- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

Three Stocks That May Be Undervalued In April 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 3.0% decline, though it remains up by 4.6% over the past year with earnings forecasted to grow by 14% annually. In this context, identifying stocks that may be undervalued involves looking for companies with strong fundamentals and growth potential that are not fully reflected in their current stock prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $39.58 | $78.07 | 49.3% |

| First National (NasdaqCM:FXNC) | $18.60 | $36.87 | 49.6% |

| First Bancorp (NasdaqGS:FBNC) | $36.82 | $72.67 | 49.3% |

| Datadog (NasdaqGS:DDOG) | $91.88 | $178.65 | 48.6% |

| DoorDash (NasdaqGS:DASH) | $179.39 | $350.88 | 48.9% |

| Sotera Health (NasdaqGS:SHC) | $10.49 | $20.95 | 49.9% |

| BioLife Solutions (NasdaqCM:BLFS) | $22.26 | $44.39 | 49.9% |

| First Advantage (NasdaqGS:FA) | $13.79 | $27.43 | 49.7% |

| MYT Netherlands Parent B.V (NYSE:MYTE) | $7.81 | $15.29 | 48.9% |

| CNX Resources (NYSE:CNX) | $30.88 | $60.85 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

Repligen (NasdaqGS:RGEN)

Overview: Repligen Corporation is a life sciences company that develops and commercializes bioprocessing technologies and systems globally, with a market cap of $7.42 billion.

Operations: Repligen generates revenue from its Medical Products segment, amounting to $634.44 million.

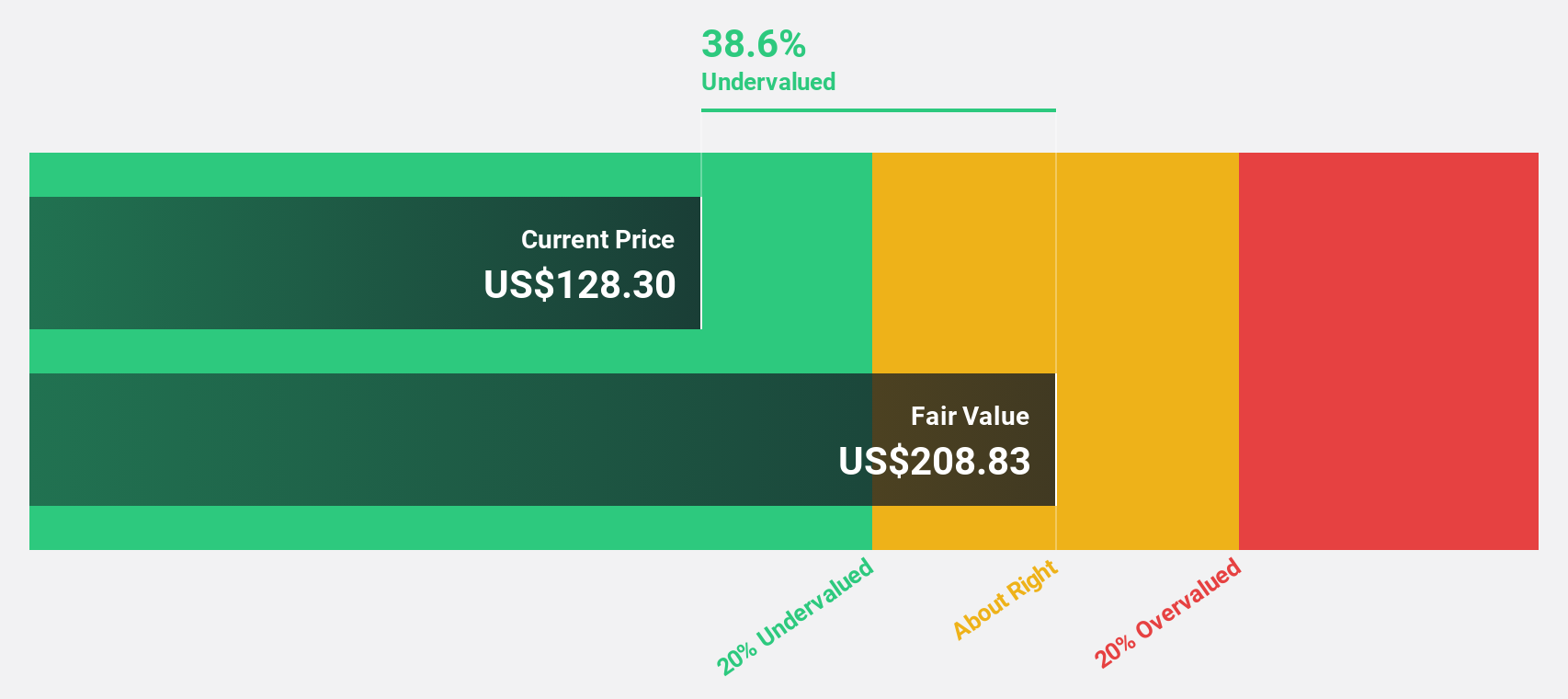

Estimated Discount To Fair Value: 37.1%

Repligen is trading at US$132.1, significantly below its estimated fair value of US$210, making it undervalued based on cash flows. Analysts agree the stock price could rise by 43%. Despite a low future Return on Equity forecast of 6.1%, Repligen's revenue is expected to grow faster than the market at 13.6% annually. However, recent challenges include delayed SEC filings and a net loss in Q4 2024, impacting investor confidence.

- The growth report we've compiled suggests that Repligen's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Repligen's balance sheet health report.

Coeur Mining (NYSE:CDE)

Overview: Coeur Mining, Inc. is a gold and silver producer operating in the United States, Canada, and Mexico with a market cap of $3.90 billion.

Operations: The company's revenue segments include Wharf at $234.01 million, Palmarejo at $379.06 million, Rochester at $215.81 million, and Kensington at $225.13 million.

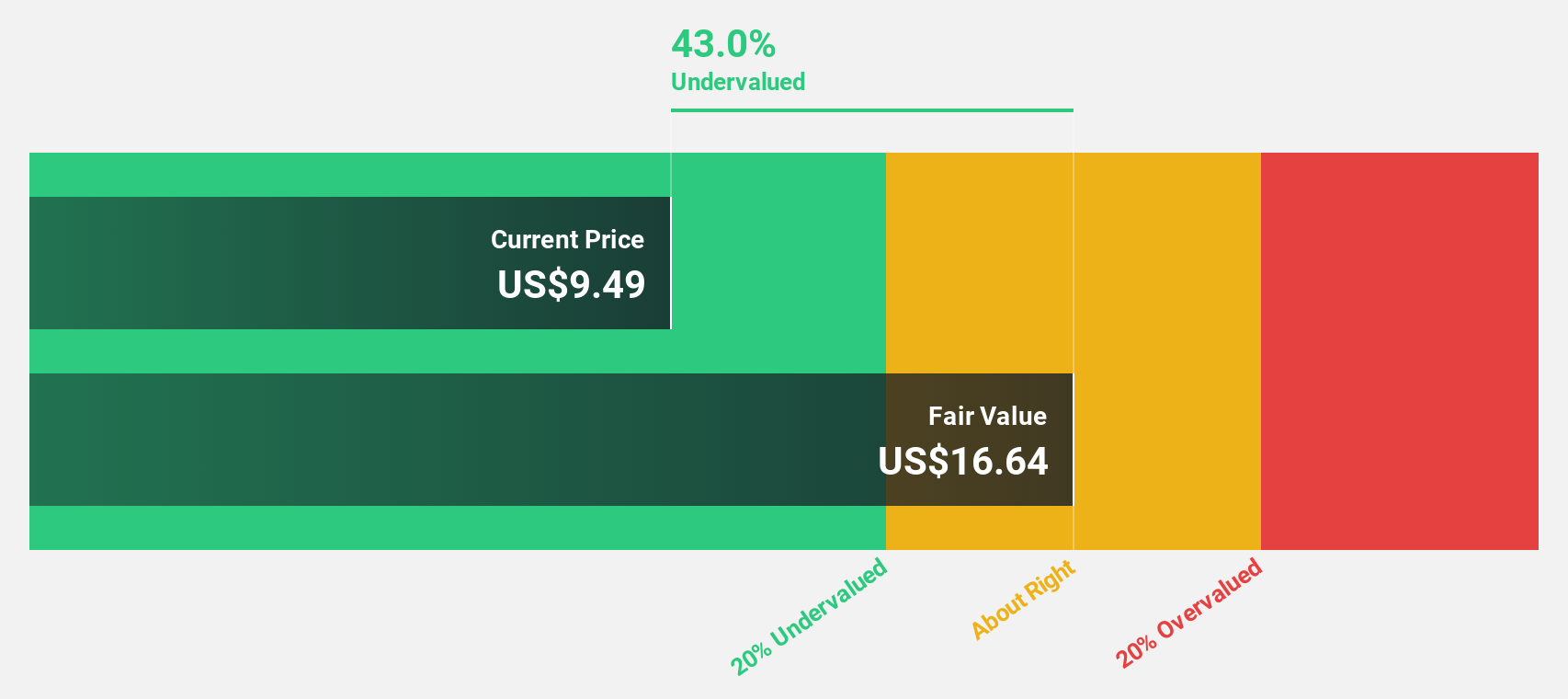

Estimated Discount To Fair Value: 34.1%

Coeur Mining, with a trading price of US$6.27, is undervalued based on cash flows, as it sits below the estimated fair value of US$9.52. Recent profitability and a forecasted 40% annual earnings growth highlight its potential despite past shareholder dilution. Revenue growth is expected to outpace the broader U.S. market at 14.4% annually. The company reported significant improvements in net income for 2024 and increased mineral reserves, enhancing its operational outlook.

- Our growth report here indicates Coeur Mining may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Coeur Mining stock in this financial health report.

CareTrust REIT (NYSE:CTRE)

Overview: CareTrust REIT, Inc. primarily focuses on acquiring, financing, developing, and owning real estate properties leased to third-party tenants in the healthcare sector, with a market cap of approximately $5.33 billion.

Operations: Revenue is primarily generated from investments in healthcare-related real estate assets, totaling $296.29 million.

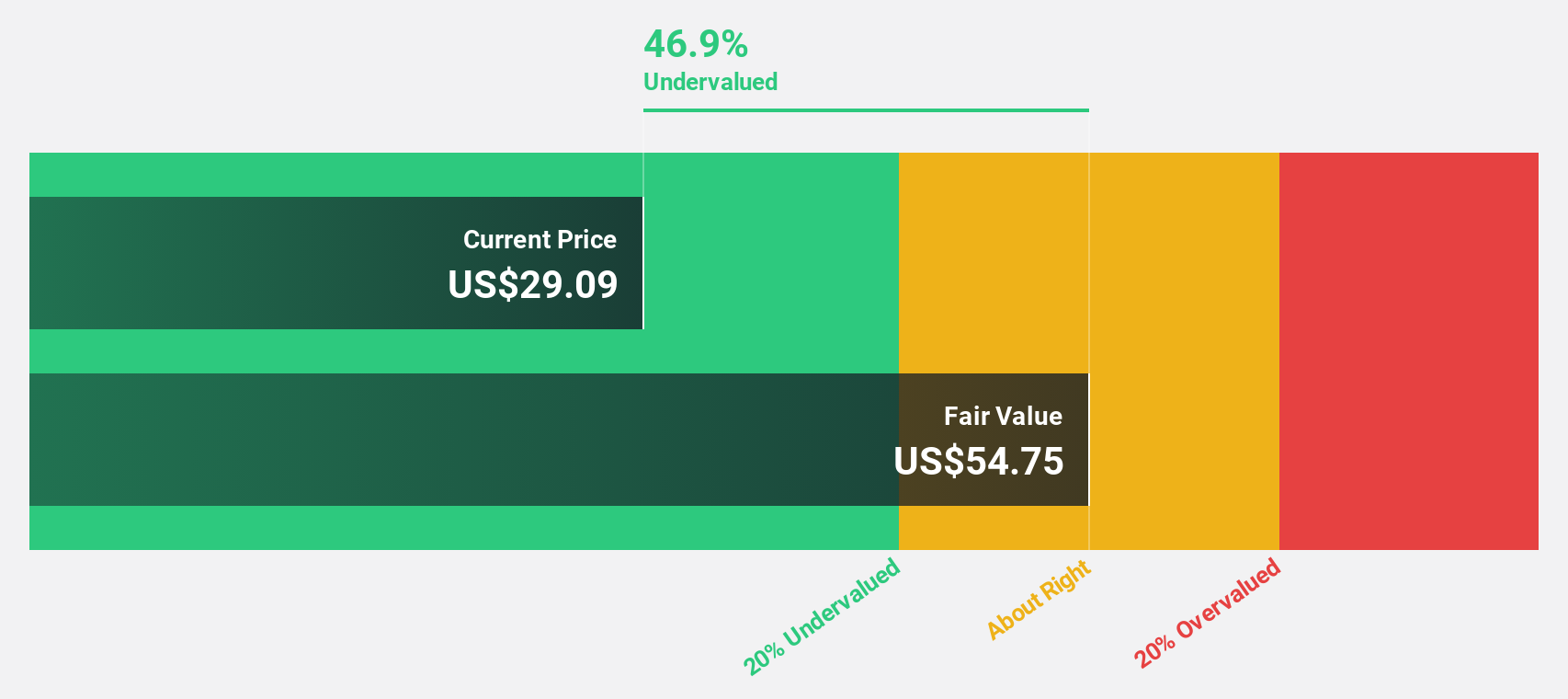

Estimated Discount To Fair Value: 47.4%

CareTrust REIT, priced at US$28.62, is significantly undervalued based on cash flows with a fair value estimate of US$54.39. Despite recent shareholder dilution and a dividend not fully covered by earnings, its earnings grew 133.7% last year and are forecasted to grow 32.54% annually, outpacing the U.S. market's growth rate of 13.5%. Recent acquisitions totaling US$55 million funded by cash on hand underscore strategic expansion efforts enhancing future revenue streams.

- Insights from our recent growth report point to a promising forecast for CareTrust REIT's business outlook.

- Click here to discover the nuances of CareTrust REIT with our detailed financial health report.

Next Steps

- Access the full spectrum of 171 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of seniors housing and healthcare-related properties.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives