- United States

- /

- Biotech

- /

- NasdaqCM:PROK

US Penny Stocks: 3 Picks With Market Caps Under $300M

Reviewed by Simply Wall St

As U.S. markets recently took a pause from a rally, optimism around corporate earnings and AI development continues to shape investor sentiment. In this context, penny stocks—often smaller or newer companies—can present unique opportunities for investors looking beyond the major indices. Despite their vintage name, these stocks can offer surprising value when supported by solid financials and growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8562 | $6.22M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.83 | $11.49M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.97 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2874 | $10.58M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.85 | $86.45M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.47 | $60.21M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.32 | $23.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8902 | $80.06M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ProKidney (NasdaqCM:PROK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ProKidney Corp. is a clinical-stage biotechnology company focused on developing a proprietary cell therapy platform for treating chronic kidney diseases in the United States, with a market cap of approximately $220.11 million.

Operations: ProKidney Corp. does not currently report any revenue segments as it is a clinical-stage biotechnology company.

Market Cap: $220.11M

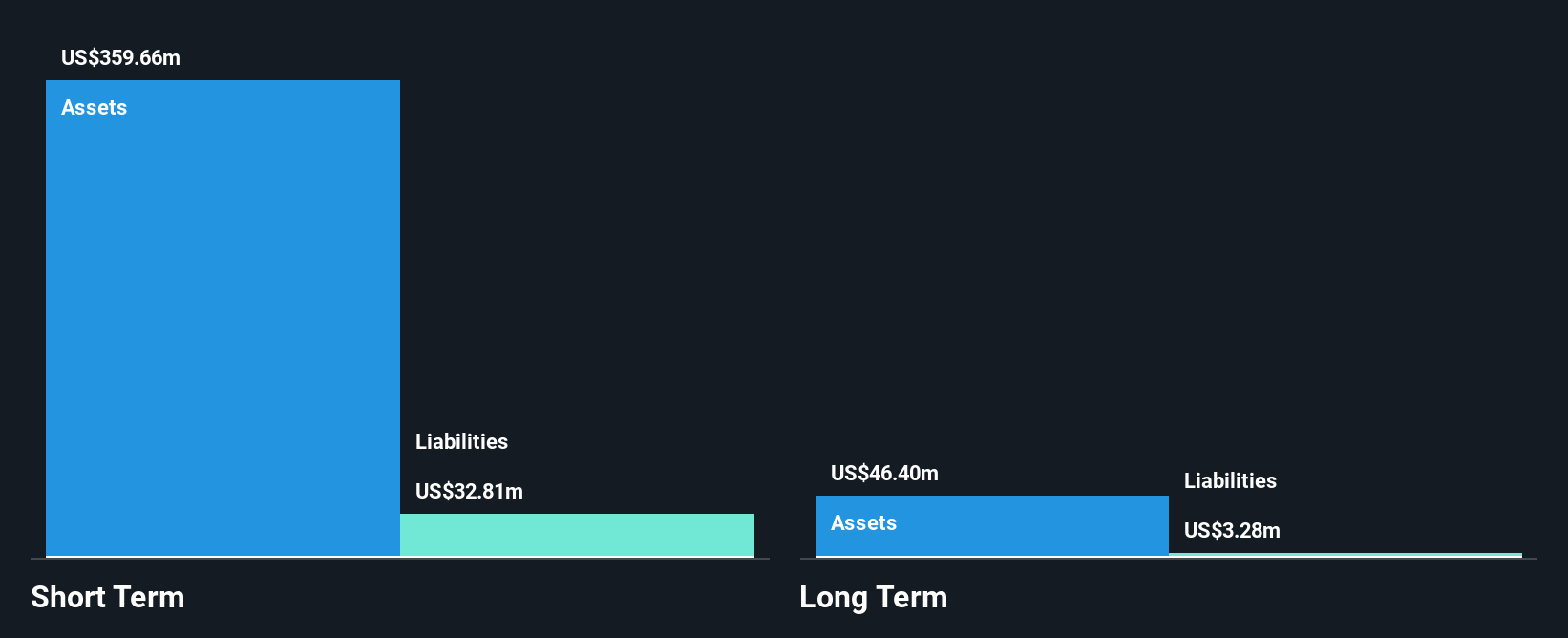

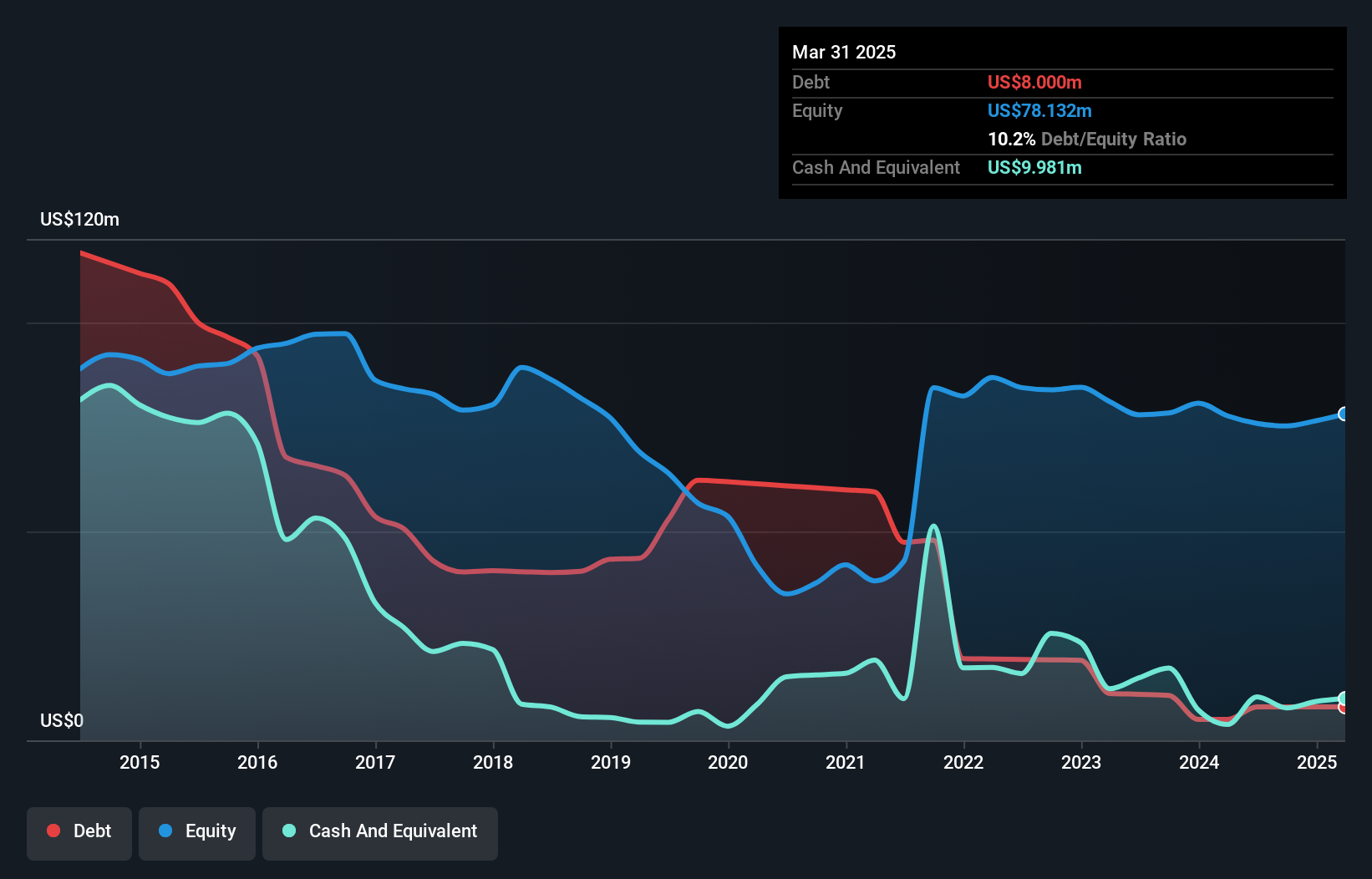

ProKidney Corp., a clinical-stage biotech firm with a market cap of US$220.11 million, remains pre-revenue, focusing on innovative cell therapies for chronic kidney diseases. Despite its unprofitability and high share price volatility, the company boasts strong financial health with short-term assets of US$430.2 million exceeding liabilities and no debt burden. Recent regulatory updates highlight promising developments in its Phase 3 trial strategy for rilparencel, potentially paving the way for accelerated FDA approval pathways. However, management's relative inexperience could pose challenges as it navigates these complex clinical and regulatory landscapes while working towards profitability.

- Dive into the specifics of ProKidney here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into ProKidney's future.

Performant Healthcare (NasdaqGS:PHLT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Performant Healthcare, Inc. offers technology-enabled payment integrity, eligibility, and analytics services with a market cap of approximately $190.25 million.

Operations: The company's revenue is derived from its Business Services segment, which generated $120.78 million.

Market Cap: $190.25M

Performant Healthcare, Inc., with a market cap of US$190.25 million, has seen its debt to equity ratio improve significantly over the past five years, now at a satisfactory 0.3%. Despite being unprofitable and not expected to achieve profitability within the next three years, it reduced losses by 33.1% annually over the past five years. The company's short-term assets of US$38.3 million comfortably cover both short and long-term liabilities, indicating sound financial positioning amidst ongoing challenges in revenue growth and management's limited experience. Recent corporate changes include a name change from Performant Financial Corporation and updated bylaws reflecting this transition.

- Click here to discover the nuances of Performant Healthcare with our detailed analytical financial health report.

- Assess Performant Healthcare's future earnings estimates with our detailed growth reports.

Equity Commonwealth (NYSE:EQC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Equity Commonwealth (NYSE: EQC) is a Chicago-based, internally managed real estate investment trust (REIT) focused on commercial office properties in the United States, with a market cap of approximately $187.03 million.

Operations: The company's revenue is primarily derived from the ownership and operation of office properties, amounting to $58.43 million.

Market Cap: $187.03M

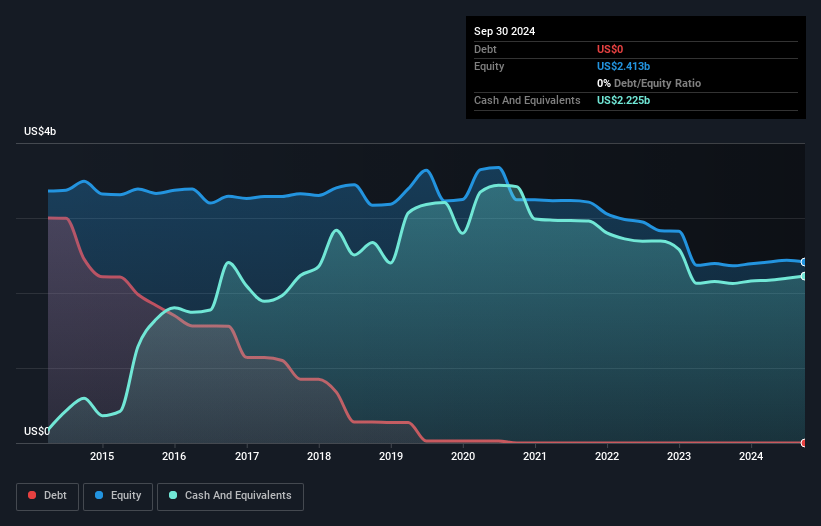

Equity Commonwealth, with a market cap of US$187.03 million, is debt-free and maintains strong financial health, as evidenced by its short-term assets of US$2.3 billion surpassing both short-term and long-term liabilities significantly. Despite this stability, the company faces challenges with declining earnings growth over the past year and a large one-off loss impacting recent financial results. The management team and board are experienced, averaging over ten years in tenure. Recent strategic moves include multiple shelf registration filings totaling substantial amounts and an announced special dividend distribution to shareholders as part of a liquidation strategy.

- Unlock comprehensive insights into our analysis of Equity Commonwealth stock in this financial health report.

- Examine Equity Commonwealth's past performance report to understand how it has performed in prior years.

Next Steps

- Embark on your investment journey to our 706 US Penny Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ProKidney, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PROK

ProKidney

A clinical-stage biotechnology company, develops a cell therapy platform for the treatment of multiple chronic kidney diseases in the United States.

Flawless balance sheet moderate.

Market Insights

Community Narratives