- United States

- /

- Life Sciences

- /

- NasdaqGM:OABI

Real Brokerage And 2 Other Compelling Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market rebounds from recent fluctuations, investors are closely monitoring earnings reports and trade developments. Amid this backdrop, penny stocks remain an intriguing investment area for those seeking potential growth in smaller or newer companies. Despite being a somewhat outdated term, penny stocks continue to offer opportunities when backed by solid financials, presenting a chance to uncover hidden value in promising companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.71 | $607.59M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9155 | $158.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.67 | $20.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $90.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Cricut (CRCT) | $4.85 | $999.59M | ✅ 2 ⚠️ 1 View Analysis > |

| Riverview Bancorp (RVSB) | $4.90 | $101.94M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.89 | $6.48M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.13 | $93.47M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.65 | $155.03M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $4.00 | $529.63M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 416 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Real Brokerage (REAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Real Brokerage Inc. operates as a real estate technology company in the United States and Canada, with a market cap of $824.80 million.

Operations: The company generates revenue primarily from its North American Brokerage segment, which accounts for $1.41 billion.

Market Cap: $824.8M

Real Brokerage, with a market cap of US$824.80 million, primarily generates revenue from its North American Brokerage segment. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a positive cash flow with a runway exceeding three years. The company has no debt and recently announced a share repurchase program worth up to US$150 million. Additionally, Real has expanded its footprint in Northern California through its Private Label program by integrating Showcase Real Estate, enhancing its agent network and community presence while leveraging AI-driven technology for growth.

- Get an in-depth perspective on Real Brokerage's performance by reading our balance sheet health report here.

- Assess Real Brokerage's future earnings estimates with our detailed growth reports.

OmniAb (OABI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OmniAb, Inc. is a biotechnology company that licenses discovery research technology to pharmaceutical and biotech companies, as well as academic institutions, to facilitate the discovery of therapeutics across the United States, Europe, Japan, China, and Canada; it has a market cap of approximately $238.55 million.

Operations: The company's revenue is derived from its Research Services segment, which generated $26.74 million.

Market Cap: $238.55M

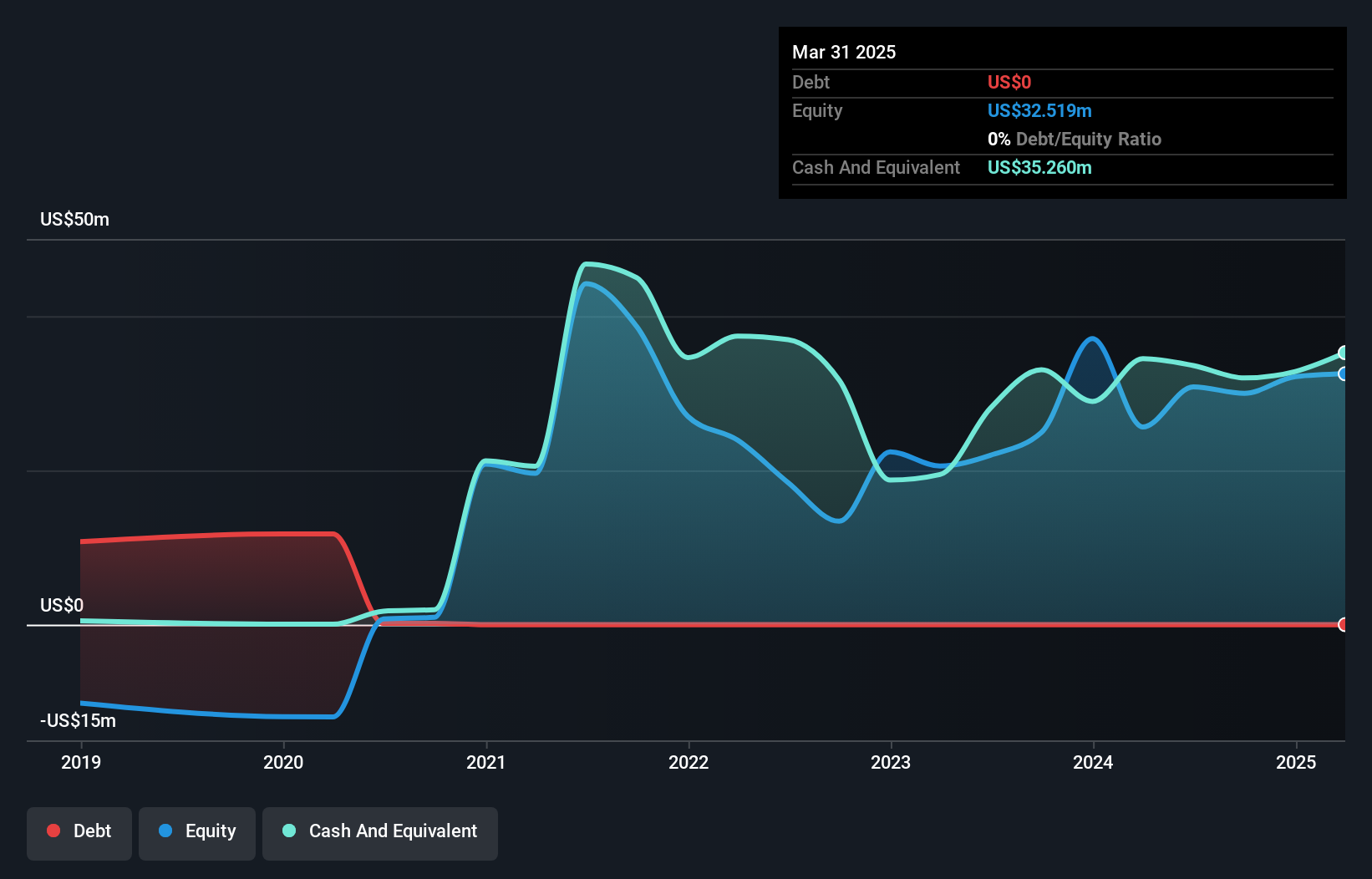

OmniAb, Inc., with a market cap of US$238.55 million, remains unprofitable but shows potential in its revenue growth, forecasting a 29.01% annual increase. The company has no debt and sufficient short-term assets to cover both short- and long-term liabilities. Despite an inexperienced board, OmniAb's management team is seasoned with an average tenure of 2.8 years. Recent developments include the launch of the xPloration Partner Access Program to enhance antibody discovery capabilities using advanced technology like AI and machine learning, which could bolster its competitive edge in the biotech industry despite current financial challenges.

- Take a closer look at OmniAb's potential here in our financial health report.

- Gain insights into OmniAb's future direction by reviewing our growth report.

Marchex (MCHX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marchex, Inc. is a conversation intelligence company offering conversational analytics and related solutions across the United States, Canada, and internationally, with a market cap of approximately $89.90 million.

Operations: The company's revenue is derived from its Conversational Analytics and Related Solutions segment, which generated $47.95 million.

Market Cap: $89.9M

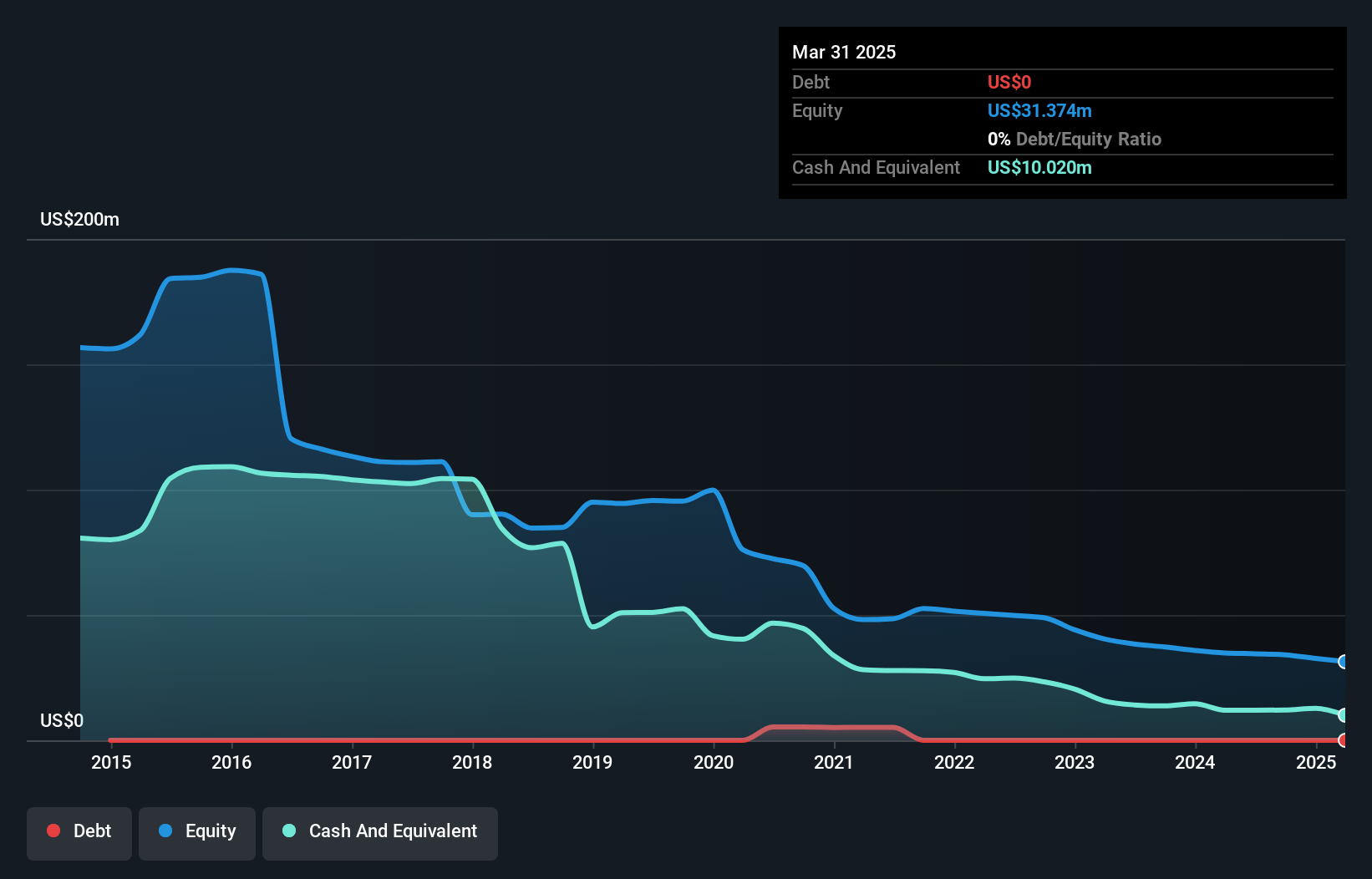

Marchex, Inc., with a market cap of approximately US$89.90 million, is currently unprofitable but has been reducing its losses by 44.3% annually over the past five years. The company remains debt-free and holds sufficient short-term assets to cover liabilities, providing financial stability amidst its challenges. Recent strategic moves include expanding partnerships with FordDirect and launching Marketing Edge on Microsoft Azure Marketplace, which aims to enhance revenue through advanced AI-driven analytics solutions for marketers and auto dealers. Despite a relatively new management team, Marchex's board is experienced with an average tenure of eight years.

- Jump into the full analysis health report here for a deeper understanding of Marchex.

- Review our historical performance report to gain insights into Marchex's track record.

Key Takeaways

- Unlock more gems! Our US Penny Stocks screener has unearthed 413 more companies for you to explore.Click here to unveil our expertly curated list of 416 US Penny Stocks.

- Contemplating Other Strategies? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OABI

OmniAb

A biotechnology company, licenses discovery research technology to pharmaceutical and biotech companies, and academic institutions to enable the discovery of therapeutics in the United States, Europe, Japan, China, and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)