- United States

- /

- Aerospace & Defense

- /

- NYSE:CDRE

3 US Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As major U.S. indexes like the Dow Jones, S&P 500, and Nasdaq Composite are on track for gains amid positive earnings reports and stable inflation data, investors continue to navigate a landscape shaped by economic resilience and evolving corporate performances. In this context, growth stocks with significant insider ownership can be particularly appealing as they often indicate strong internal confidence in the company's future potential and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 48% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 28.1% |

| MoneyLion (NYSE:ML) | 20.3% | 92.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13% | 66.2% |

Let's uncover some gems from our specialized screener.

ARS Pharmaceuticals (NasdaqGM:SPRY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing treatments for severe allergic reactions with a market cap of approximately $1.39 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to $2.57 million.

Insider Ownership: 19.1%

Earnings Growth Forecast: 58.7% p.a.

ARS Pharmaceuticals is positioned as a growth company with high insider ownership, driven by its innovative product neffy, an FDA-approved epinephrine nasal spray. Despite recent insider selling, the company's revenue is forecast to grow significantly faster than the market at 45.5% annually. Recent licensing agreements and approvals in multiple regions, including Europe and Canada, provide substantial revenue potential through upfront payments and milestone-based earnings. However, current revenues remain modest at US$3 million amidst ongoing losses.

- Click to explore a detailed breakdown of our findings in ARS Pharmaceuticals' earnings growth report.

- Upon reviewing our latest valuation report, ARS Pharmaceuticals' share price might be too optimistic.

Cadre Holdings (NYSE:CDRE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cadre Holdings, Inc. manufactures and distributes safety equipment for protection in hazardous situations both in the United States and internationally, with a market cap of approximately $1.57 billion.

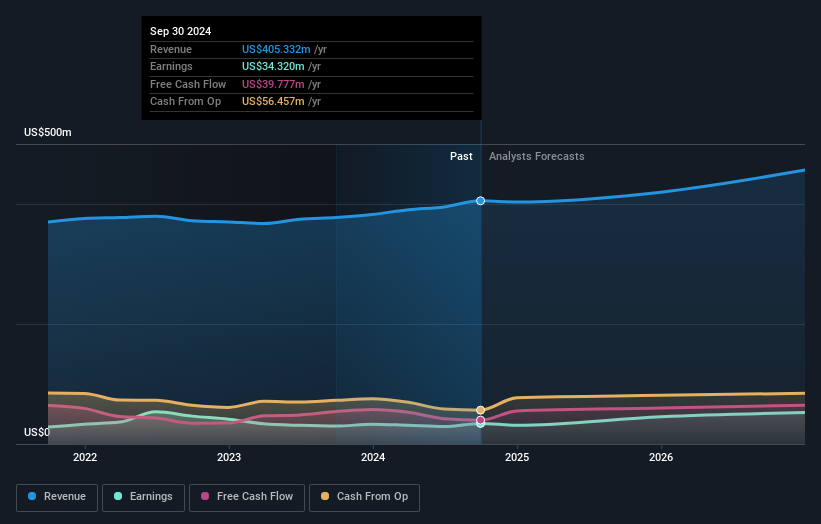

Operations: The company's revenue segments consist of $449.48 million from Product and $99.39 million from Distribution.

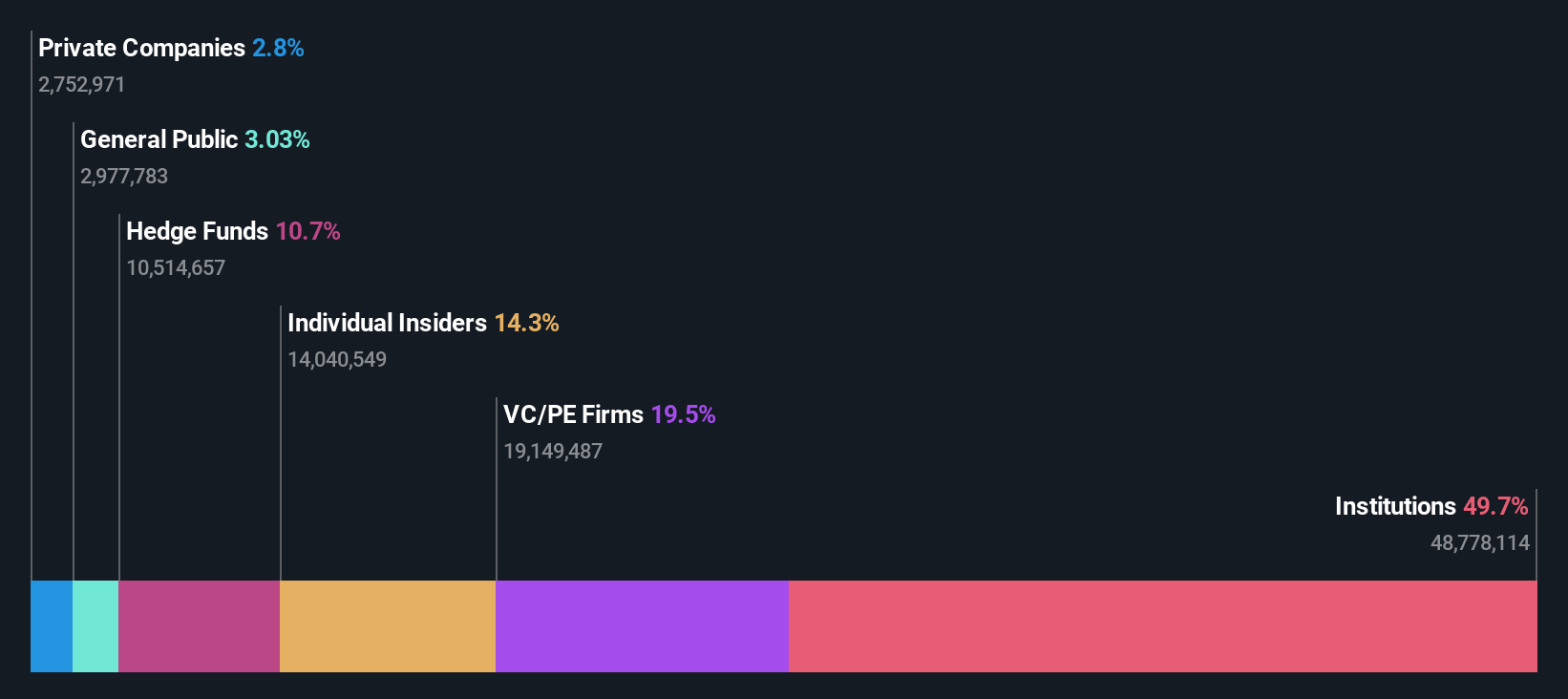

Insider Ownership: 33.8%

Earnings Growth Forecast: 30.1% p.a.

Cadre Holdings is experiencing significant growth, with earnings projected to increase by 30.1% annually, outpacing the broader US market. Despite a recent decline in quarterly sales and net income, the company maintains a robust financial position with US$458 million available for growth initiatives. Insider activity shows more buying than selling recently, reflecting confidence in future prospects. The company is actively seeking acquisitions to scale its nuclear products category further.

- Click here and access our complete growth analysis report to understand the dynamics of Cadre Holdings.

- Our valuation report here indicates Cadre Holdings may be undervalued.

Carriage Services (NYSE:CSV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Carriage Services, Inc. operates in the United States offering funeral and cemetery services and merchandise, with a market cap of $635.26 million.

Operations: The company generates revenue through its funeral segment, which accounts for $266.69 million, and its cemetery segment, contributing $138.64 million.

Insider Ownership: 10.8%

Earnings Growth Forecast: 23.8% p.a.

Carriage Services is poised for growth, with earnings expected to rise 23.8% annually, surpassing the US market's average. Despite revenue growth lagging behind market expectations at 4.6%, the company trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Recent insider activity shows more buying than selling, indicating confidence in future performance. The appointment of John Enwright as CFO underscores a focus on strategic financial leadership and transformative growth objectives.

- Dive into the specifics of Carriage Services here with our thorough growth forecast report.

- The analysis detailed in our Carriage Services valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 201 more companies for you to explore.Click here to unveil our expertly curated list of 204 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDRE

Cadre Holdings

Manufactures and distributes safety equipment and other related products that provides protection to users in hazardous or life-threatening situations in the United States and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives