- United States

- /

- Residential REITs

- /

- NYSE:CPT

Assessing Camden Property Trust (CPT) Valuation as Shareholder Returns Decline and Growth Trends Continue

Reviewed by Kshitija Bhandaru

See our latest analysis for Camden Property Trust.

Camden Property Trust’s latest share price of $101.70 reflects a year in which momentum has faded, with a 1-year total shareholder return of -12.7% and a steady pullback over recent months. While fundamentals like revenue and net income keep trending upward, the weak performance signals that the market is reassessing the risk-reward profile of residential REITs at this time.

If sector shifts have you thinking bigger, this may be an opportune moment to broaden your investment universe and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and fundamentals still growing, investors must now consider if Camden Property Trust is an overlooked value or if the current price simply reflects tempered expectations for future growth.

Most Popular Narrative: 16.3% Undervalued

With Camden Property Trust closing at $101.70, the most widely followed narrative puts fair value at $121.55, significantly above the current share price. This view is driven by optimistic expectations for rent growth and sector recovery.

Record-high apartment demand, improving affordability (wages outpacing rent growth for 31 months), and strong resident retention due to high homeownership costs are strengthening Camden's occupancy and ability to grow revenues. These factors may lay the groundwork for outsized rent growth as supply moderates in 2026 and 2027.

Want to see how this bold price target is built? The narrative points to a powerful mix of strong rental demand, rising margins, and a profit outlook that surprises even industry veterans. What hidden growth assumptions drive this forecast? Click through to uncover the secret sauce behind these numbers.

Result: Fair Value of $121.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to Sun Belt markets and any slowdown in job growth could quickly test the market’s optimism and undermine near-term revenue expectations.

Find out about the key risks to this Camden Property Trust narrative.

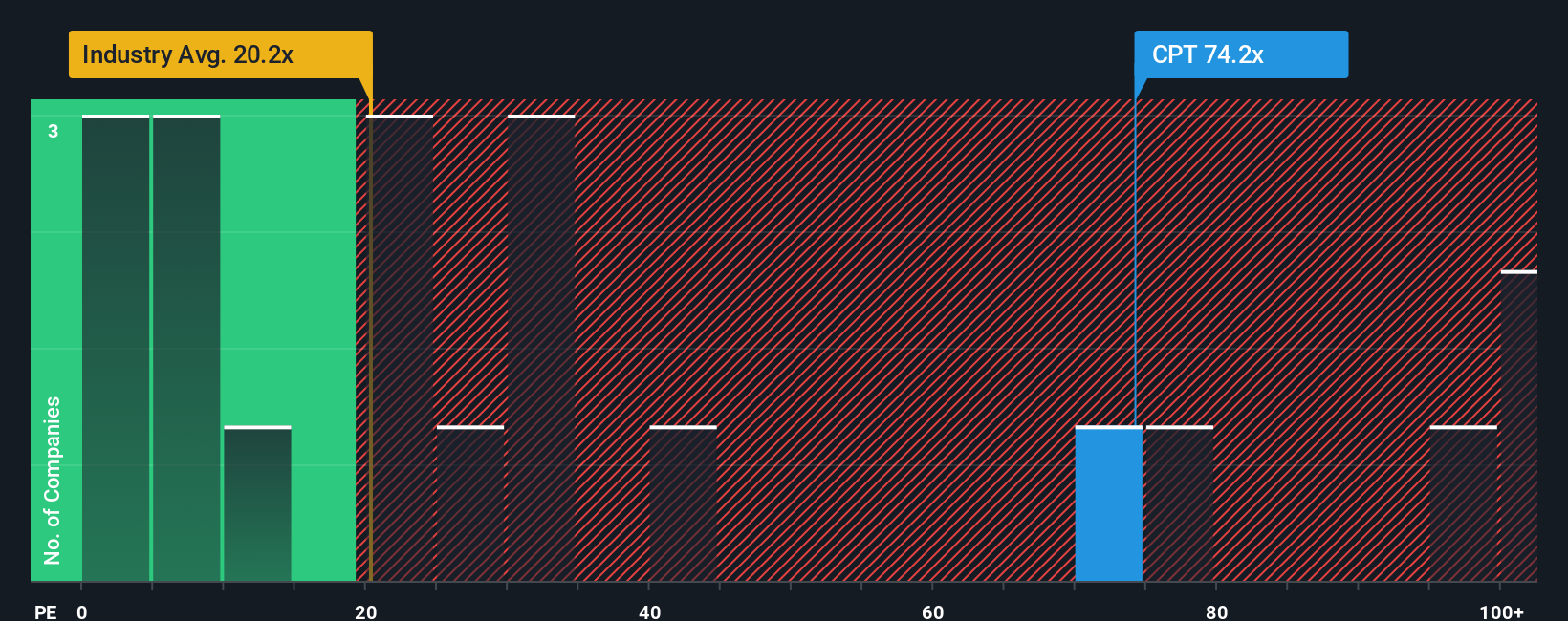

Another View: Market Multiples Tell a Different Story

Looking at Camden Property Trust's valuation based on its price-to-earnings ratio, there is a different perspective. The company trades at 69.8x earnings, which is much higher than both the global industry average of 19.9x and its peer average of 41.4x. Even the fair ratio, which the market could eventually revert toward, is just 34.2x. This large gap suggests the shares may actually be expensive by this measure, indicating more valuation risk than the DCF approach implies. Could the market be too optimistic about future growth, or is there something unique supporting this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camden Property Trust Narrative

If you have a different perspective or want a hands-on feel for the data, crafting your own view is quick and easy. Do it your way.

A great starting point for your Camden Property Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Sharpen your investing game and give yourself the edge by tapping into handpicked ideas you may be missing out on. Take the next step as these lists never last and the best chances go fast, so don’t let them slip by.

- Tap into reliable income streams by checking out these 18 dividend stocks with yields > 3% that consistently pay over 3% yields and build wealth with steady cash flow.

- Spot early movers with future potential by exploring these 24 AI penny stocks that harness artificial intelligence to disrupt industries and fuel the next wave of innovation.

- Capitalize on market mispricing by targeting these 871 undervalued stocks based on cash flows powering ahead despite being overlooked, so you seize value before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPT

Camden Property Trust

An S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives