- United States

- /

- Industrials

- /

- NYSE:MMM

3 US Stocks Estimated To Be Undervalued In October 2024

Reviewed by Simply Wall St

As of September 30, 2024, the U.S. stock market has been performing exceptionally well, with the S&P 500 and Dow reaching record highs after a strong month and quarter. Investors are increasingly confident in the economy's trajectory, bolstered by expectations of further interest rate cuts from the Federal Reserve. In this favorable market environment, identifying undervalued stocks can be particularly rewarding. Here are three U.S. stocks estimated to be undervalued in October 2024 that could offer significant upside potential for investors looking to capitalize on current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Heartland Financial USA (NasdaqGS:HTLF) | $56.70 | $112.73 | 49.7% |

| California Resources (NYSE:CRC) | $52.47 | $104.38 | 49.7% |

| KBR (NYSE:KBR) | $65.13 | $126.97 | 48.7% |

| Symbotic (NasdaqGM:SYM) | $24.39 | $47.68 | 48.8% |

| Tenable Holdings (NasdaqGS:TENB) | $40.52 | $78.94 | 48.7% |

| Enphase Energy (NasdaqGM:ENPH) | $113.02 | $224.88 | 49.7% |

| EVERTEC (NYSE:EVTC) | $33.89 | $66.21 | 48.8% |

| ChromaDex (NasdaqCM:CDXC) | $3.65 | $7.10 | 48.6% |

| Dingdong (Cayman) (NYSE:DDL) | $3.55 | $6.92 | 48.7% |

| SunOpta (NasdaqGS:STKL) | $6.38 | $12.65 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

KE Holdings (NYSE:BEKE)

Overview: KE Holdings Inc. (NYSE: BEKE) operates an integrated online and offline platform for housing transactions and services in China, with a market cap of $24.18 billion.

Operations: The company's revenue segments include New Home Transaction Services (CN¥26.33 billion), Existing Home Transaction Services (CN¥25.42 billion), and Home Renovation and Furnishing (CN¥13.27 billion).

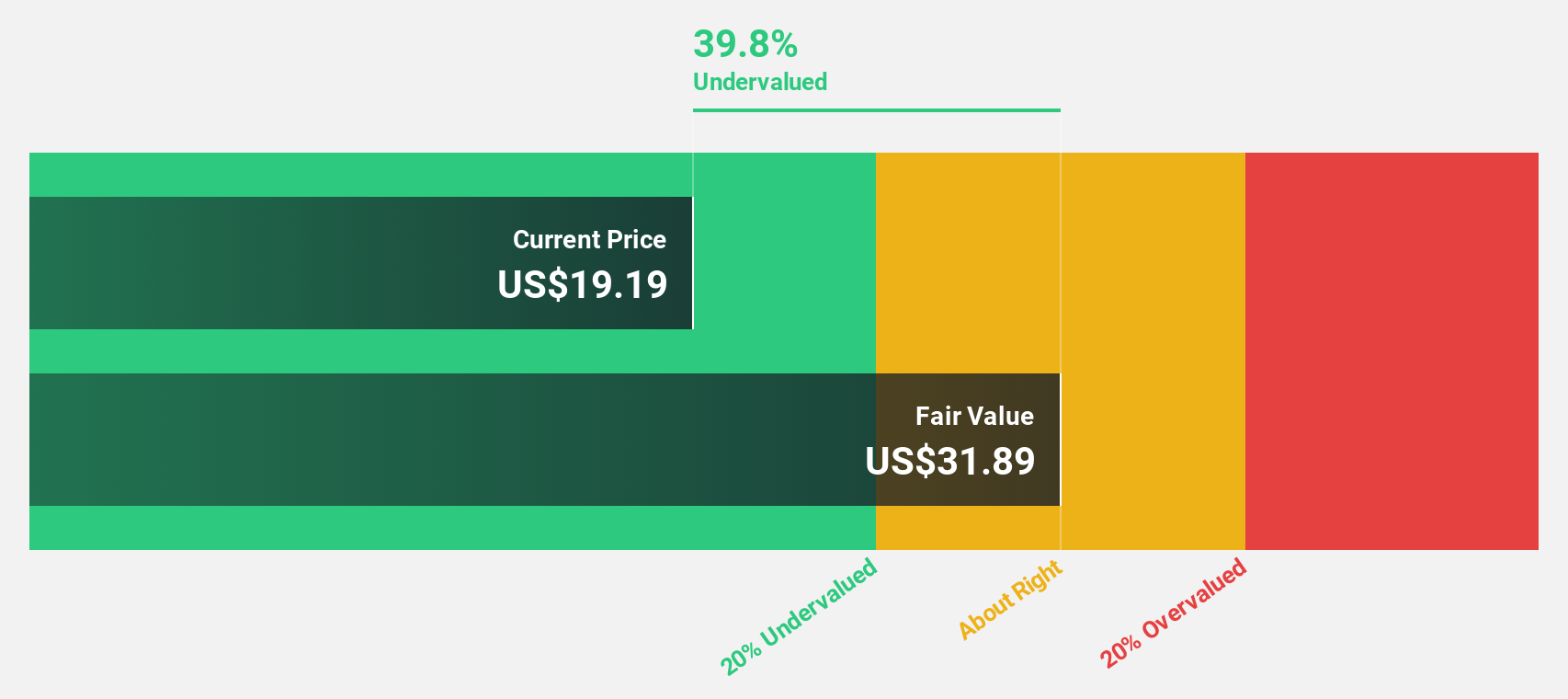

Estimated Discount To Fair Value: 32.5%

KE Holdings appears undervalued based on cash flows, trading at US$19.91, which is 32.5% below its estimated fair value of US$29.50. Despite recent impairment charges and a mixed earnings report for the first half of 2024, the company has shown robust revenue growth in Q2 2024 with CNY 23,370.43 million compared to CNY 19,483.92 million a year ago. Additionally, KE Holdings has increased its buyback authorization by $1 billion to $3 billion and extended the plan duration until August 31, 2025.

- Insights from our recent growth report point to a promising forecast for KE Holdings' business outlook.

- Navigate through the intricacies of KE Holdings with our comprehensive financial health report here.

Levi Strauss (NYSE:LEVI)

Overview: Levi Strauss & Co. designs, markets, and sells apparel and related accessories for men, women, and children worldwide, with a market cap of approximately $8.61 billion.

Operations: The company's revenue segments are as follows: Asia: $1.06 billion, Europe: $1.54 billion, Americas: $3.10 billion, and Other Brands: $451.50 million.

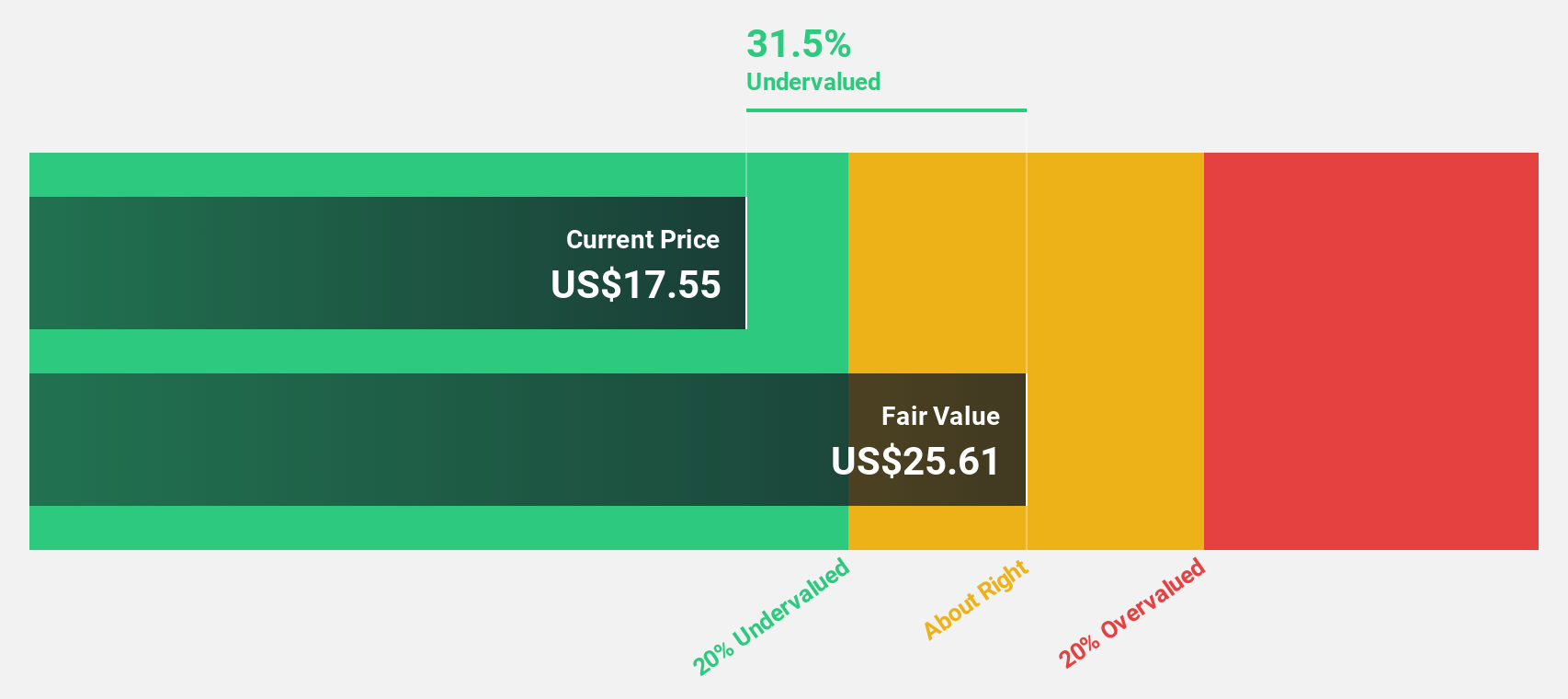

Estimated Discount To Fair Value: 29.6%

Levi Strauss is trading at US$21.8, significantly below its estimated fair value of US$30.97, indicating potential undervaluation based on cash flows. Despite a decline in profit margins from 7.1% to 2.3%, earnings are forecast to grow substantially at 39.5% per year, outpacing the broader US market's growth rate of 15.2%. Recent executive changes include Tracy Layney stepping down as Chief Human Resources Officer effective October 11, 2024.

- The analysis detailed in our Levi Strauss growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Levi Strauss stock in this financial health report.

3M (NYSE:MMM)

Overview: 3M Company offers diversified technology services both in the United States and internationally, with a market cap of approximately $75.43 billion.

Operations: The company's revenue segments include Consumer ($4.94 billion), Safety and Industrial ($10.90 billion), and Transportation and Electronics ($8.51 billion).

Estimated Discount To Fair Value: 36.3%

3M, trading at US$136.70, is significantly undervalued based on cash flows with an estimated fair value of US$214.64. Despite high debt levels and expected revenue decline of 5.6% annually over the next three years, earnings are projected to grow by 21.48% per year, surpassing market expectations of 15.2%. Recent executive changes include Anurag Maheshwari's appointment as CFO effective September 1, 2024, bringing extensive financial expertise to the company.

- Our growth report here indicates 3M may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in 3M's balance sheet health report.

Taking Advantage

- Embark on your investment journey to our 198 Undervalued US Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Fair value low.

Similar Companies

Market Insights

Community Narratives