- United States

- /

- Biotech

- /

- NasdaqGM:SAGE

Here's Why We're Not Too Worried About Sage Therapeutics' (NASDAQ:SAGE) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Sage Therapeutics (NASDAQ:SAGE) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Sage Therapeutics

Does Sage Therapeutics Have A Long Cash Runway?

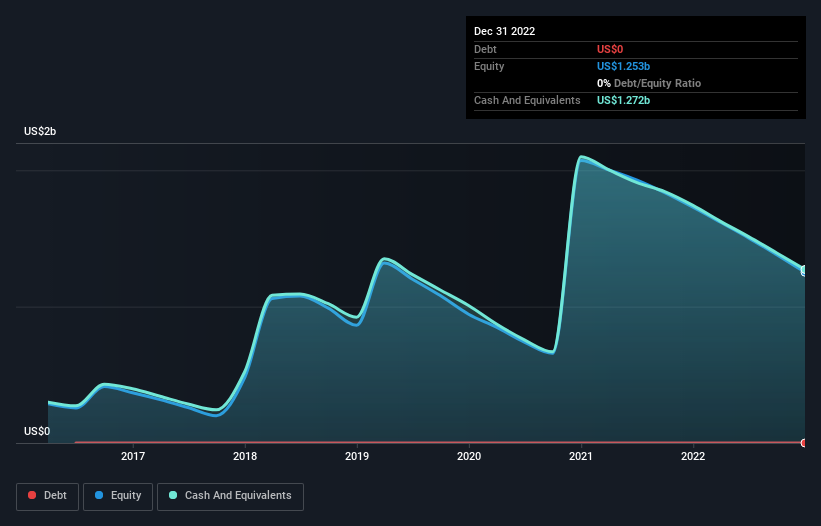

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Sage Therapeutics last reported its balance sheet in December 2022, it had zero debt and cash worth US$1.3b. Looking at the last year, the company burnt through US$461m. Therefore, from December 2022 it had 2.8 years of cash runway. Importantly, analysts think that Sage Therapeutics will reach cashflow breakeven in 4 years. Essentially, that means the company will either reduce its cash burn, or else require more cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is Sage Therapeutics Growing?

Some investors might find it troubling that Sage Therapeutics is actually increasing its cash burn, which is up 22% in the last year. The silver lining is that revenue was up 22%, showing the business is growing at the top line. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Sage Therapeutics Raise More Cash Easily?

While Sage Therapeutics seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$2.6b, Sage Therapeutics' US$461m in cash burn equates to about 18% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Sage Therapeutics' Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Sage Therapeutics' cash runway was relatively promising. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 1 warning sign for Sage Therapeutics that investors should know when investing in the stock.

Of course Sage Therapeutics may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SAGE

Sage Therapeutics

A biopharmaceutical company, develops and commercializes brain health medicines.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)