- United States

- /

- Real Estate

- /

- NYSE:CBRE

CBRE Group (NYSE:CBRE) Completes US$3.8 Billion Buyback Reports US$163 Million Net Income

Reviewed by Simply Wall St

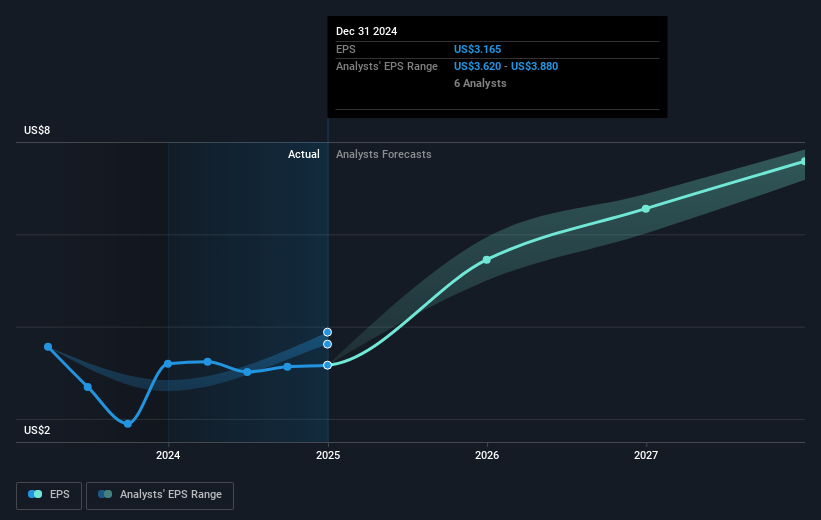

CBRE Group (NYSE:CBRE) recently reported strong earnings for the first quarter of 2025, with sales rising to $5,112 million and net income increasing to $163 million. In addition, CBRE has been active in its share buyback program, repurchasing over 4 million shares this year. These positive financial developments likely supported the company's 4.5% share price gain over the past week. The broader market, with its mixed performance amid tariff uncertainties and varying earnings reports from other major companies, saw CBRE benefitting from its strong internal metrics, counterbalancing the mixed external market signals.

Buy, Hold or Sell CBRE Group? View our complete analysis and fair value estimate and you decide.

CBRE Group's recent earnings announcement, featuring an increase in sales to US$5.11 billion and net income rising to US$163 million, is expected to influence its future revenue and earnings forecasts positively. The ongoing share buyback program may further enhance shareholder value by reducing the number of outstanding shares, which aligns with the anticipated 2% annual decline over the next three years. Such financial strength supports the narrative that CBRE is positioned for expansion, particularly through acquisitions like Industrious and the merger with Turner & Townsend that target high-growth sectors like data centers and flex workspaces.

Over a five-year period, CBRE's total returns, including share price and dividends, rose 186.23%, reflecting significant longer-term growth. In the past year, CBRE outperformed the US Real Estate industry, which had a 16.1% return, indicating strong relative performance. However, the company's earnings and revenue forecasts suggest slower growth than the broader market, with earnings expected to grow 11.5% annually compared to the US market's 14.1% per year.

The current share price of US$118.19 remains at a discount of approximately 15% to the consensus analyst price target of US$141.08, suggesting potential upside if the company meets future earnings expectations. This price target assumes that CBRE will achieve significant growth in revenue and profit margins by 2028. Investors should consider these forecasts in relation to the company's recent results and strategic initiatives when evaluating future potential returns.

Our valuation report unveils the possibility CBRE Group's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CBRE Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives