- United States

- /

- Specialized REITs

- /

- NYSE:EPR

Is EPR Properties Still Attractive After Its 2025 Rally and Experiential Pivot?

Reviewed by Bailey Pemberton

- Wondering if EPR Properties is still a buy after its recent run, or if you have already missed the best of the gains? This breakdown will help you decide whether the current price still stacks up against its fundamentals.

- The stock has climbed 22.5% over the last year and is up 17.4% year to date. The past week has been a modest -1.2% pullback and the last month only nudged 1.3% higher, which suggests sentiment is still broadly constructive but not euphoric.

- Recent headlines have focused on EPR doubling down on experiential real estate and selectively recycling its portfolio, as management leans into properties tied to entertainment, attractions, and education rather than traditional offices or retail. That shift has caught investors attention as it ties directly into how resilient, or risky, its long term cash flows might be.

- On our numbers, EPR scores 5 out of 6 on our undervaluation checks, giving it a valuation score of 5/6. The big questions now are which methods make it look cheap, which do not, and whether there is an even smarter way to think about valuation that we will come back to at the end of this article.

Approach 1: EPR Properties Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects EPR Properties future adjusted funds from operations, then discounts those cash flows back to today to estimate what the business is worth now.

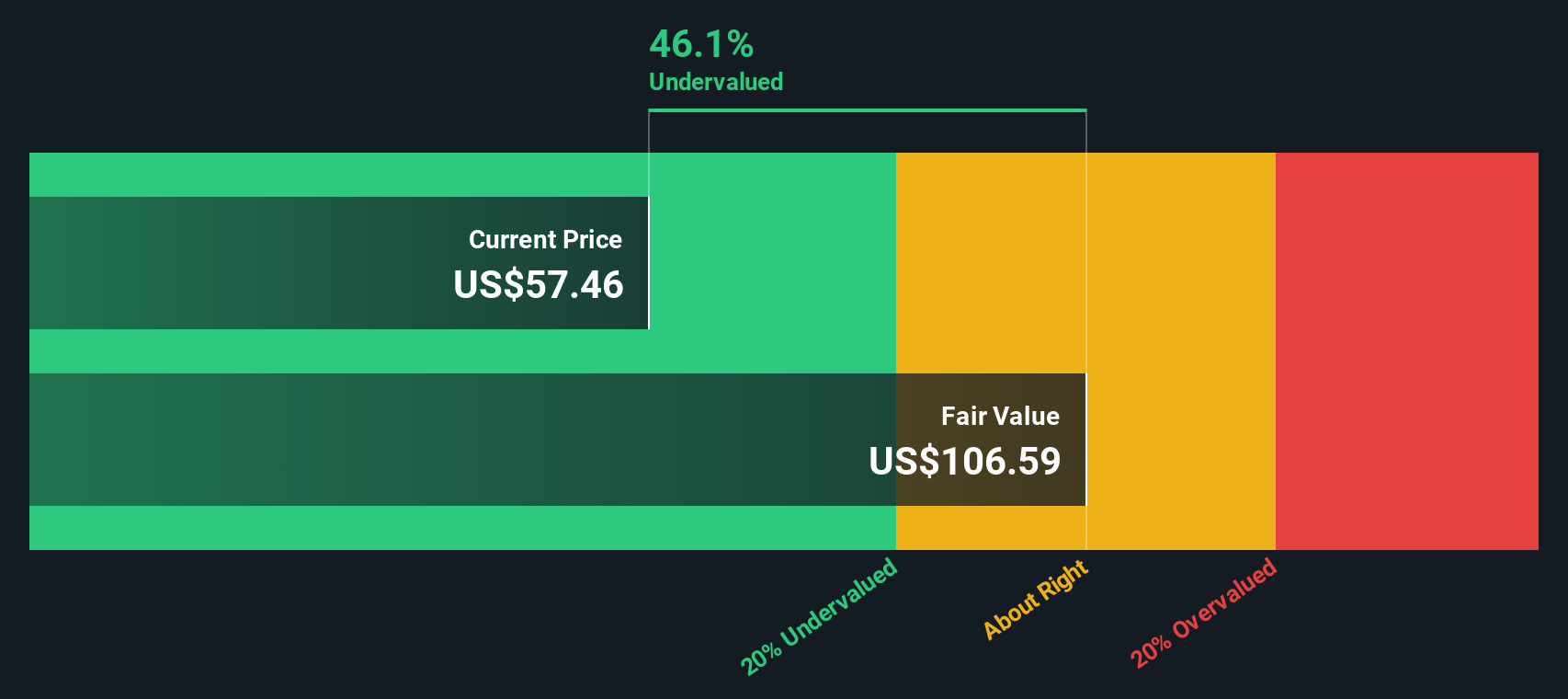

EPR is currently generating about $371.4 Million in free cash flow, and analysts expect this to rise steadily over the next decade. By 2035, Simply Wall St projects free cash flow of roughly $579.0 Million, with analyst estimates informing the first few years and later years extrapolated using modest growth assumptions.

Adding up all these discounted cash flows yields an intrinsic value of about $106.30 per share. Compared with the current share price, this implies the stock is trading at roughly a 51.4% discount to its estimated fair value. This suggests there may be a wide margin of safety if the cash flow path proves broadly accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EPR Properties is undervalued by 51.4%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: EPR Properties Price vs Earnings

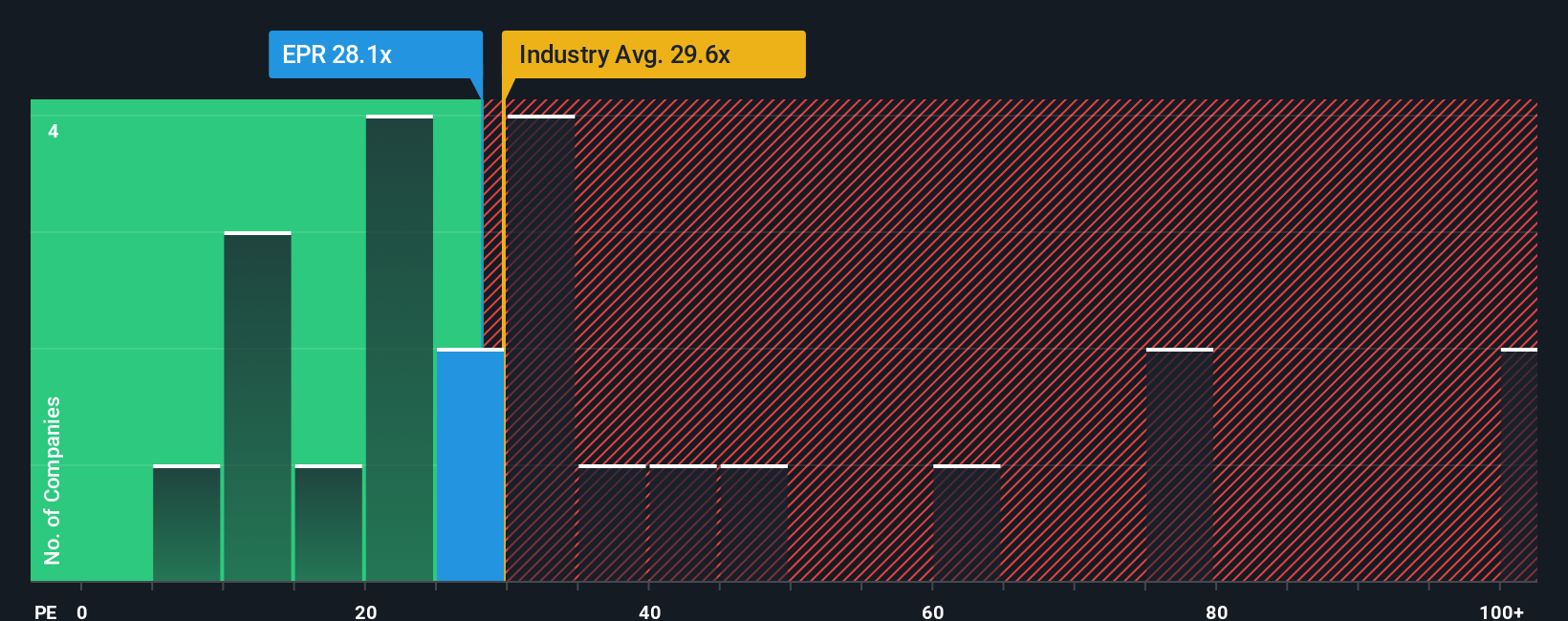

For a profitable REIT like EPR Properties, the price to earnings ratio is a useful yardstick because it links what investors pay today directly to the companys current earning power. In general, faster growth and lower perceived risk justify a higher PE, while slower growth, more cyclical cash flows, or higher leverage argue for a lower multiple.

EPR currently trades on a PE of about 22.4x. That is above the Specialized REITs industry average of roughly 16.8x, but below the peer group average of around 25.6x. This suggests investors are assigning it a premium to the sector, but not an aggressive one versus close comparables.

Simply Wall Sts Fair Ratio framework goes a step further by estimating what PE EPR should trade on, given its earnings growth outlook, risk profile, profit margins, industry, and market cap. On this basis, EPRs Fair Ratio comes out at about 33.0x, comfortably higher than the current 22.4x. That gap implies the market is still discounting the stock more than its fundamentals warrant, even after the recent share price recovery.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EPR Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a companys story with a financial forecast and a fair value that you can compare directly to todays share price.

A Narrative on Simply Wall St is your story for a stock, where you spell out why you think EPRs experiential strategy, growth, risks, and margins will play out a certain way, and those assumptions are then turned into explicit forecasts for revenue, earnings, and profitability, which in turn produce a fair value estimate.

Because Narratives live inside the Community page on Simply Wall St, they are easy to create, compare, and update. The platform automatically refreshes the underlying forecasts and fair values as new information like earnings releases or major news is incorporated.

For EPR Properties, for example, one investor might build a bullish Narrative that leans toward the higher analyst target around $65.50 based on accelerating experiential growth and margin expansion. A more cautious investor might anchor closer to the $52.00 low target if they believe theater and tenant risks will cap returns. By setting up these Narratives side by side, both can quickly see whether todays price offers enough upside, or signals it is time to trim or avoid the stock altogether.

Do you think there's more to the story for EPR Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EPR Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPR

EPR Properties

EPR Properties (NYSE:EPR) is the leading diversified experiential net lease real estate investment trust (REIT), specializing in select enduring experiential properties in the real estate industry.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026