- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

Repligen (RGEN): Assessing Valuation After Coverage Flags Weaker Organic Growth and Margin Pressure

Reviewed by Simply Wall St

Repligen (RGEN) is back in focus after fresh coverage spotlighted a growing disconnect between its acquisition driven expansion and softer organic revenue growth, along with a clear slide in operating margins.

See our latest analysis for Repligen.

The latest note seems to have cooled sentiment a little, with a modest pullback in the 7 day share price return after a strong 90 day share price rally and only lukewarm 1 year total shareholder return. This hints that momentum is still rebuilding rather than fully established.

If Repligen's acquisition strategy has caught your eye, this could be a good moment to compare it with other innovative names in the sector and explore healthcare stocks as fresh opportunities emerge.

Yet with the share price still trading below analyst targets and intrinsic value estimates despite slowing organic growth, is Repligen quietly undervalued today, or is the market already factoring in a meaningful earnings recovery?

Most Popular Narrative: 13.6% Undervalued

With Repligen's fair value pegged at $187 against a last close of $161.66, the leading narrative leans toward upside driven by accelerating fundamentals.

Continued product launches (new resins, Metenova single use mixers, integrated PAT platforms) and recent acquisitions (e.g., 908 bioprocessing) are building additional recurring consumable pull through and expanding the addressable market, directly supporting long term revenue and operating margin growth.

Want to see how recurring consumables, margin expansion, and a rich future earnings multiple all combine into that upside case? The narrative spells out the full financial blueprint.

Result: Fair Value of $187 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer biotech funding and heightened trade or regulatory pressures could still easily derail the expected recovery in growth, margins, and valuation.

Find out about the key risks to this Repligen narrative.

Another Angle on Valuation

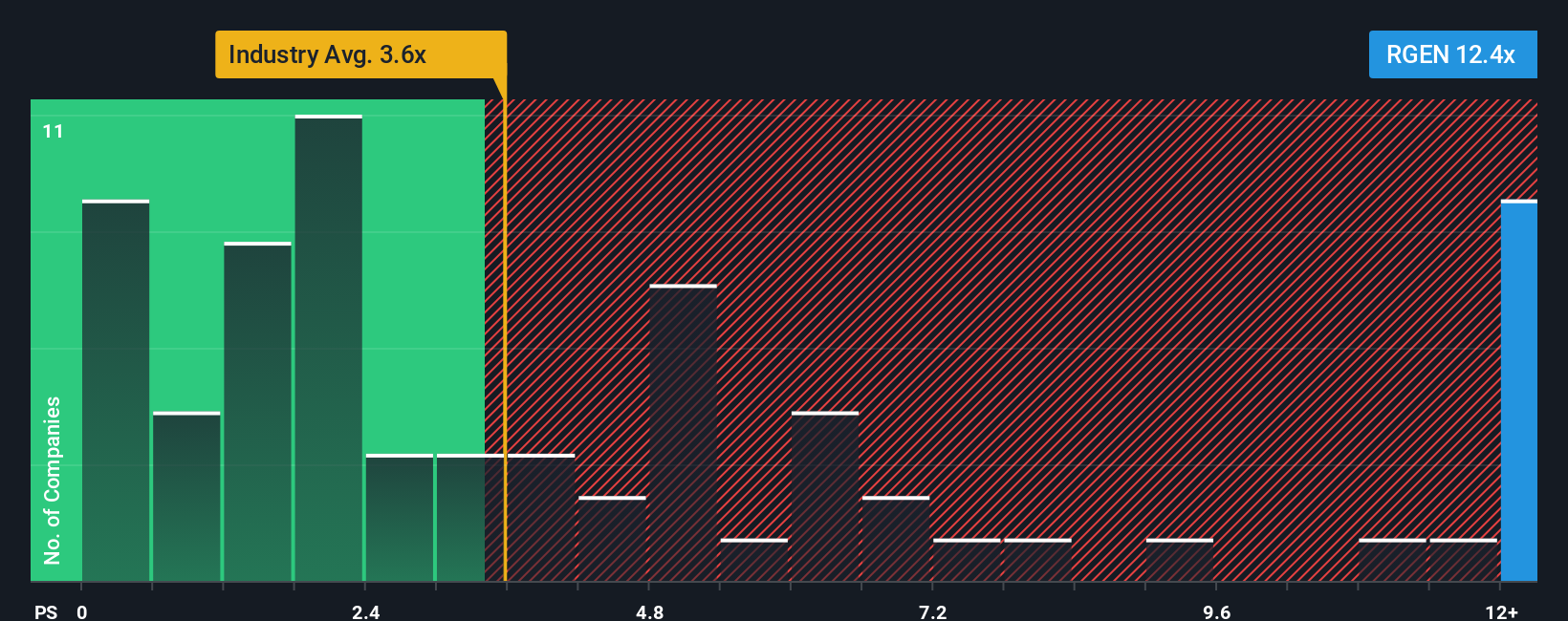

On revenue multiples, Repligen looks far less forgiving, trading on a price to sales of 12.9 times versus 3.4 times for the US Life Sciences industry and a fair ratio of 5.5 times. That rich gap suggests limited margin for error if growth or margins stumble. How comfortable are you with that risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Repligen Narrative

If you see the setup differently or prefer to dive into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way

A great starting point for your Repligen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider identifying your next smart move with fresh opportunities from our powerful Screener, so you do not miss what the market overlooks.

- Explore mispriced potential by scanning these 905 undervalued stocks based on cash flows that could offer different characteristics than the usual large cap names on your watchlist.

- Focus on innovation trends by targeting these 25 AI penny stocks positioned at the heart of accelerating artificial intelligence adoption across industries.

- Build your income stream with these 12 dividend stocks with yields > 3% that can help support long term returns even when markets become volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026