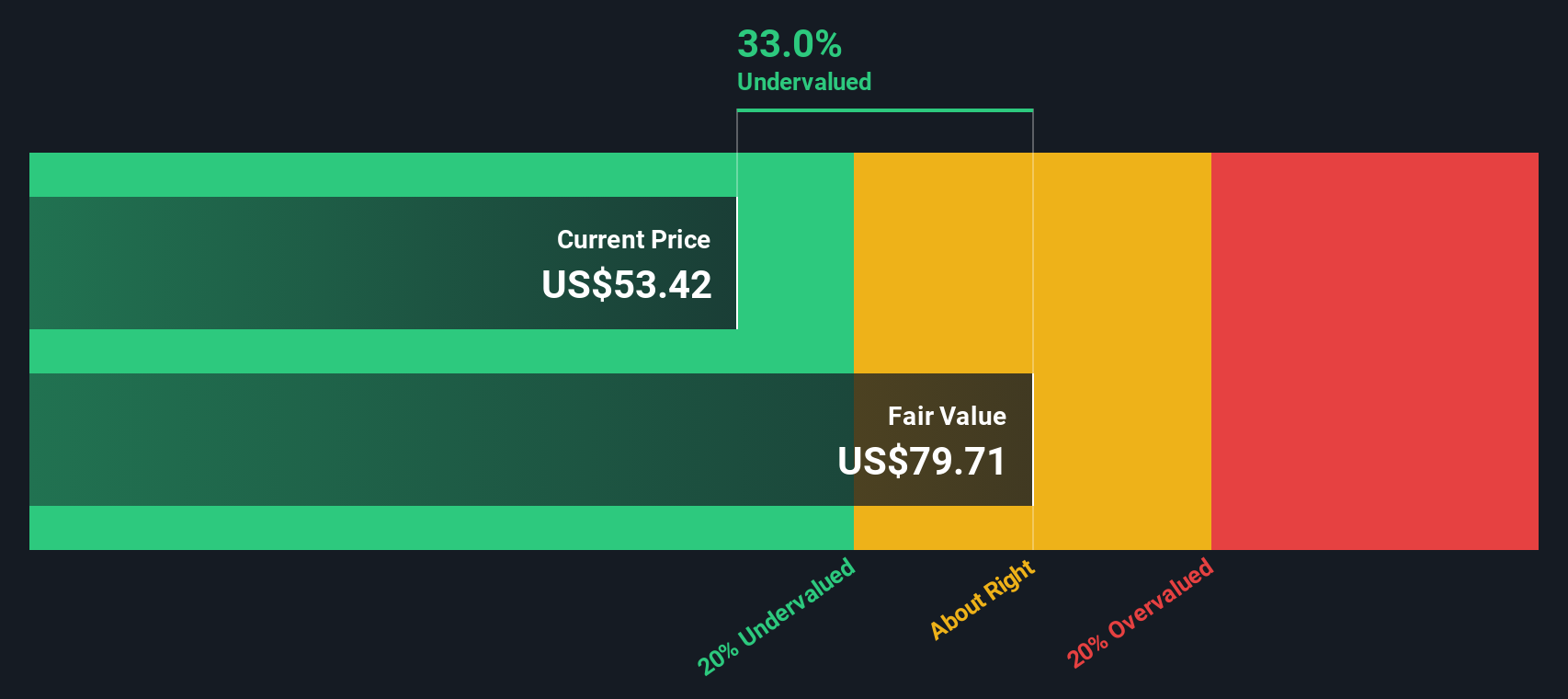

Peoples Financial Services, a smaller player in the financial sector, has recently showcased significant insider confidence with share purchases over the past six months. The company reported a substantial increase in net interest income and net income for Q2 2025, with figures jumping to US$42.2 million and US$16.96 million respectively compared to last year. Despite one-off items affecting results, earnings are projected to grow by 32% annually. Additionally, they've completed an $85 million fixed-income exchange offer and declared a quarterly dividend of $0.6175 per share, indicating solid financial management and potential growth prospects in the coming years.

- Navigate through the intricacies of Peoples Financial Services with our comprehensive valuation report here.

Gain insights into Peoples Financial Services' past trends and performance with our Past report.

Farmland Partners (FPI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Farmland Partners is a real estate investment trust focusing on owning and managing high-quality farmland across North America, with a market cap of approximately $0.74 billion.

Operations: FPI generates revenue primarily from its commercial real estate investment trust (REIT) operations. The company has experienced fluctuations in its net income margin, with recent periods showing a significant increase, reaching as high as 1.21%. Operating expenses are a notable component of the cost structure, consistently impacting profitability alongside non-operating expenses. Gross profit margins have varied but generally remained above 76%, indicating efficient management of direct costs over time.

PE: 7.2x

Farmland Partners, a company with a focus on agricultural real estate, has recently seen insider confidence as Independent Director John Good purchased 15,000 shares for US$183,516. Despite earnings forecasted to decline by an average of 97.7% annually over the next three years and reliance on external borrowing for funding, the company reported a net income of US$7.6 million in Q2 2025 compared to a loss last year. Additionally, they completed a significant share buyback program totaling US$184.53 million since May 2017. With dividends declared at US$0.06 per share payable in October 2025 and recent positive earnings results from continuing operations, Farmland Partners presents potential value amidst its challenges in the agricultural sector.

Where To Now?

- Reveal the 71 hidden gems among our Undervalued US Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFIS

Peoples Financial Services

Provides commercial and retail banking services.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)